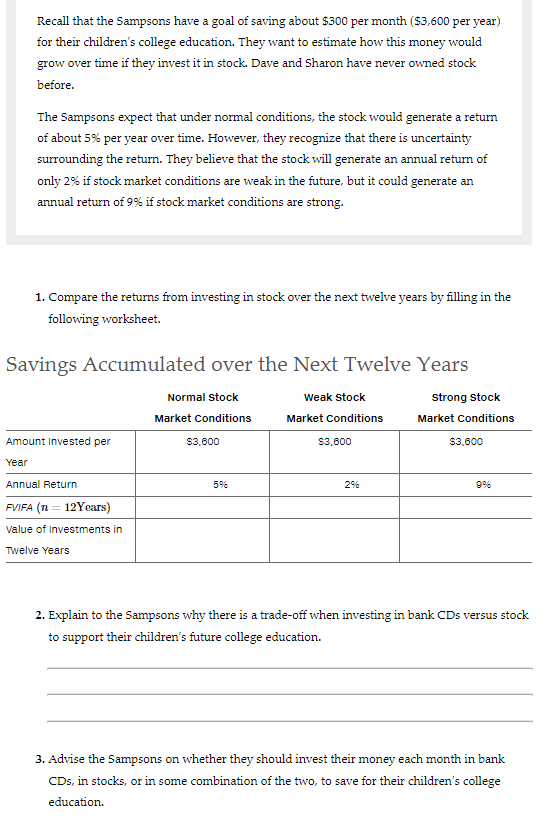

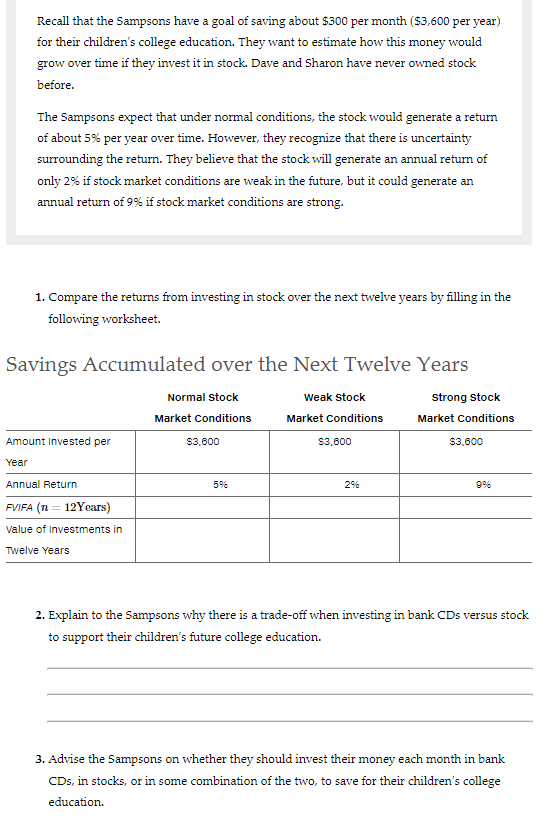

Recall that the Sampsons have a goal of saving about $300 per month ($3,600 per year) for their children's college education. They want to estimate how this money would grow over time if they invest it in stock. Dave and Sharon have never owned stock before. The Sampsons expect that under normal conditions, the stock would generate a return of about 5% per year over time. However, they recognize that there is uncertainty surrounding the return. They believe that the stock will generate an annual return of only 2% if stock market conditions are weak in the future, but it could generate an annual return of 9% if stock market conditions are strong. 1. Compare the returns from investing in stock over the next twelve years by filling in the following worksheet. Savings Accumulated over the Next Twelve Years Normal stock Weak Stock Strong Stock Market Conditions Market Conditions Market Conditions S3.600 Amount invested per S3,600 $3,600 Year 596 29 9% Annual Return FVIFA (n = 12 Years) Value of Investments in Twelve years 2. Explain to the Sampsons why there is a trade-off when investing in bank CDs versus stock to support their children's future college education. 3. Advise the Sampsons on whether they should invest their money each month in bank CDs, in stocks, or in some combination of the two, to save for their children's college education. Recall that the Sampsons have a goal of saving about $300 per month ($3,600 per year) for their children's college education. They want to estimate how this money would grow over time if they invest it in stock. Dave and Sharon have never owned stock before. The Sampsons expect that under normal conditions, the stock would generate a return of about 5% per year over time. However, they recognize that there is uncertainty surrounding the return. They believe that the stock will generate an annual return of only 2% if stock market conditions are weak in the future, but it could generate an annual return of 9% if stock market conditions are strong. 1. Compare the returns from investing in stock over the next twelve years by filling in the following worksheet. Savings Accumulated over the Next Twelve Years Normal stock Weak Stock Strong Stock Market Conditions Market Conditions Market Conditions S3.600 Amount invested per S3,600 $3,600 Year 596 29 9% Annual Return FVIFA (n = 12 Years) Value of Investments in Twelve years 2. Explain to the Sampsons why there is a trade-off when investing in bank CDs versus stock to support their children's future college education. 3. Advise the Sampsons on whether they should invest their money each month in bank CDs, in stocks, or in some combination of the two, to save for their children's college education