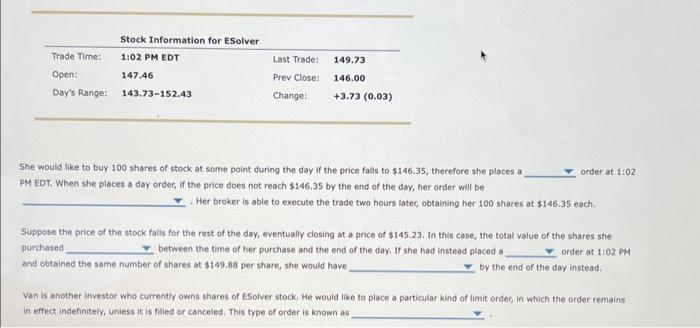

Recognizing Different Types of Orders As an investor, based on your goals and investment objectives you create an investment plan. You choose your stockbroker that suits your needs, but when it is time to actually buy or sell securities in the securities market, it is important to understand how your transactions will be executed. Based on your expectations regarding a specific transaction you have the option to select from three different order types: market order, limit order, or a stop-loss order. Amy is an experienced investor who enjoys researching and investing in individual stocks that appear promising. On August 12 she is reviewing the trading information for a new educational technology company Esolver, presented in the following table, She would tike to buy 100 shares of stock at some point during the day if the price falls to $146.35, therefore she places a order at 1:02. PM EDT. When she places a day order, if the price does not reach $146.35 by the end of the day, her order will be . Her broker is able to execute the trade two hours later, obtaining her 100 shares at $146.35 each. Suppose the price of the stock falis for the rest of the day, eventually closing at a price of $145.23. In this case, the total value of the shares she purchased between the time of her purchase and the end of the day. If she had instead placed a order at 1:02PM and obtained the same number of shares at $149.88 per share, she would have by the end of the day instead. Van is another investor who currently owns shares of Esolver stock. He would like to place a particular kind of limit order, in which the order remains in effect indefinitely, uniess it is niled or canceled. This type of order is known as Recognizing Different Types of Orders As an investor, based on your goals and investment objectives you create an investment plan. You choose your stockbroker that suits your needs, but when it is time to actually buy or sell securities in the securities market, it is important to understand how your transactions will be executed. Based on your expectations regarding a specific transaction you have the option to select from three different order types: market order, limit order, or a stop-loss order. Amy is an experienced investor who enjoys researching and investing in individual stocks that appear promising. On August 12 she is reviewing the trading information for a new educational technology company Esolver, presented in the following table, She would tike to buy 100 shares of stock at some point during the day if the price falls to $146.35, therefore she places a order at 1:02. PM EDT. When she places a day order, if the price does not reach $146.35 by the end of the day, her order will be . Her broker is able to execute the trade two hours later, obtaining her 100 shares at $146.35 each. Suppose the price of the stock falis for the rest of the day, eventually closing at a price of $145.23. In this case, the total value of the shares she purchased between the time of her purchase and the end of the day. If she had instead placed a order at 1:02PM and obtained the same number of shares at $149.88 per share, she would have by the end of the day instead. Van is another investor who currently owns shares of Esolver stock. He would like to place a particular kind of limit order, in which the order remains in effect indefinitely, uniess it is niled or canceled. This type of order is known as