Answered step by step

Verified Expert Solution

Question

1 Approved Answer

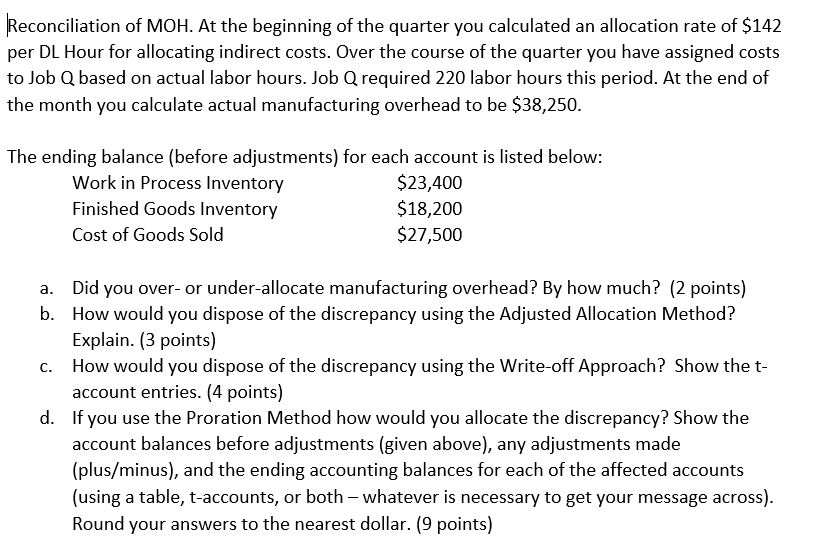

Reconciliation of MOH. At the beginning of the quarter you calculated an allocation rate of $142 per DL Hour for allocating indirect costs. Over

Reconciliation of MOH. At the beginning of the quarter you calculated an allocation rate of $142 per DL Hour for allocating indirect costs. Over the course of the quarter you have assigned costs to Job Q based on actual labor hours. Job Q required 220 labor hours this period. At the end of the month you calculate actual manufacturing overhead to be $38,250. The ending balance (before adjustments) for each account is listed below: Work in Process Inventory Finished Goods Inventory Cost of Goods Sold a. b. $23,400 $18,200 $27,500 Did you over- or under-allocate manufacturing overhead? By how much? (2 points) How would you dispose of the discrepancy using the Adjusted Allocation Method? Explain. (3 points) How would you dispose of the discrepancy using the Write-off Approach? Show the t- account entries. (4 points) d. If you use the Proration Method how would you allocate the discrepancy? Show the account balances before adjustments (given above), any adjustments made (plus/minus), and the ending accounting balances for each of the affected accounts (using a table, t-accounts, or both - whatever is necessary to get your message across). Round your answers to the nearest dollar. (9 points)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The company underallocated manufacturing overhead by 1250 b The Adjusted Allocation Method would involve recalculating the overhead allocatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started