Answered step by step

Verified Expert Solution

Question

1 Approved Answer

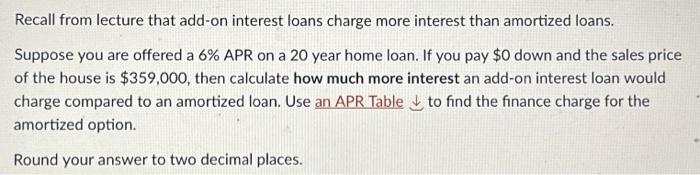

Recall from lecture that add-on interest loans charge more interest than amortized loans. Suppose you are offered a 6% APR on a 20 year

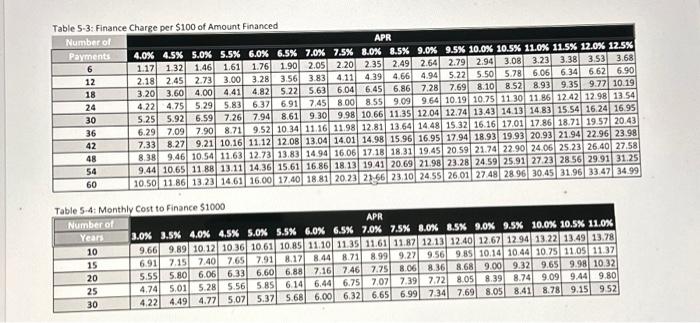

Recall from lecture that add-on interest loans charge more interest than amortized loans. Suppose you are offered a 6% APR on a 20 year home loan. If you pay $0 down and the sales price of the house is $359,000, then calculate how much more interest an add-on interest loan would charge compared to an amortized loan. Use an APR Table to find the finance charge for the amortized option. Round your answer to two decimal places. Table 5-3: Finance Charge per $100 of Amount Financed Number of APR Payments 4.0% 4.5 % 5.0 % 5.5 % 6.0 % 6.5 % 7.0% 7.5 % 8.0 % 8.5 % 6 1.17 1.32 1.46 1.61 1.76 1.90 2.05 2.20 12 2.18 2.45 2.73 3.00 3.28 3.56 3.83 18 3.20 3.60 4.00 4.41 4.82 24 4.22 4.75 5.29 5.83 30 5.25 5.92 6.59 7.26 9.30 9.0 % 9.5 % 10.0 % 10.5 % 11.0% 11.5 % 12.0% 12.5% 2.64 2.79 2.94 3.08) 3.23 3.38 3.53 3.68 2.35 2.49 6.06 6.34 6.62 6.90 5.22 5.50 5.78 4.11 4.39 4.66 4.94 8.93 9.35 8.10 8.52 9.77 10.19 7.69 6.45 6.86 7.28 5.63 6.04 5.22 6.37 6.91 7.45 8.00 8.55 9.09 9.64 10.19 10.75 11.30 11.86 12.42 12.98 13.54 8.61 7.94 9.98 10.66 11.35 12.04 12.74 13.43 14.13 14.83 15.54 16.24 16.95 36 6.29 7.09 7.90 8.71 42 7.33 48 8.38 54 60 9.52 10.34 11.16 11.98 12.81 13.64 14.48 15.32 16.16 17.01 17.86 18.71 19.57 20.43 8.27 9.21 10.16 11.12 12.08 13.04 14.01 14.98 15.96 16.95 17.94 18.93 19.93 20.93 21.94 22.96 23.98 9.46 10.54 11.63 12.73 13.83 14.94 16.06 17.18 18.31 19.45 20.59 21.74 22.90 24.06 25.23 26.40 27.58 9.44 10.65 11.88 13.11 14.36 15.61 16.86 18.13 19.41 20.69 21.98 23.28 24.59 25.91 27.23 28.56 29.91 31.25 10.50 11.86 13.23 14.61 16.00 17.40 18.81 20.23 21-66 23.10 24.55 26.01 27.48 28.96 30.45 31.96 33.47 34.99 Table 5-4: Monthly Cost to Finance $1000 Number of Years 10 15 6.91 7.15 20 5.55 5.80 25 4.74 30 5.01 4.22 4.49 4.77 5.07 APR 3.0% 3.5 % 4.0 % 4.5 % 5.0 % 5.5 % 6.0 % 6.5 % 7.0 % 7.5 % 8.0 % 8.5 % 9.0% 9.5 % 10.0% 10.5 % 11.0% 9.66 9.89 10.12 10.36 10.61 10.85 11.10 11.35 11.61 11.87 12.13 12.40 12.67 12.94 13.22 13.49 13.78 8.71 8.99 9.27 9.56 7.40 7.65 7.91 8.17 8.44 7.75 7.16 7.46 8.06 8.36 6.60 6.88 6.06 6.33 6.75 7.07 7.39 7.72 5.85 6.14 6.44 5.28 5.56 6.00 6.32 6.65 6.99 7.34 7.69 8.05 8.41 5.37 5.68 9.85 10.14 10.44 10.75 11.05 11.37 8.68 9.00 9.32 8.05 8.39 8.74 9.65 9.98 10.32 9.09 9.44 9.80 8.78 9.15 9.52

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the total interest charged by both loan options first lets find the finance char...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started