Question

Recent events have made it clear that the economy is likely experiencing an output gap. Looking for technical assistance, the Government has hired you as

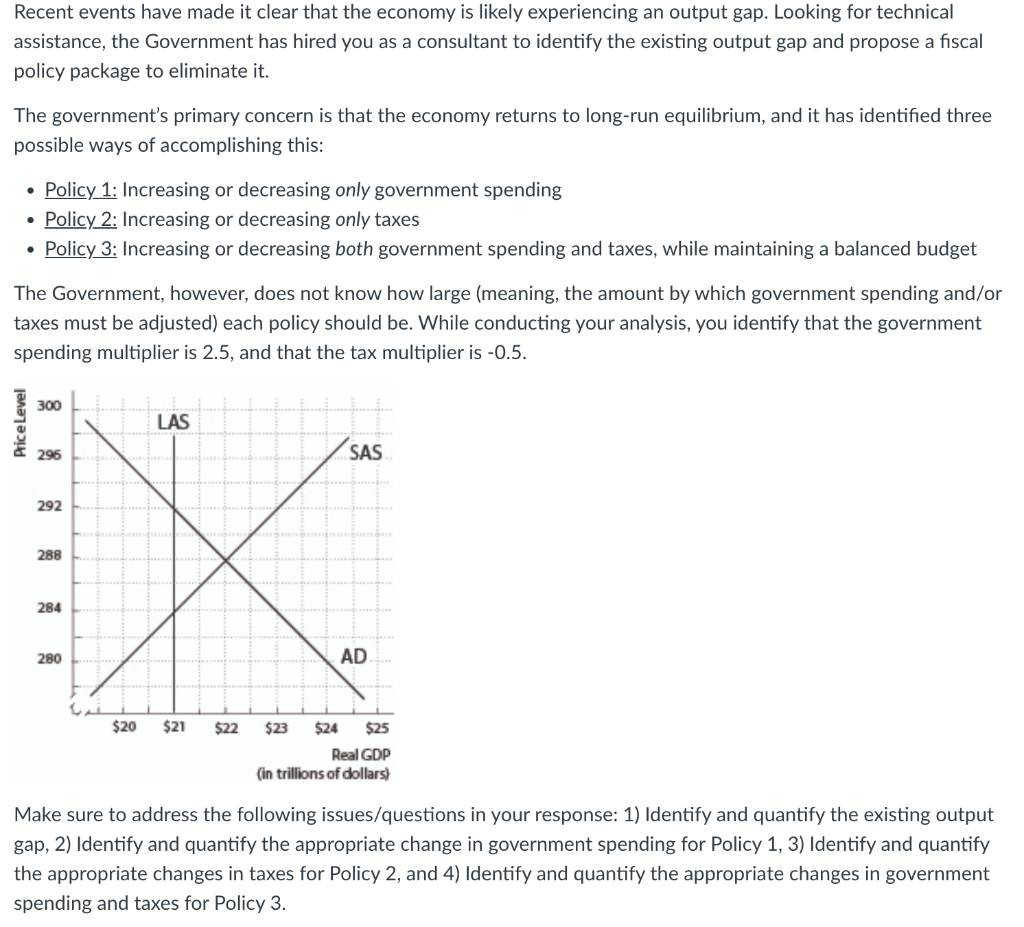

Recent events have made it clear that the economy is likely experiencing an output gap. Looking for technical assistance, the Government has hired you as a consultant to identify the existing output gap and propose a fiscal policy package to eliminate it. The governments primary concern is that the economy returns to long-run equilibrium, and it has identified three possible ways of accomplishing this: Policy 1: Increasing or decreasing only government spending Policy 2: Increasing or decreasing only taxes Policy 3: Increasing or decreasing both government spending and taxes, while maintaining a balanced budget The Government, however, does not know how large (meaning, the amount by which government spending and/or taxes must be adjusted) each policy should be. While conducting your analysis, you identify that the government spending multiplier is 2.5, and that the tax multiplier is -0.5.

Recent events have made it clear that the economy is likely experiencing an output gap. Looking for technical assistance, the Government has hired you as a consultant to identify the existing output gap and propose a fiscal policy package to eliminate it. The governments primary concern is that the economy returns to long-run equilibrium, and it has identified three possible ways of accomplishing this: Policy 1: Increasing or decreasing only government spending Policy 2: Increasing or decreasing only taxes Policy 3: Increasing or decreasing both government spending and taxes, while maintaining a balanced budget The Government, however, does not know how large (meaning, the amount by which government spending and/or taxes must be adjusted) each policy should be. While conducting your analysis, you identify that the government spending multiplier is 2.5, and that the tax multiplier is -0.5.

Make sure to address the following issues/questions in your response: 1) Identify and quantify the existing output gap, 2) Identify and quantify the appropriate change in government spending for Policy 1, 3) Identify and quantify the appropriate changes in taxes for Policy 2, and 4) Identify and quantify the appropriate changes in government spending and taxes for Policy 3.

Recent events have made it clear that the economy is likely experiencing an output gap. Looking for technical assistance, the Government has hired you as a consultant to identify the existing output gap and propose a fiscal policy package to eliminate it. The government's primary concern is that the economy returns to long-run equilibrium, and it has identified three possible ways of accomplishing this: - Policy 1: Increasing or decreasing only government spending - Policy 2: Increasing or decreasing only taxes - Policy 3 : Increasing or decreasing both government spending and taxes, while maintaining a balanced budget The Government, however, does not know how large (meaning, the amount by which government spending and/or taxes must be adjusted) each policy should be. While conducting your analysis, you identify that the government spending multiplier is 2.5, and that the tax multiplier is 0.5. Make sure to address the following issues/questions in your response: 1) Identify and quantify the existing output gap, 2) Identify and quantify the appropriate change in government spending for Policy 1,3 ) Identify and quantify the appropriate changes in taxes for Policy 2, and 4) Identify and quantify the appropriate changes in government spending and taxes for Policy 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started