Answered step by step

Verified Expert Solution

Question

1 Approved Answer

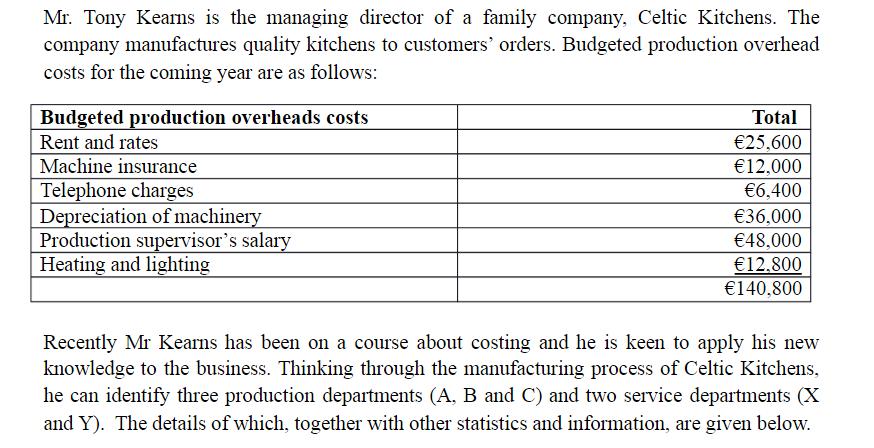

Mr. Tony Kearns is the managing director of a family company, Celtic Kitchens. The company manufactures quality kitchens to customers' orders. Budgeted production overhead

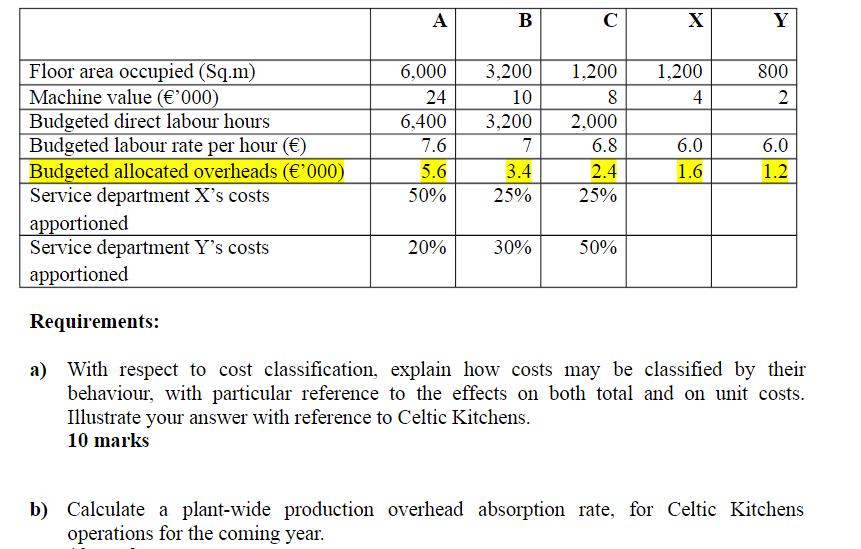

Mr. Tony Kearns is the managing director of a family company, Celtic Kitchens. The company manufactures quality kitchens to customers' orders. Budgeted production overhead costs for the coming year are as follows: Budgeted production overheads costs Rent and rates Machine insurance Telephone charges Depreciation of machinery Production supervisor's salary Heating and lighting Total 25,600 12,000 6,400 36,000 48,000 12,800 140,800 Recently Mr Kearns has been on a course about costing and he is keen to apply his new knowledge to the business. Thinking through the manufacturing process of Celtic Kitchens, he can identify three production departments (A, B and C) and two service departments (X and Y). The details of which, together with other statistics and information, are given below. Floor area occupied (Sq.m) Machine value ('000) Budgeted direct labour hours Budgeted labour rate per hour () Budgeted allocated overheads ('000) Service department X's costs A 6,000 24 6,400 7.6 5.6 50% B 20% 3,200 10 3,200 7 3.4 25% C 30% 1,200 8 2,000 6.8 2.4 25% X 50% 1,200 4 6.0 1.6 Y apportioned Service department Y's costs apportioned Requirements: a) With respect to cost classification, explain how costs may be classified by their behaviour, with particular reference to the effects on both total and on unit costs. Illustrate your answer with reference to Celtic Kitchens. 10 marks 800 2 6.0 1.2 b) Calculate a plant-wide production overhead absorption rate, for Celtic Kitchens operations for the coming year. c) d) e) Allocate and apportion the estimated production overhead costs to each of the company's departments, and on the basis of the resulting departmental overhead totals, compute an absorption rate for each production department. 10 marks Two kitchens are to be manufactured for customers in the coming year. Job codes of 123 and 456 are assigned and the following direct material and direct labour are associated with each job: (1) (111) Direct materials Direct labour Job 123 450 22 hours Dept A 10 hours Dept B 10 hours Dept C Calculate the prime cost associated with each job. Calculate the total cost associated with each job if departmental overhead rates are used. 20 marks At the end of the year, the following information was reported: Actual direct labour hours Actual overhead A 6,000 90,200 Job 456 650 14 hours Dept A 8 hours Dept B 12 hours Dept C B 3,600 45,400 C 2,500 32,000 Calculate the amount of under or over absorption of production overhead for the period and state the appropriate treatment in the financial accounts.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Cost Classification by Behavior Costs can be classified based on their behavior with respect to changes in production or activity levels The two main categories are fixed costs and variable costs Fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started