Answered step by step

Verified Expert Solution

Question

1 Approved Answer

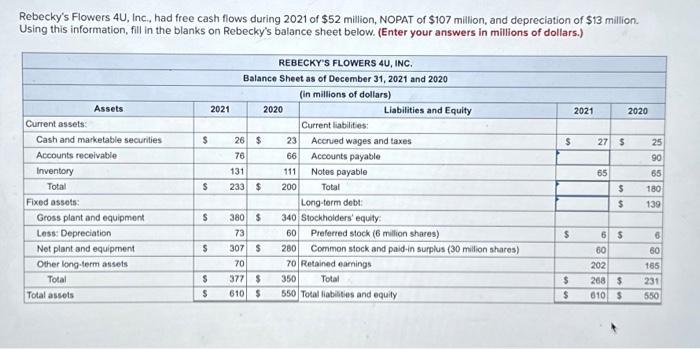

Rebecky's Flowers 4U, Inc., had free cash flows during 2021 of $52 million, NOPAT of $107 million, and depreciation of $13 million. Using this information,

Rebecky's Flowers 4U, Inc., had free cash flows during 2021 of $52 million, NOPAT of $107 million, and depreciation of $13 million. Using this information, fill in the blanks on Rebecky's balance sheet below. (Enter your answers in millions of dollars.) Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Depreciation Net plant and equipment Other long-term assets Total Total assets $ $ $ GA $ $ $ 2021 REBECKY'S FLOWERS 4U, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 26 $ 76 131 233 $ 380 $ 73 307 70 377 $ 610 $ $ 2020 23 66 111 200 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-term debt: 340 Stockholders' equity: 60 Preferred stock (6 million shares) Common stock and paid-in surplus (30 million shares) 280 70 Retained earnings 350 Total 550 Total liabilities and equity $ $ $ $ 2021 27 65 $ 25 90 65 180 $ 139 LA $ SS $ 6 60 202 268 610 $ $ 2020 SA SA 6 60 165 231 550

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started