Question

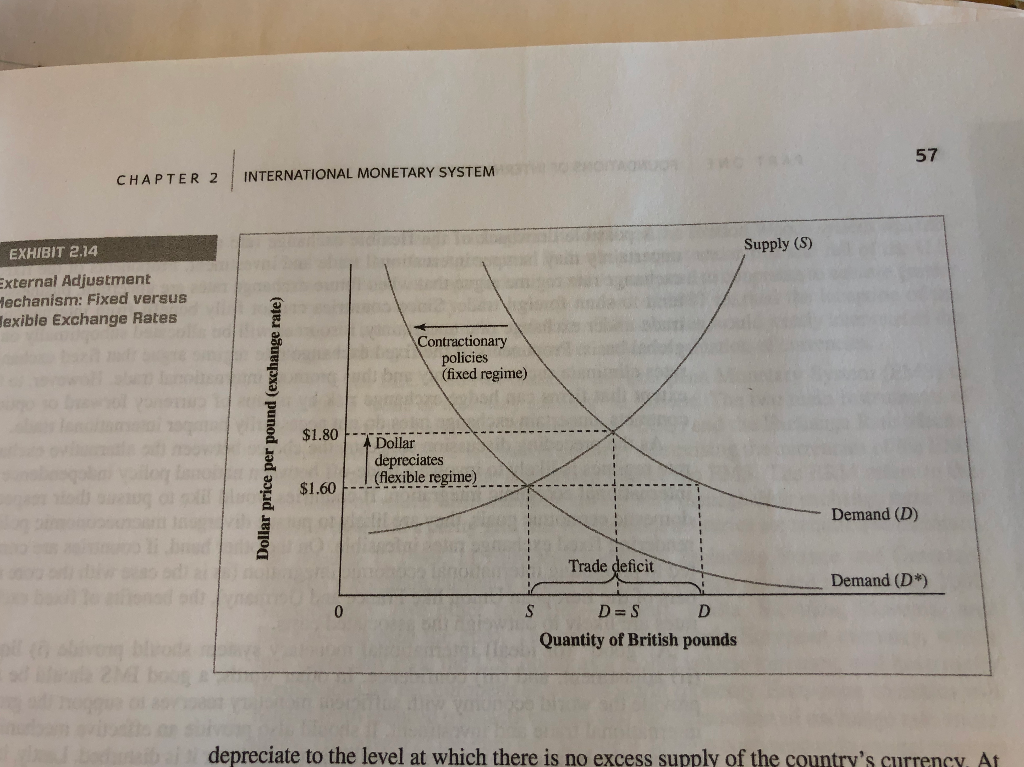

Recall Exhibit 2.14 which shows an overvalued dollar at $1.60/. a.)Redraw the graph with the $ overvalued and with the quantity of $s on the

- Recall Exhibit 2.14 which shows an overvalued dollar at $1.60/.

a.)Redraw the graph with the $ overvalued and with the quantity of $s on the horizontal axis.

i.)Locate the appropriate points A and B and interpret them.

ii.)Assuming the exchange rate is fixed at $1.60/, explain how the Fed would behave to defend the peg and show this behavior on the graph. For how long can the Fed continue this behavior?

iii.)Go back to the original Exhibit 2.14 where the $ is overvalued at $1.60/. Assuming the exchange rate is fixed at $1.60/, do the Bank of Englands actions to maintain the peg close the UKs trade surplus with the US?

b.)Suppose the dollar is undervalued.

i.)Redraw the graph, choosing an exchange rate value that shows an undervalued $. Identify and interpret the appropriate points A and B.

ii.)Assuming the exchange rate is fixed, what are the possible fiscal and monetary policies that each government might use to defend the peg?

iii.)What could the Bank of England and the Fed do to defend the exchange rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started