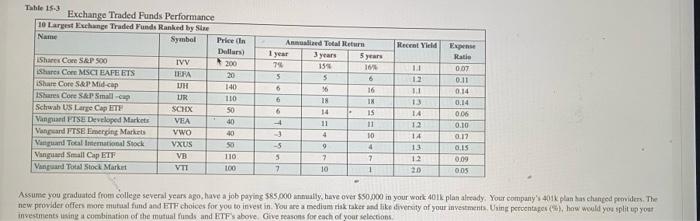

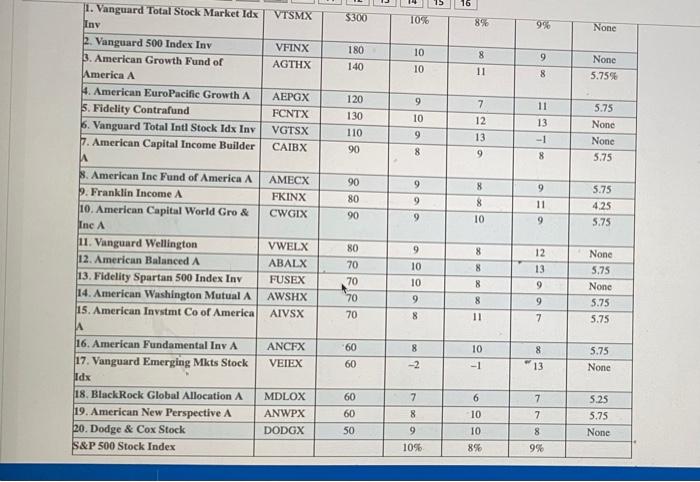

Recent Yield Exp Rati 200 0.07 0.11 Table 15-3 Exchange Traded Funds Performance 10 Largest Exchange Traded Funds Ranked by Size Symbol Price In Dulles Shares Core SAP 500 IVY Shares Core MSCIEAFEETS IERA 20 Share Core S&P Mid-cap UH 140 IShares Core SAP Small- UR 110 Schwab US Large Cap LTE SCHX 50 Vanguard FTSE Developed Markets VEA 40 Vanguard FTSE Emerging Markets VWO 40 Vingad Total International Stock VXUS Sa Vingad Small Cap ETF VB 110 Vanguard Tot Stock Market VTT 100 And Total Return 1 year 3 years 5 years 74 15% 16 5 5 6 16 6 18 IN 6 IS 11 11 4 -5 9 3 7 7 10 0.14 0.14 0.06 12 1.1 13 14 12 14 13 1.2 2.0 0.10 TE 0.17 0.15 --- 0,09 0.05 - Assume you graduated from college several years ago, have a job paying $85.000 annually have over $50,000 in your work 401k plan already. Your company's 401k plan bas changed peiders. The new provider offers more mutal find and ETF choices for you to invest in. You are a medium to take and like diversity of your investments. Using percentage (S), how would you split up your investments using a combination of the mutual funds and ETFs above. Give reasons for each of your selections 16 VTSMX $300 10% 8% 9% None VFINX AGTHX 180 140 8 10 10 9 1. Vanguard Total Stock Market Idx Iny 2. Vanguard 500 Index Inv 3. American Growth Fund of America A 4. American EuroPacific Growth A 5. Fidelity Contrafund 6. Vanguard Total Intl Stock Idx Iny 7. American Capital Income Builder 11 None 5.75 8 120 11 130 AEPGX FCNTX VGTSX CAIBX 13 9 10 9 8 110 90 7 12 13 9 . 5.75 None None 5.75 -1 8 9 AMECX FKINX CWGIX 888 90 80 90 9 9 8 8 10 11 9 5.75 4.25 5.75 9 9 8 12 13 8 VWELX ABALX FUSEX AWSHX AIVSX 80 70 70 70 70 10 10 8 9 S. American Inc Fund of America A 9. Franklin Income A 10. American Capital World Gro & Inc A 11. Vanguard Wellington 12. American Balanced A 13. Fidelity Spartan 500 Index Iny 14. American Washington Mutual A 15. American Inystmt Co of America A 16. American Fundamental Inv A 17. Vanguard Emerging Mats Stock Idx 18. BlackRock Global Allocation A 19. American New Perspective A 20. Dodge & Cox Stock S&P 500 Stock Index None 5.75 None 5.75 5.75 8 9 9 8 11 7 ANCEX VEIEX 60 60 8 -2 10 -1 8 13 5.75 None 6 MDLOX ANWPX DODGX 60 60 50 7 8 9 7 7 10 IO 8% 5.25 5.75 None 8 10% 9% Assume your dested from college several years ago, have a job paying 585.000 mily, have over 550 000 in your work 401k plan already. Your company's 101k planchanged providers. The new provider offers more mutual fund and ETF choices for you to invest in. You are a medium risk take and like diversity of your investment. Uning percentages, how would you split up your Investments using a combination of the mutual funds and ETF's above. Oive sons for each of your selection Recent Yield Exp Rati 200 0.07 0.11 Table 15-3 Exchange Traded Funds Performance 10 Largest Exchange Traded Funds Ranked by Size Symbol Price In Dulles Shares Core SAP 500 IVY Shares Core MSCIEAFEETS IERA 20 Share Core S&P Mid-cap UH 140 IShares Core SAP Small- UR 110 Schwab US Large Cap LTE SCHX 50 Vanguard FTSE Developed Markets VEA 40 Vanguard FTSE Emerging Markets VWO 40 Vingad Total International Stock VXUS Sa Vingad Small Cap ETF VB 110 Vanguard Tot Stock Market VTT 100 And Total Return 1 year 3 years 5 years 74 15% 16 5 5 6 16 6 18 IN 6 IS 11 11 4 -5 9 3 7 7 10 0.14 0.14 0.06 12 1.1 13 14 12 14 13 1.2 2.0 0.10 TE 0.17 0.15 --- 0,09 0.05 - Assume you graduated from college several years ago, have a job paying $85.000 annually have over $50,000 in your work 401k plan already. Your company's 401k plan bas changed peiders. The new provider offers more mutal find and ETF choices for you to invest in. You are a medium to take and like diversity of your investments. Using percentage (S), how would you split up your investments using a combination of the mutual funds and ETFs above. Give reasons for each of your selections 16 VTSMX $300 10% 8% 9% None VFINX AGTHX 180 140 8 10 10 9 1. Vanguard Total Stock Market Idx Iny 2. Vanguard 500 Index Inv 3. American Growth Fund of America A 4. American EuroPacific Growth A 5. Fidelity Contrafund 6. Vanguard Total Intl Stock Idx Iny 7. American Capital Income Builder 11 None 5.75 8 120 11 130 AEPGX FCNTX VGTSX CAIBX 13 9 10 9 8 110 90 7 12 13 9 . 5.75 None None 5.75 -1 8 9 AMECX FKINX CWGIX 888 90 80 90 9 9 8 8 10 11 9 5.75 4.25 5.75 9 9 8 12 13 8 VWELX ABALX FUSEX AWSHX AIVSX 80 70 70 70 70 10 10 8 9 S. American Inc Fund of America A 9. Franklin Income A 10. American Capital World Gro & Inc A 11. Vanguard Wellington 12. American Balanced A 13. Fidelity Spartan 500 Index Iny 14. American Washington Mutual A 15. American Inystmt Co of America A 16. American Fundamental Inv A 17. Vanguard Emerging Mats Stock Idx 18. BlackRock Global Allocation A 19. American New Perspective A 20. Dodge & Cox Stock S&P 500 Stock Index None 5.75 None 5.75 5.75 8 9 9 8 11 7 ANCEX VEIEX 60 60 8 -2 10 -1 8 13 5.75 None 6 MDLOX ANWPX DODGX 60 60 50 7 8 9 7 7 10 IO 8% 5.25 5.75 None 8 10% 9% Assume your dested from college several years ago, have a job paying 585.000 mily, have over 550 000 in your work 401k plan already. Your company's 101k planchanged providers. The new provider offers more mutual fund and ETF choices for you to invest in. You are a medium risk take and like diversity of your investment. Uning percentages, how would you split up your Investments using a combination of the mutual funds and ETF's above. Oive sons for each of your selection