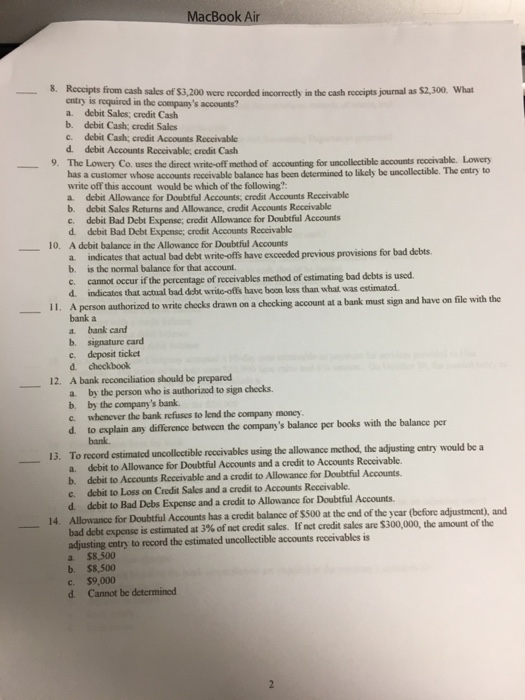

Receipts from cash sales of $5, 200 were recorded incorrectly in the cash receipts journal as $2, 300. What entry is required in the company's accounts? debit Sales, credit Cash debit Cash, credit Sales debit Cash, credit Accounts Receivable debit Accounts Receivable, credit Cash The Lowers Co. uses the direct write-off method of accounting for uncollectible accounts receivable Lowery has a customer whose accounts receivable balance has been determined to likely be uncollectible. The entry to write off this account would be which of the following? debit Allowance for Doubtful Accounts, credit Accounts Receivable debit Sales Returns and Allowance, credit Accounts Receivable debit Bad Debt Expense, credit Allowance for Doubtful Accounts debit Bad Debt Expense, credit Accounts Receivable A debit balance in the Allowance for Doubtful Accounts indicates that actual bad debt write-offs have exceeded previous provisions for bad debts is the normal balance for that account cannot occur if the percentage of receivables method of estimating bad debts is used indicates that actual bad debt write-offs have been less than what was estimated A person authorized to write checks drawn on a checking account at a bank must sign and have on file with the bank a bank card signature card deposit ticket checkbook A bank reconciliation should be prepared by the person who is authorized to sign checks by the company's bank whenever the bank refuses to lend the company money. to explain any difference between the company's balance pa books with the balance per bank To record estimated uncollectible receivables using the allowance method, the adjusting entry would be a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts debit to Loss on Credit Sales and a credit to Accounts Receivable debit to Bad Debs Expense and a credit to Allowance for Doubtful Accounts Allowance for Doubtful Accounts has a credit balance of $500 at the end of the year (before adjustment), and bad debt expense is estimated it 3% of net credit sales. If net credit sales are $300,000, the amount of the adjusting entry to record the estimated uncollectible accounts receivables is $8, 500 $8, 500 $9,000 Cannot be determined