Answered step by step

Verified Expert Solution

Question

1 Approved Answer

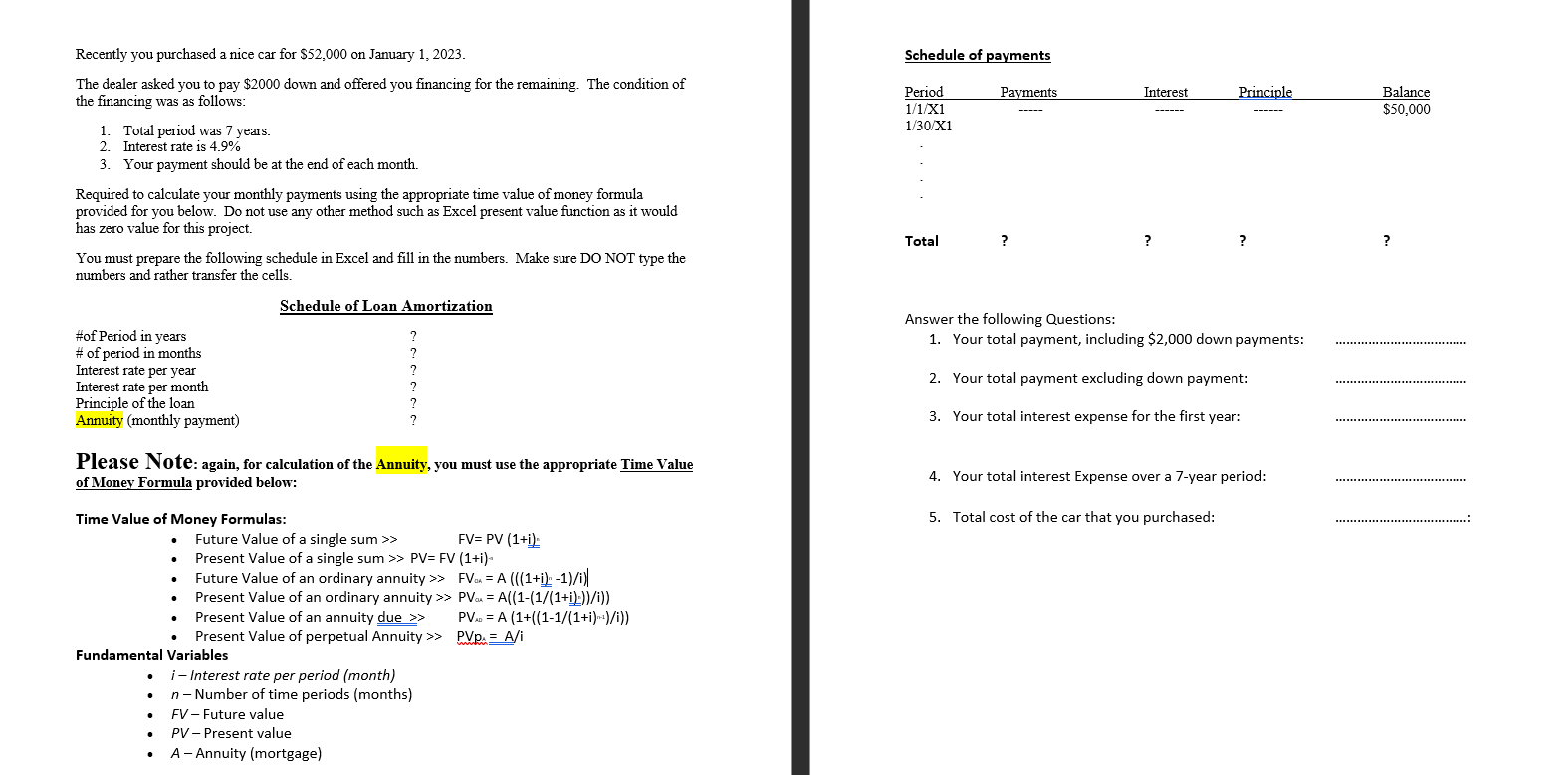

Recently you purchased a nice car for $ 5 2 , 0 0 0 on January 1 , 2 0 2 3 . The dealer

Recently you purchased a nice car for $ on January

The dealer asked you to pay $ down and offered you financing for the remaining. The condition of

the financing was as follows:

Total period was years.

Interest rate is

Your payment should be at the end of each month.

Required to calculate your monthly payments using the appropriate time value of money formula

provided for you below. Do not use any other method such as Excel present value function as it would

has zero value for this project.

You must prepare the following schedule in Excel and fill in the numbers. Make sure DO NOT type the

numbers and rather transfer the cells.

Schedule of Loan Amortization

#of Period in years

# of period in months

Interest rate per year

Interest rate per month

Principle of the loan

Annuity monthly payment

Please Note: again, for calculation of the Annuity, you must use the appropriate Time Value

of Money Formula provided below:

Time Value of Money Formulas:

Future Value of a single sum

Present Value of a single sum

Future Value of an ordinary annuity

Present Value of an ordinary annuity

Present Value of perpetual Annuity

Fundamental Variables

Interest rate per period month

Number of time periods months

Future value

Present value

AAnnuity mortgage

Schedule of payments

Answer the following Questions:

Your total payment, including $ down payments:

Your total payment excluding down payment:

Your total interest expense for the first year:

Your total interest Expense over a year period:

Total cost of the car that you purchased:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started