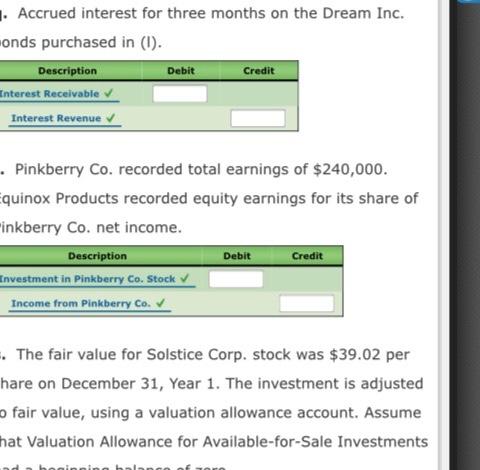

Received $27,00 dividend from Pinkberry investment in (h). Cred Description Cash Investment in Pinkbery Car Stock 1. Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of $375. The bonds are classified as a held-to-maturity long-term investment. Description Crede Investments in Dream Inc. Bonde Interest Cash m. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (a). Description Credit Cash Treasury Stock Paid-ta Capital From Sale of Treasury Back n. Received a dividend of $0.50 per share from the Solstice Corp. investment in (1) Description Dividend Reven o. Sold 1,000 shares of Solstice Corp, at $45, including commission. Description Cash Gain on sale of Investment Investments in Solstice Corp Stock P. Recorded the payment of semiannual interest on the bonds issued in (C) and the amortization of the premium for six months. The amortization is determined using the straight-line method Credit Description | Interest Expense Premium Bands Payable Chat 1. Accrued interest for three months on the Dream Inc. onds purchased in (1). Description Debit Credit Interest Receivable Interest Revenue . Pinkberry Co. recorded total earnings of $240,000. quinox Products recorded equity earnings for its share of inkberry Co. net income. Description Credit Investment in Pinkberry Co. Stock Income from Pinkberry Co. Debit The fair value for Solstice Corp. stock was $39.02 per hare on December 31, Year 1. The investment is adjusted o fair value, using a valuation allowance account. Assume hat Valuation Allowance for Available-for-Sale Investments Received $27,00 dividend from Pinkberry investment in (h). Cred Description Cash Investment in Pinkbery Car Stock 1. Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of $375. The bonds are classified as a held-to-maturity long-term investment. Description Crede Investments in Dream Inc. Bonde Interest Cash m. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (a). Description Credit Cash Treasury Stock Paid-ta Capital From Sale of Treasury Back n. Received a dividend of $0.50 per share from the Solstice Corp. investment in (1) Description Dividend Reven o. Sold 1,000 shares of Solstice Corp, at $45, including commission. Description Cash Gain on sale of Investment Investments in Solstice Corp Stock P. Recorded the payment of semiannual interest on the bonds issued in (C) and the amortization of the premium for six months. The amortization is determined using the straight-line method Credit Description | Interest Expense Premium Bands Payable Chat 1. Accrued interest for three months on the Dream Inc. onds purchased in (1). Description Debit Credit Interest Receivable Interest Revenue . Pinkberry Co. recorded total earnings of $240,000. quinox Products recorded equity earnings for its share of inkberry Co. net income. Description Credit Investment in Pinkberry Co. Stock Income from Pinkberry Co. Debit The fair value for Solstice Corp. stock was $39.02 per hare on December 31, Year 1. The investment is adjusted o fair value, using a valuation allowance account. Assume hat Valuation Allowance for Available-for-Sale Investments