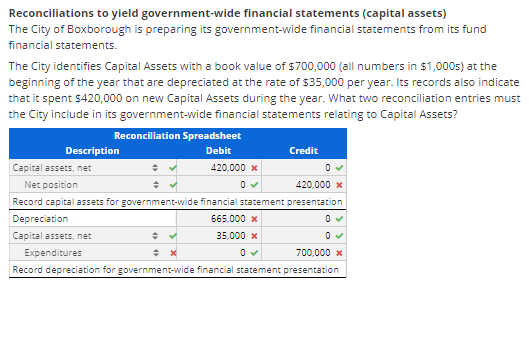

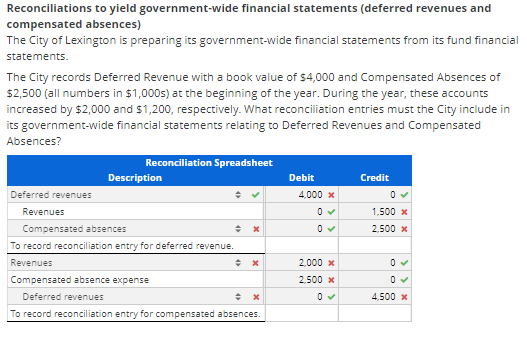

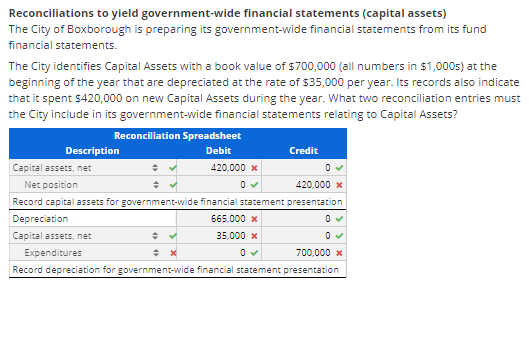

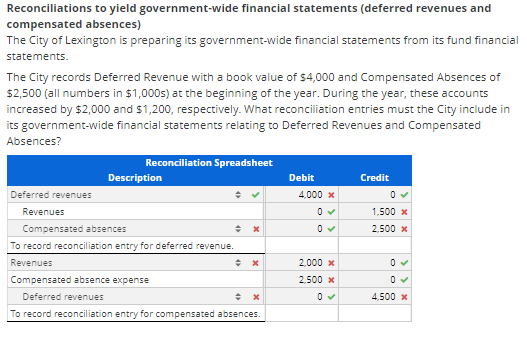

Reconciliations to yield government-wide financial statements (capital assets) The City of Boxborough is preparing its government-wide financial statements from its fund financial statements. The City identifies Capital Assets with a book value of $700,000 (all numbers in $1,000s) at the beginning of the year that are depreciated at the rate of $35,000 per year. Its records also indicate that it spent $420,000 on new Capital Assets during the year. What two reconciliation entries must the City include in its government-wide financial statements relating to Capital Assets? Reconciliation Spreadsheet Description Debit Credit Capital assets, net 420,000 x 0 Net position 420.000 x Record capital assets for government-wide financial statement presentation Depreciation 665,000 x Capital assets, net 35,000 X Expenditures 700,000 X Record depreciation for government-wide financial statement presentation . Reconciliations to yield government-wide financial statements (deferred revenues and compensated absences) The City of Lexington is preparing its government-wide financial statements from its fund financial statements The City records Deferred Revenue with a book value of $4,000 and Compensated Absences of $2,500 (all numbers in $1,000s) at the beginning of the year. During the year, these accounts increased by $2,000 and $1,200, respectively. What reconciliation entries must the City include in its government-wide financial statements relating to Deferred Revenues and Compensated Absences? Reconciliation Spreadsheet Description Debit Credit Deferred revenues 4.000 x Revenues 1.500 X Compensated absences 2.500 x To record reconciliation entry for deferred revenue. Revenues 2.000 x Compensated absence expense 2.500 X Deferred revenues 4.500 X To record reconciliation entry for compensated absences. Reconciliations to yield government-wide financial statements (capital assets) The City of Boxborough is preparing its government-wide financial statements from its fund financial statements. The City identifies Capital Assets with a book value of $700,000 (all numbers in $1,000s) at the beginning of the year that are depreciated at the rate of $35,000 per year. Its records also indicate that it spent $420,000 on new Capital Assets during the year. What two reconciliation entries must the City include in its government-wide financial statements relating to Capital Assets? Reconciliation Spreadsheet Description Debit Credit Capital assets, net 420,000 x 0 Net position 420.000 x Record capital assets for government-wide financial statement presentation Depreciation 665,000 x Capital assets, net 35,000 X Expenditures 700,000 X Record depreciation for government-wide financial statement presentation . Reconciliations to yield government-wide financial statements (deferred revenues and compensated absences) The City of Lexington is preparing its government-wide financial statements from its fund financial statements The City records Deferred Revenue with a book value of $4,000 and Compensated Absences of $2,500 (all numbers in $1,000s) at the beginning of the year. During the year, these accounts increased by $2,000 and $1,200, respectively. What reconciliation entries must the City include in its government-wide financial statements relating to Deferred Revenues and Compensated Absences? Reconciliation Spreadsheet Description Debit Credit Deferred revenues 4.000 x Revenues 1.500 X Compensated absences 2.500 x To record reconciliation entry for deferred revenue. Revenues 2.000 x Compensated absence expense 2.500 X Deferred revenues 4.500 X To record reconciliation entry for compensated absences