Question

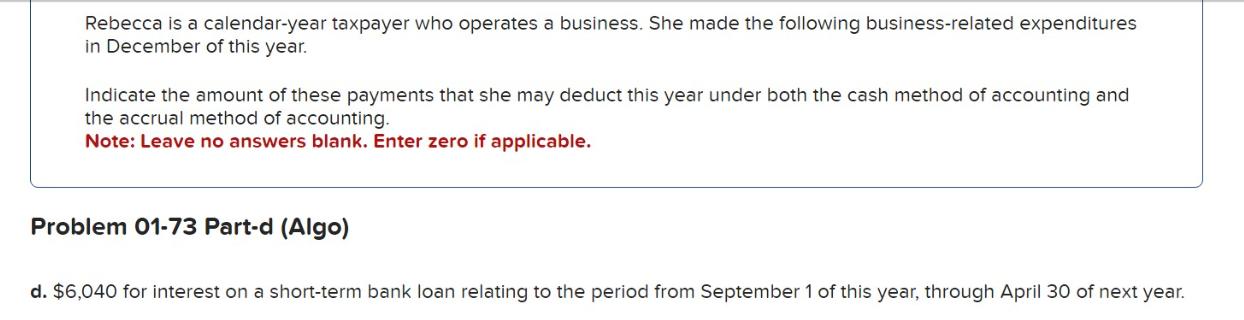

Rebecca is a calendar-year taxpayer who operates a business. She made the following business-related expenditures in December of this year. Indicate the amount of

Rebecca is a calendar-year taxpayer who operates a business. She made the following business-related expenditures in December of this year. Indicate the amount of these payments that she may deduct this year under both the cash method of accounting and the accrual method of accounting. Note: Leave no answers blank. Enter zero if applicable. Problem 01-73 Part-d (Algo) d. $6,040 for interest on a short-term bank loan relating to the period from September 1 of this year, through April 30 of next year.

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Under the cash method of accounting Rebecca can deduct expenses in the year they are a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2021

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

12th Edition

1260247139, 978-1260247138

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App