Question

Realty Income Ltd. is a young company, established with the intent of earning rental income from apartment complexes. The Company is owned by Jeff Hault.

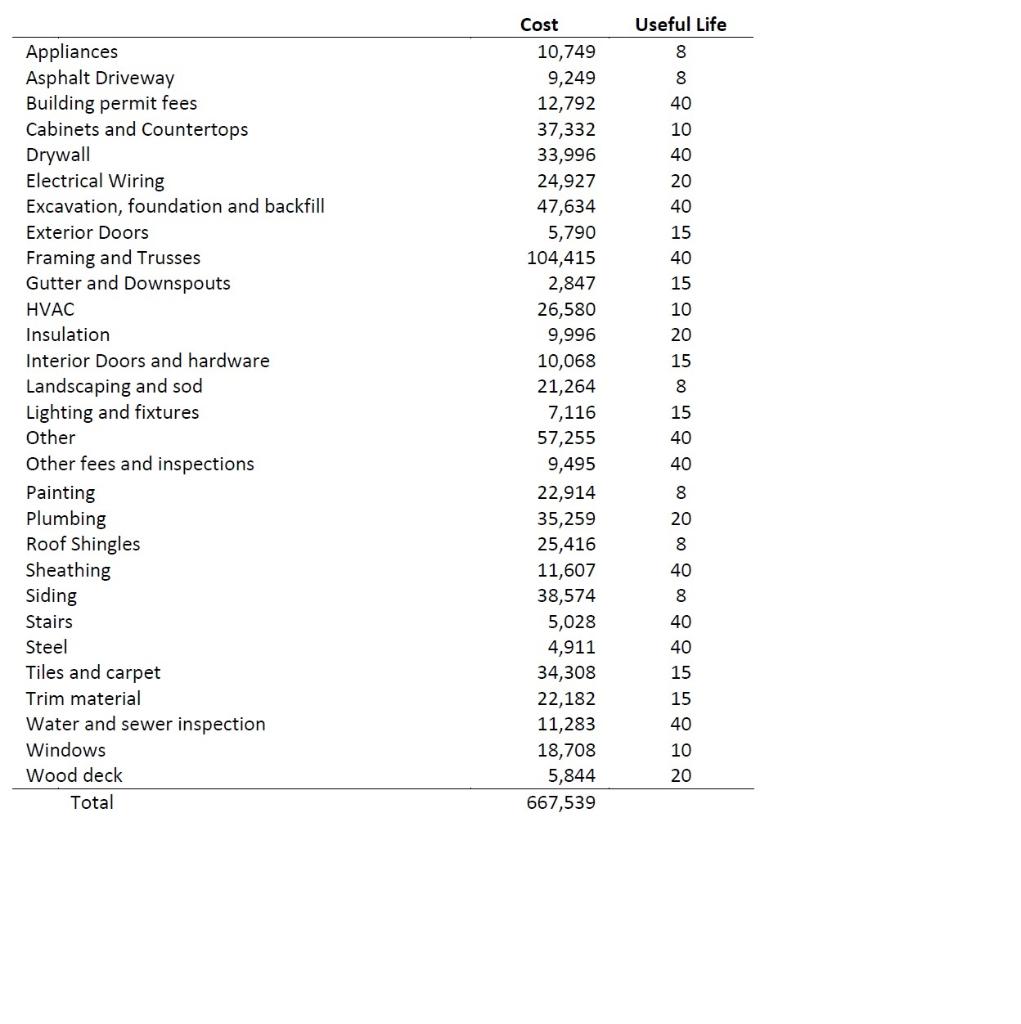

Realty Income Ltd. is a young company, established with the intent of earning rental income from apartment complexes. The Company is owned by Jeff Hault. During the most recent year, the Company built a 24-unit apartment complex. The construction commenced on March 1, and was completed by December 31, 2013 (yearend). The following is a detailed break-down of the construction costs incurred (it is safe to assume that the costs were incurred evenly throughout the year):

On March 1, 2013, the Company issued a $500,000 bond payable at a rate of 10% to finance a significant portion of the construction costs. Details of other interest-bearing debt outstanding during the year are as follows: 8% 15-year bonds, issued September 1, 2002, 350,000 6% 5-year bonds, issued July 1, 2008 175,000 Given the recent expansion with the Company, Jeff has hired you as a controller. The Company has adopted the cost model (CM) for their investment properties.

Required: Jeff has asked you to determine the cost basis of the apartment complex, and prepare an estimate of the annual amortization. The Company reports under IFRS.

Operating Phase:

Seven years have transpired since the construction of the 24-unit apartment complex. Currently, the 24 units are fully rented, and operations are running smoothly. The company is getting ready to prepare the 2027 year-end financial statements. Again, Bahram has asked for your assistance with certain transactions related to the apartment building. Specifically, the following transactions must be accounted for:

During the year, the following repairs and maintenance took place:

- On April 1, 2027, the roof and shingles were removed and replaced with a new and improved shingle design. The total cost of the new shingles was $26,500. The new shingles are expected to have a useful life of eight years.

- On October 1, 2027, the entire apartment was repainted for a cost of $18,000. At the same time, the landscaping was redone, including laying new sod, for a total of $29,000. Both the painting and the landscaping are expected to have a useful life of eight years. Prior to these transactions, no repairs or maintenance were required on the building.

- At December 31, 2027, 24 new alarm systems were instaled, one in each unit. The total cost of the new alarm system was $35,000. The building did not include an alarm system prior to this installation.

In addition to the above transactions, Bahram is contemplating the use of either the fair value model (FVM) under IAS 40 or the revaluation model (RVM) under IAS 16. He is wondering how the financial statements would be impacted if the either of the FVM or RVM was implemented since inception (ignore any retroactive adjustments). Based on various valuation reports and industry standards, Bahram estimates the following fair values:

- 2020 $850,000

- 2021 $665,000

- 2022 $750,000

- 2023 $835,000

- 2024 $900,000

- 2025 $900,000

The sharp declines in 2021 and 2022 are a result of a global economic recession, with a rebound in 2023.

Required Prepare a report that addresses Bahram's concerns. Analysis of the FR issue - Cost basis/ interest capitalization; components/depreciation ; and Cost v Reval v FV model. please provided calculations as well

Useful Life 40 10 40 20 40 15 40 15 10 20 15 Cost 10,749 9,249 12,792 37,332 33,996 24,927 47,634 5,790 104,415 2,847 26,580 9,996 10,068 21,264 7,116 57,255 9,495 22,914 35,259 25,416 11,607 38,574 5,028 4,911 34,308 22,182 11,283 18,708 5,844 667,539 Appliances Asphalt Driveway Building permit fees Cabinets and Countertops Drywall Electrical Wiring Excavation, foundation and backfill Exterior Doors Framing and Trusses Gutter and Downspouts HVAC Insulation Interior Doors and hardware Landscaping and sod Lighting and fixtures Other Other fees and inspections Painting Plumbing Roof Shingles Sheathing Siding Stairs Steel Tiles and carpet Trim material Water and sewer inspection Windows Wood deck Total 18 8 genessang85 8 98 8 s sea 15 40 40 20 40 40 40 15 15 40 10 20 Useful Life 40 10 40 20 40 15 40 15 10 20 15 Cost 10,749 9,249 12,792 37,332 33,996 24,927 47,634 5,790 104,415 2,847 26,580 9,996 10,068 21,264 7,116 57,255 9,495 22,914 35,259 25,416 11,607 38,574 5,028 4,911 34,308 22,182 11,283 18,708 5,844 667,539 Appliances Asphalt Driveway Building permit fees Cabinets and Countertops Drywall Electrical Wiring Excavation, foundation and backfill Exterior Doors Framing and Trusses Gutter and Downspouts HVAC Insulation Interior Doors and hardware Landscaping and sod Lighting and fixtures Other Other fees and inspections Painting Plumbing Roof Shingles Sheathing Siding Stairs Steel Tiles and carpet Trim material Water and sewer inspection Windows Wood deck Total 18 8 genessang85 8 98 8 s sea 15 40 40 20 40 40 40 15 15 40 10 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started