Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Receivables Receivables are stated at their carrying values, net of a reserve for doubtful accounts, and are primarily due from the following: customers, which also

Receivables

Receivables are stated at their carrying values, net of a reserve for doubtful accounts, and are primarily due from the following: customers, which also includes insurance companies resulting from pharmacy sales, banks for customer credit, debit cards and electronic transfer transactions that take in excess of seven days to process; suppliers for marketing or incentive programs; governments for income taxes; and real estate transactions. As of January and January receivables from transactions with customers, net were $ billion and $ billion, respectively.

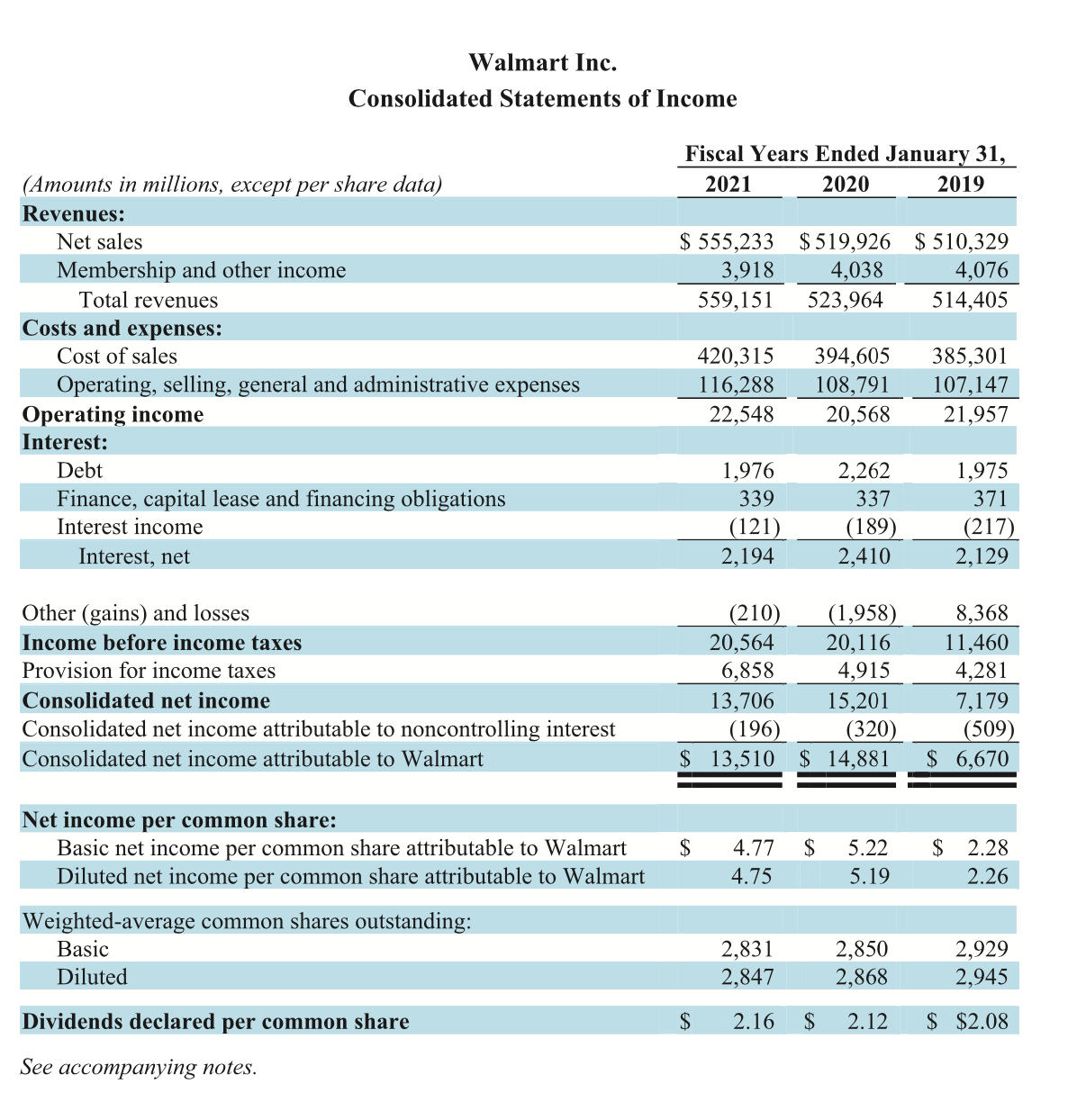

Refer to the financial statements of Target Appendix B and Walmart Appendix C

Required:

Compute the receivables turnover ratio for both companies for the most recent year. For Target, use the "Accounts and other receivables" amounts located in Note Other Current Assets for the denominator. For Walmart, use the "receivables from transactions with customers, net" amounts located in Note Receivables for the denominator.

What characteristic of their businesses is the main cause their receivables turnover ratios to be so high?

bHow do Target and Walmart account for expected or estimated customer returns?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started