Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recently, Amur has joined a large UK company as a manager. His employment contracts provide him various benefits such as free accommodation, company car,

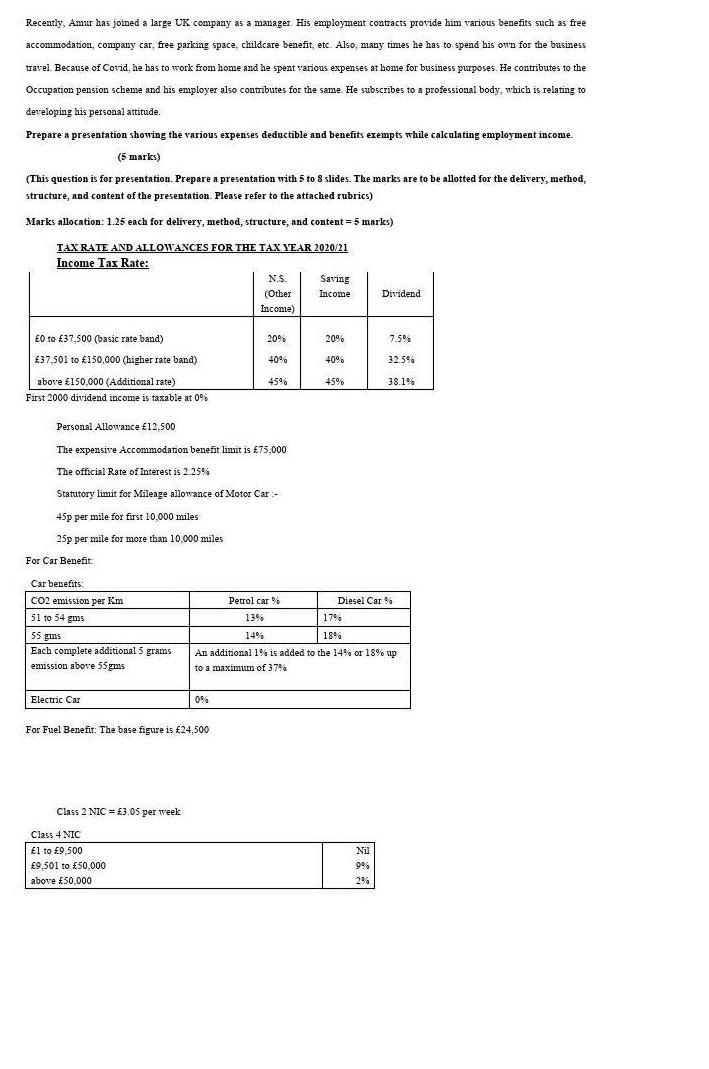

Recently, Amur has joined a large UK company as a manager. His employment contracts provide him various benefits such as free accommodation, company car, free parking space, childcare benefit, etc. Also, many times he has to spend his own for the business travel. Because of Covid, he has to work from home and he spent various expenses at home for business purposes. He contributes to the Occupation pension scheme and his employer also contributes for the same. He subscribes to a professional body, which is relating to developing his personal attitude. Prepare a presentation showing the various expenses deductible and benefits exempts while calculating employment income. (5 marks) (This question is for presentation. Prepare a presentation with 5 to 8 slides. The marks are to be allotted for the delivery, method, structure, and content of the presentation. Please refer to the attached rubrics) Marks allocation: 1.25 each for delivery, method, structure, and content = 5 marks) TAX RATE AND ALLOWANCES FOR THE TAX YEAR 2020/21 Income Tax Rate: 0 to 37,500 (basic rate band) 37,501 to 150,000 (higher rate band) above 150,000 (Additional rate) First 2000 dividend income is taxable at 0% For Car Benefit Car benefits: CO2 emission per Km 51 to 54 gms Personal Allowance 12,500 The expensive Accommodation benefit limit is 75,000 The official Rate of Interest is 2.25% Statutory limit for Mileage allowance of Motor Car - 45p per mile for first 10,000 miles 25p per mile for more than 10.000 miles 55 gms Each complete additional 5 grams emission above 55 gms Electric Car Class 2 NIC = 3.05 per week For Fuel Benefit: The base figure is 24,500 Class 4 NIC 1 to 9,500 9,501 to 50,000 above 50,000 N.S. (Other Income) 0% 20% 40% 45% Saving Income 20% 40% 45% Dividend 7.5% Nil 9% 2% 32.5% Petrol car % 13% 17% 18% 14% An additional 1% is added to the 14% or 18% up to a maximum of 37% 38.1% Diesel Car %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Reasons pdion A when Asset use onsaction is known as on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started