Answered step by step

Verified Expert Solution

Question

1 Approved Answer

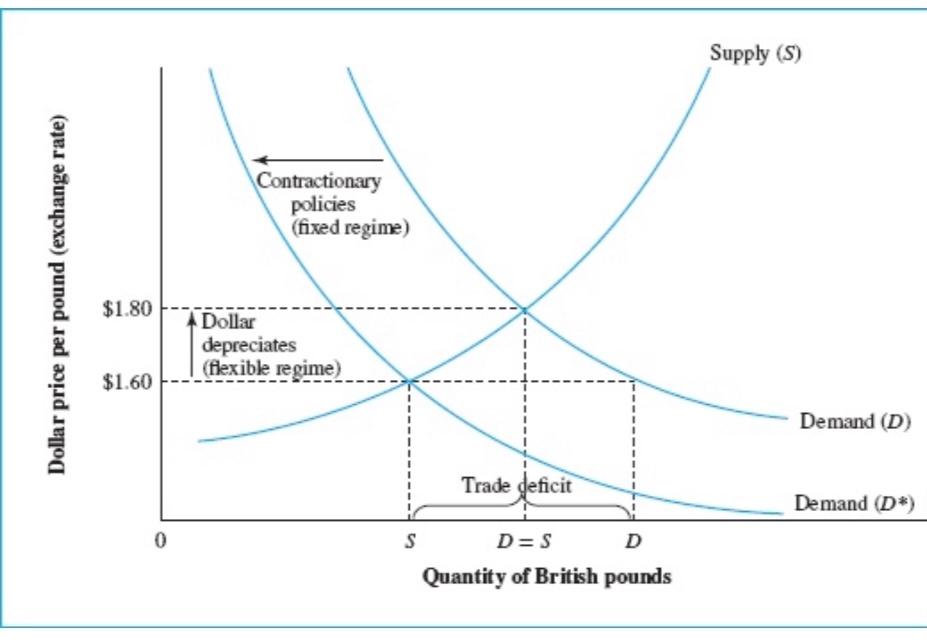

Recall Exhibit 2.14 from the textbook which shows an overvalued dollar at $1.60/. Redraw the graph with the $ overvalued and with the quantity of

- Recall Exhibit 2.14 from the textbook which shows an overvalued dollar at $1.60/.

- Redraw the graph with the $ overvalued and with the quantity of $s on the horizontal axis.

- Locate the appropriate points A and B and interpret them.

- Assuming the exchange rate is fixed at $1.60/, explain how the Fed would behave to defend the peg and show this behavior on the graph. For how long can the Fed continue this behavior?

- Go back to the original Exhibit 2.14 where the $ is overvalued at $1.60/. Assuming the exchange rate is fixed at $1.60/, do the Bank of Englands actions to maintain the peg close the UKs trade surplus with the US?

- Suppose the dollar is undervalued.

- Redraw the graph, choosing an exchange rate value that shows an undervalued $. Identify and interpret the appropriate points A and B.

- Assuming the exchange rate is fixed, what are the possible fiscal and monetary policies that each government might use to defend the peg?

- What could the Bank of England and the Fed do to defend the exchange rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started