Answered step by step

Verified Expert Solution

Question

1 Approved Answer

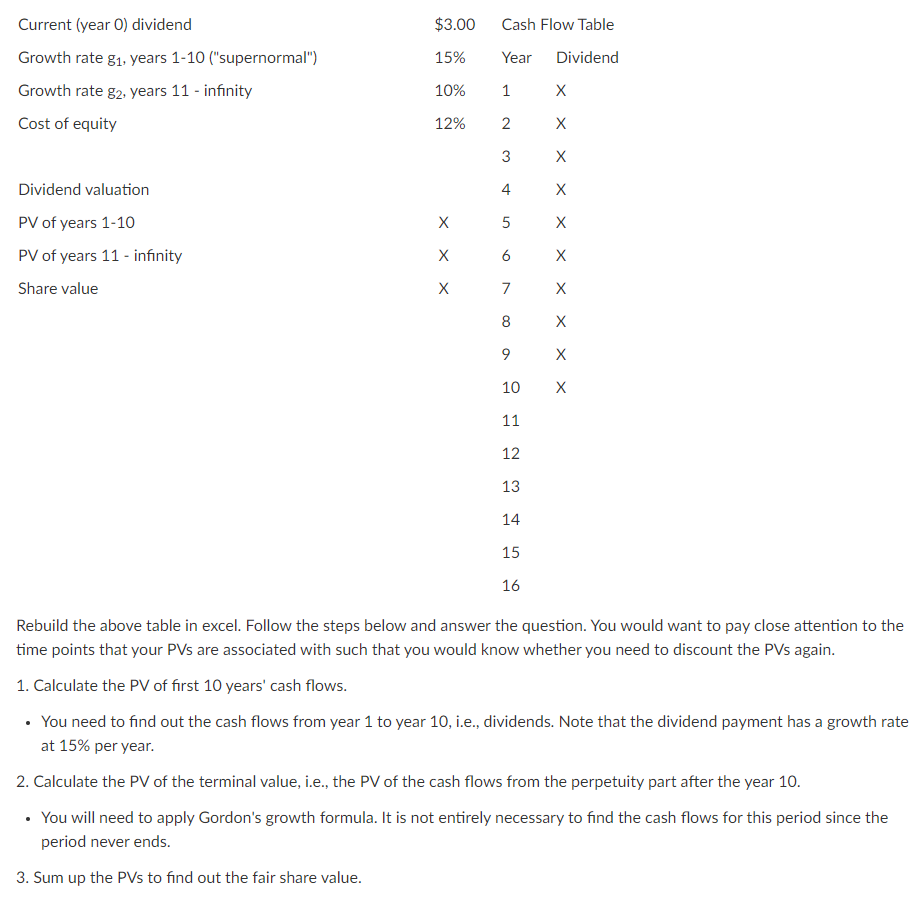

Rebuild the above table in excel. Follow the steps below and answer the question. You would want to pay close attention to the time points

Rebuild the above table in excel. Follow the steps below and answer the question. You would want to pay close attention to the

time points that your PVs are associated with such that you would know whether you need to discount the PVs again.

Calculate the PV of first years' cash flows.

You need to find out the cash flows from year to year ie dividends. Note that the dividend payment has a growth rate

at per year.

Calculate the PV of the terminal value, ie the PV of the cash flows from the perpetuity part after the year

You will need to apply Gordon's growth formula. It is not entirely necessary to find the cash flows for this period since the

period never ends.

Sum up the PVs to find out the fair share value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started