Question

LMN Company purchased another company on January 1, 2015, resulting in the recording of goodwill of $2,000,000 and a patent valued at $120,000. The

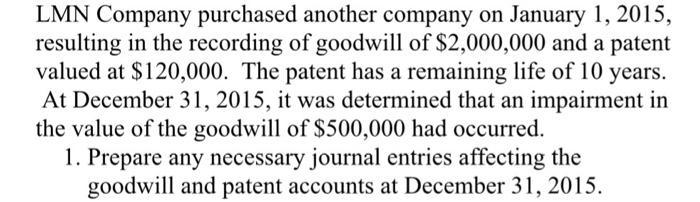

LMN Company purchased another company on January 1, 2015, resulting in the recording of goodwill of $2,000,000 and a patent valued at $120,000. The patent has a remaining life of 10 years. At December 31, 2015, it was determined that an impairment in the value of the goodwill of $500,000 had occurred. 1. Prepare any necessary journal entries affecting the goodwill and patent accounts at December 31, 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the necessary journal entries affecting the goodwill and patent accounts at December 31 2015 we need to account for the impairment in the value of goodwill Heres how the journal entries wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App