Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reconciliation Task Two: (LOS 4 & 5) (16 Marks) The following information is available as you are in the process of reconciling Basma Co's book

Reconciliation

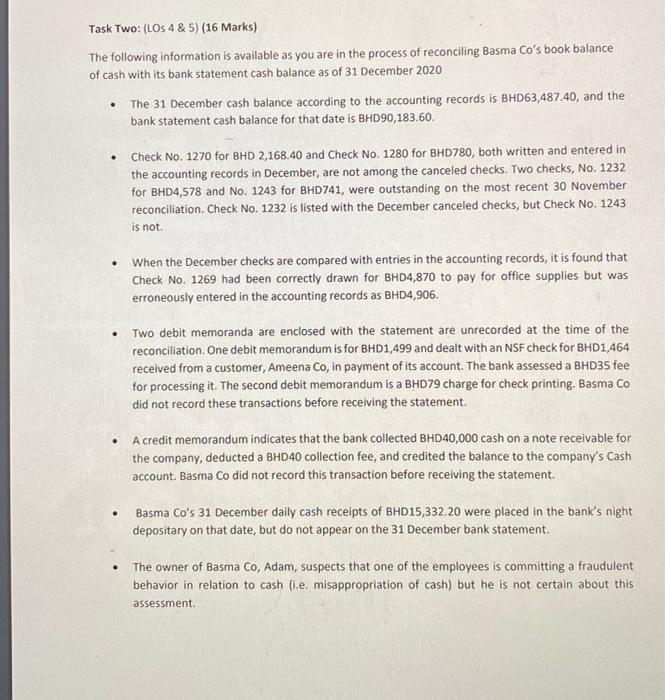

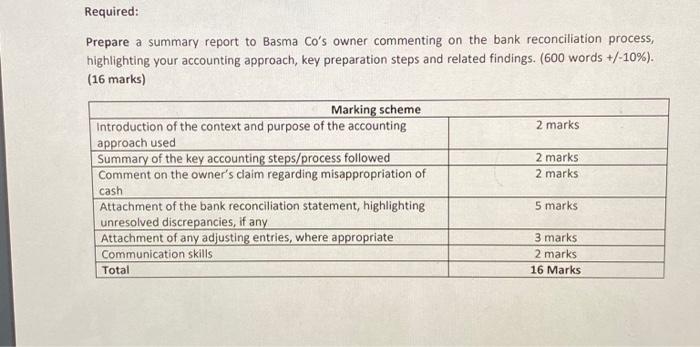

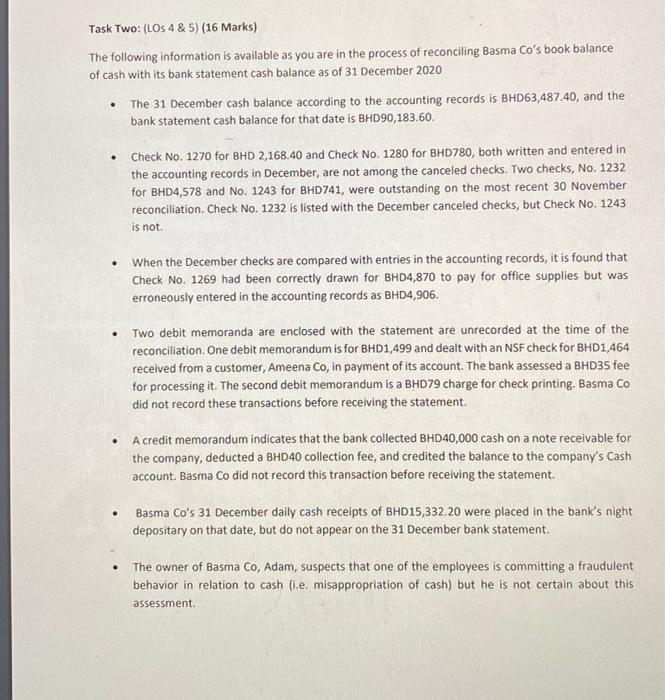

Task Two: (LOS 4 & 5) (16 Marks) The following information is available as you are in the process of reconciling Basma Co's book balance of cash with its bank statement cash balance as of 31 December 2020 The 31 December cash balance according to the accounting records is BHD63,487.40, and the bank statement cash balance for that date is BHD90,183.60 Check No. 1270 for BHD 2,168.40 and Check No. 1280 for BHD780, both written and entered in the accounting records in December, are not among the canceled checks. Two checks, No. 1232 for BHD4,578 and No. 1243 for BHD741, were outstanding on the most recent 30 November reconciliation. Check No. 1232 is listed with the December canceled checks, but Check No. 1243 is not . When the December checks are compared with entries in the accounting records, it is found that Check No. 1269 had been correctly drawn for BHD4,870 to pay for office supplies but was erroneously entered in the accounting records as BHD4,906. Two debit memoranda are enclosed with the statement are unrecorded at the time of the reconciliation. One debit memorandum is for BHD1,499 and dealt with an NSF check for BHD1,464 received from a customer, Ameena Co, in payment of its account. The bank assessed a BHD35 fee for processing it. The second debit memorandum is a BHD79 charge for check printing. Basma Co did not record these transactions before receiving the statement. . A credit memorandum indicates that the bank collected BHD40,000 cash on a note receivable for the company, deducted a BHD40 collection fee, and credited the balance to the company's Cash account. Basma Co did not record this transaction before receiving the statement. . Basma Co's 31 December daily cash receipts of BHD15,332.20 were placed in the bank's night depositary on that date, but do not appear on the 31 December bank statement. The owner of Basma Co, Adam, suspects that one of the employees is committing a fraudulent behavior in relation to cash (1.e. misappropriation of cash) but he is not certain about this assessment. Required: Prepare a summary report to Basma Co's owner commenting on the bank reconciliation process, highlighting your accounting approach, key preparation steps and related findings. (600 words +/-10%). (16 marks) Marking scheme Introduction of the context and purpose of the accounting 2 marks approach used Summary of the key accounting steps/process followed 2 marks Comment on the owner's claim regarding misappropriation of 2 marks cash Attachment of the bank reconciliation statement, highlighting 5 marks unresolved discrepancies, if any Attachment of any adjusting entries, where appropriate 3 marks Communication skills 2 marks Total 16 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

![For Mowen/hansen/heitgers Cornerstones Of Managerial Accounting, 6th Edition, [instant Access]](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/book_images/2022/04/6257c87e3025b_1256257c87dcfa77.jpg)