Answered step by step

Verified Expert Solution

Question

1 Approved Answer

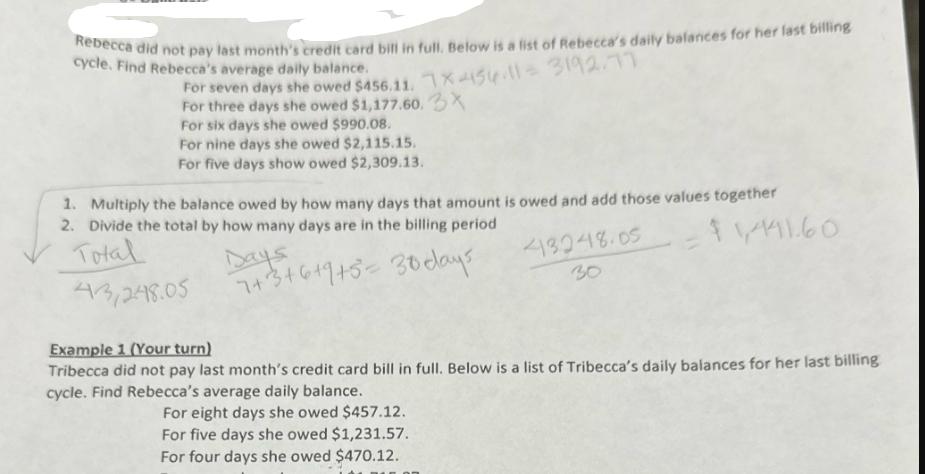

Rebecca did not pay last month's credit card bill in full. Below is a list of Rebecca's daily balances for her last billing cycle.

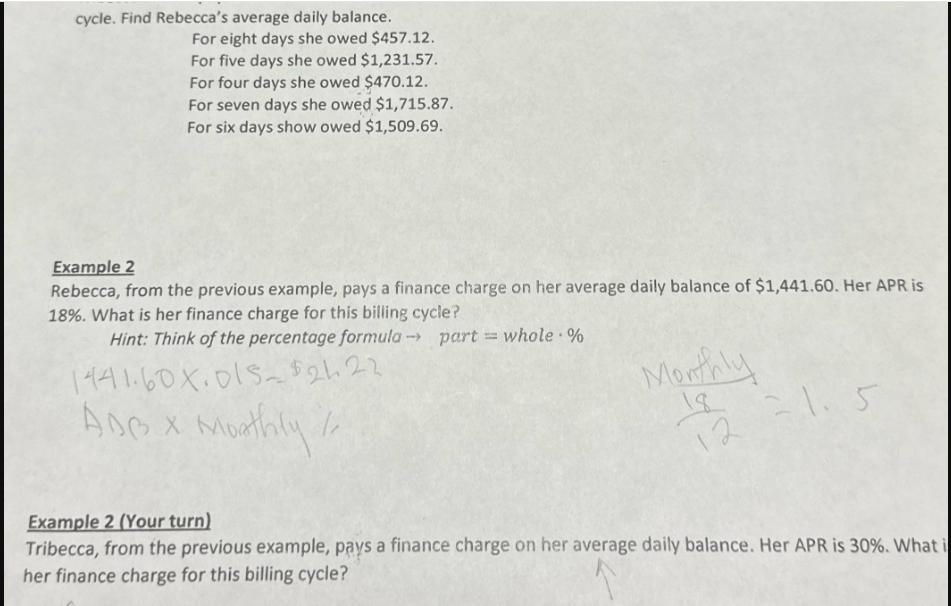

Rebecca did not pay last month's credit card bill in full. Below is a list of Rebecca's daily balances for her last billing cycle. Find Rebecca's average daily balance. For seven days she owed $456.11. 1x445113192.77 For three days she owed $1,177.60.3x For six days she owed $990.08. For nine days she owed $2,115.15. For five days show owed $2,309.13. 1. Multiply the balance owed by how many days that amount is owed and add those values together 2. Divide the total by how many days are in the billing period $1441.60 Total 43,248.05 Days 7+3+6+9+5= 30 days 413248.05 30 Example 1 (Your turn) Tribecca did not pay last month's credit card bill in full. Below is a list of Tribecca's daily balances for her last billing cycle. Find Rebecca's average daily balance. For eight days she owed $457.12. For five days she owed $1,231.57. For four days she owed $470.12. cycle. Find Rebecca's average daily balance. For eight days she owed $457.12. For five days she owed $1,231.57. For four days she owed $470.12. For seven days she owed $1,715.87. For six days show owed $1,509.69. Example 2 Rebecca, from the previous example, pays a finance charge on her average daily balance of $1,441.60. Her APR is 18%. What is her finance charge for this billing cycle? Hint: Think of the percentage formula part whole.% 1441.60X.015-$2422 ADC X Moathly/ Example 2 (Your turn) Monthly 12 1.5 Tribecca, from the previous example, pays a finance charge on her average daily balance. Her APR is 30%. What i her finance charge for this billing cycle?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started