Recast Frosty Footwear's balance sheet for the last year, considering the balance sheet adjustments for the asset approach to business value. Recommend a business value using the asset approach.

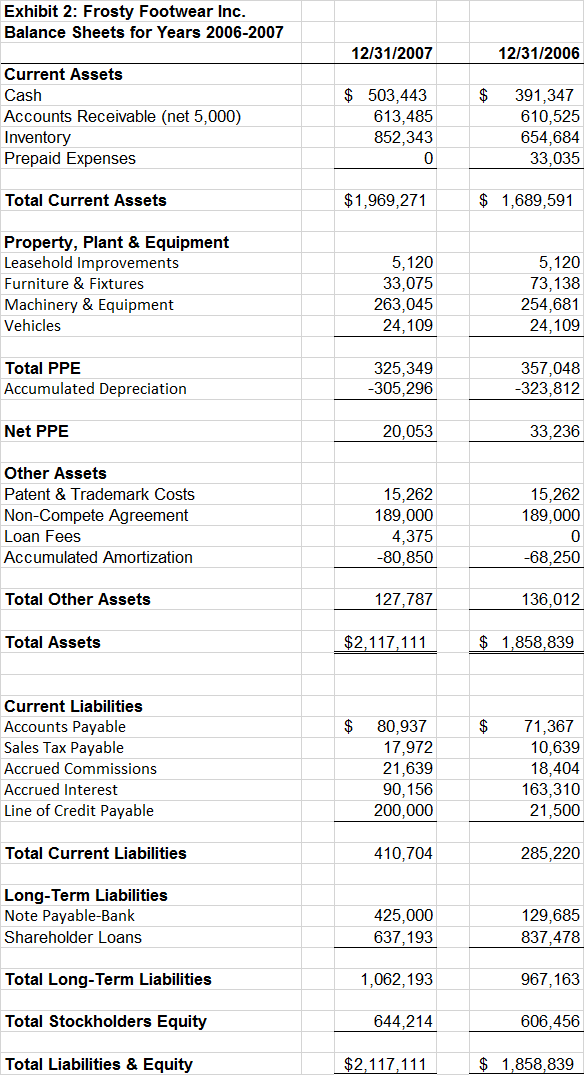

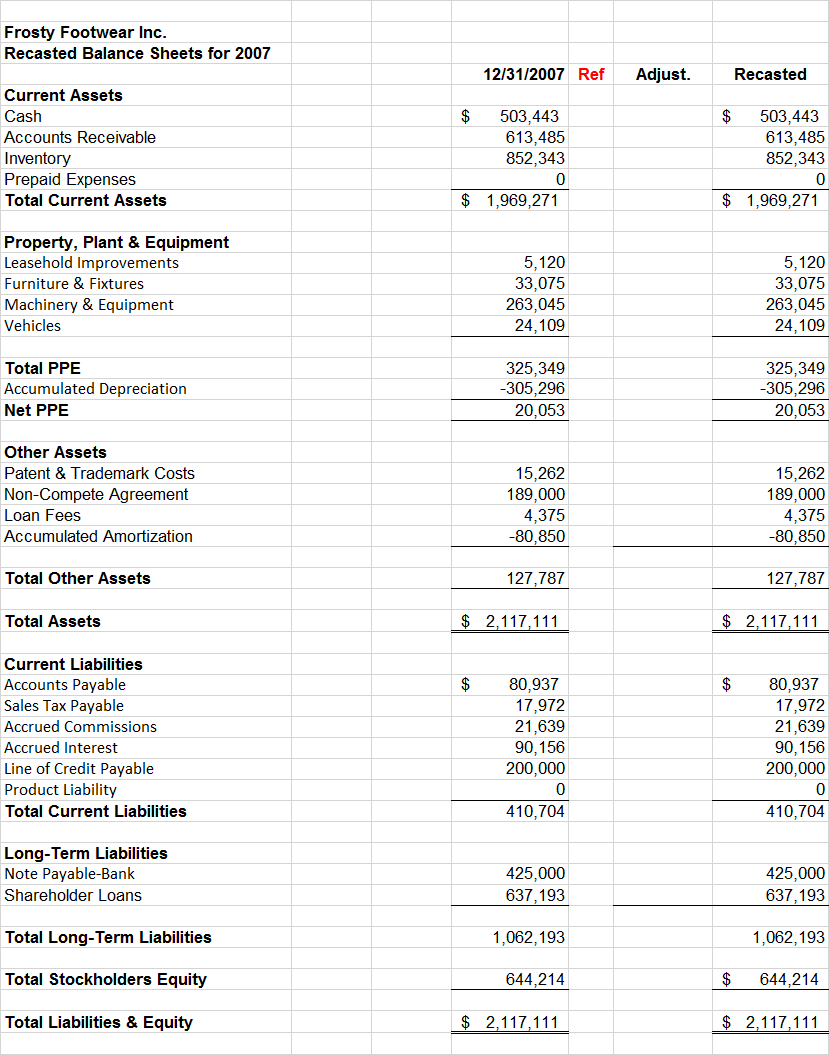

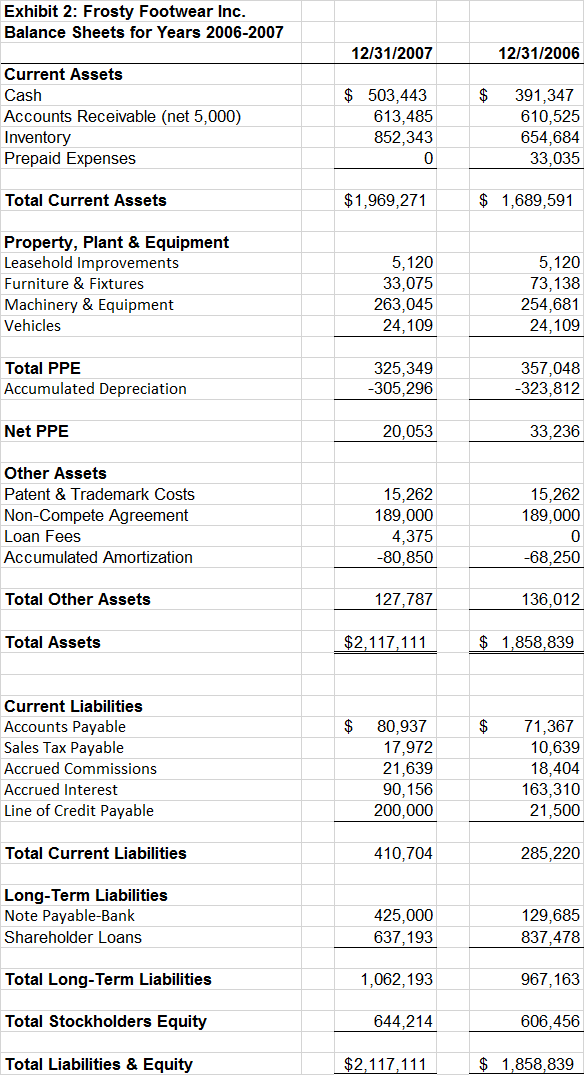

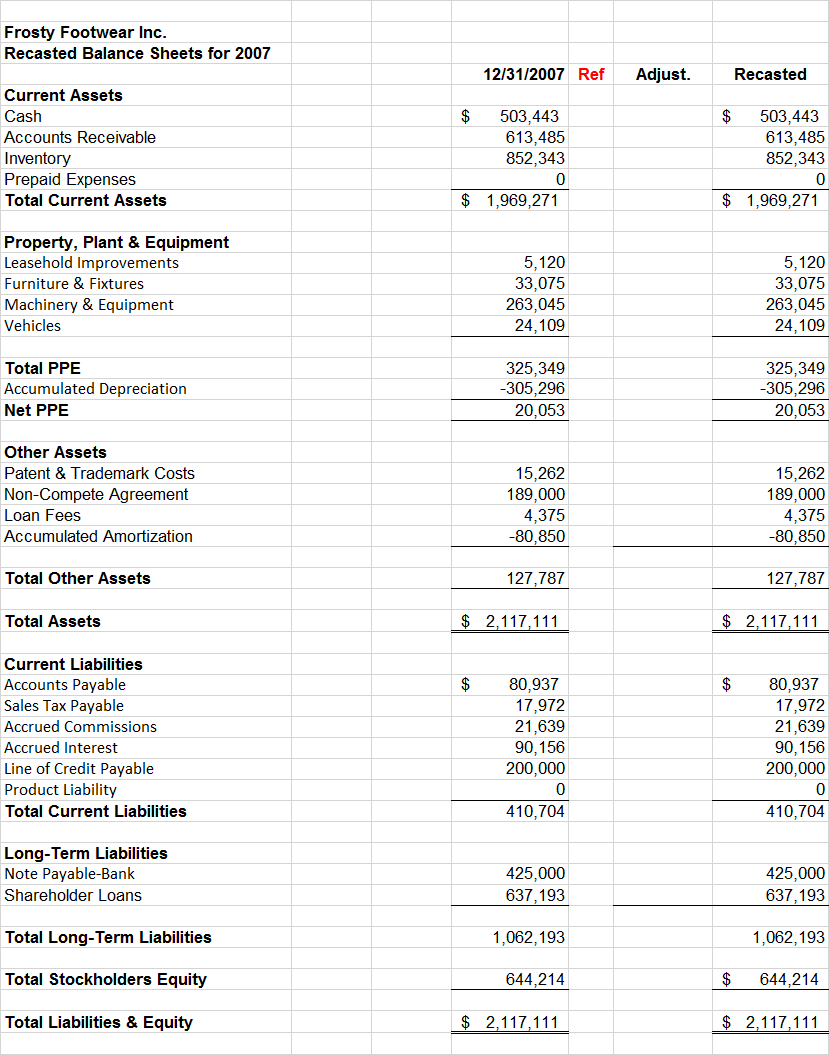

Exhibit 2: Frosty Footwear Inc. Balance Sheets for Years 2006-2007 12/31/2007 12/31/2006 $ Current Assets Cash Accounts Receivable (net 5,000) Inventory Prepaid Expenses $ 503,443 613,485 852,343 391,347 610,525 654,684 33,035 Total Current Assets $1,969,271 $ 1,689,591 Property, Plant & Equipment Leasehold Improvements Furniture & Fixtures Machinery & Equipment Vehicles 5,120 33,075 263,045 24,109 5,120 73,138 254,681 24,109 Total PPE Accumulated Depreciation 325,349 -305,296 357,048 -323,812 Net PPE 20,053 33,236 Other Assets Patent & Trademark Costs Non-Compete Agreement Loan Fees Accumulated Amortization 15,262 189,000 15,262 189,000 4,375 -80,850 -68,250 Total Other Assets 127,787 136,012 Total Assets $2,117,111 $ 1.858.839 $ Current Liabilities Accounts Payable Sales Tax Payable Accrued Commissions Accrued Interest Line of Credit Payable 80,937 17,972 21,639 90, 156 200,000 71.367 10,639 18,404 163,310 21,500 Total Current Liabilities 410,704 285,220 Long-Term Liabilities Note Payable-Bank Shareholder Loans 425.000 637,193 129,685 837,478 Total Long-Term Liabilities 1,062,193 967,163 Total Stockholders Equity 644,214 606,456 Total Liabilities & Equity $2,117,111 $ 1,858,839 Frosty Footwear Inc. Recasted Balance Sheets for 2007 12/31/2007 Ref Adjust. Recasted $ Current Assets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets $ 503,443 613,485 852,343 0 $ 1,969,271 503,443 613,485 852,343 0 1,969,271 $ Property, Plant & Equipment Leasehold Improvements Furniture & Fixtures Machinery & Equipment Vehicles 5,120 33,075 263,045 24,109 5,120 33,075 263,045 24,109 Total PPE Accumulated Depreciation Net PPE 325,349 -305,296 20,053 325,349 -305.296 20,053 Other Assets Patent & Trademark Costs Non-Compete Agreement Loan Fees Accumulated Amortization 15,262 189,000 4,375 -80,850 15,262 189,000 4,375 -80,850 Total Other Assets 127,787 127,787 Total Assets $ 2,117,111 $ 2,117,111 $ $ Current Liabilities Accounts Payable Sales Tax Payable Accrued Commissions Accrued Interest Line of Credit Payable Product Liability Total Current Liabilities 80,937 17,972 21.639 90,156 200,000 80,937 17,972 21,639 90,156 200,000 410,704 410,704 Long-Term Liabilities Note Payable-Bank Shareholder Loans 425,000 637,193 425,000 637,193 Total Long-Term Liabilities 1,062,193 1,062, 193 Total Stockholders Equity 644,214 $ 644,214 Total Liabilities & Equity $ 2,117,111 $ 2,117,111