Answered step by step

Verified Expert Solution

Question

1 Approved Answer

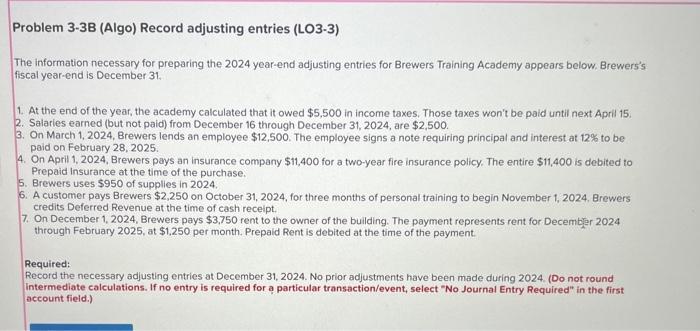

Record adjusting entries Problem 3-3B (Algo) Record adjusting entries (LO3-3) The information necessary for preparing the 2024 year-end adjusting entries for Brewers Training Academy appears

Record adjusting entries

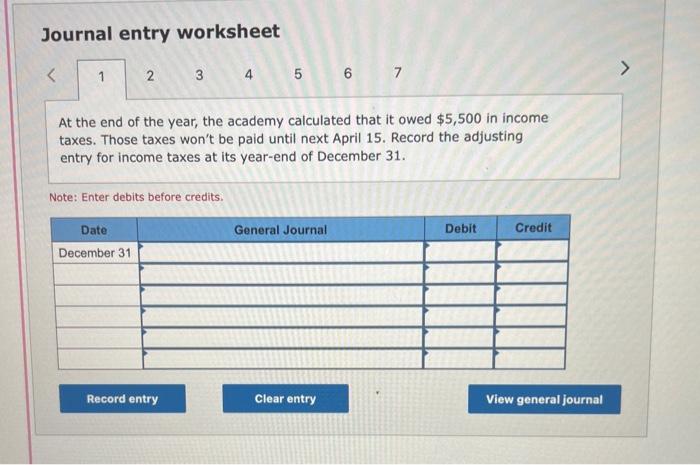

Problem 3-3B (Algo) Record adjusting entries (LO3-3) The information necessary for preparing the 2024 year-end adjusting entries for Brewers Training Academy appears below. Brewers's fiscal year-end is December 31 . 1. At the end of the year, the academy calculated that it owed $5,500 in income taxes. Those taxes won't be paid until next April 15. 2. Salarles earned (but not paid) from December 16 through December 31,2024 , are $2,500. 3. On March 1,2024, Brewers lends an employee $12,500. The employee signs a note requiring principal and interest at 12% to be paid on February 28,2025. 4. On April 1, 2024, Brewers pays an insurance company $11,400 for a two-year fire insurance policy. The entire $11,400 is debited to Prepaid Insurance at the time of the purchase. 5. Brewers uses $950 of supplies in 2024 . 6. A customer pays Brewers $2,250 on October 31,2024 , for three months of personal training to begin November 1, 2024, Brewers credits Deferred Revenue at the time of cash receipt. 7. On December 1, 2024, Brewers pays $3,750 rent to the owner of the building. The payment represents rent for Decembier 2024 through February 2025, at $1,250 per month. Prepaid Rent is debited at the time of the payment. Required: Record the necessary adjusting entries at December 31, 2024. No prior adjustments have been made during 2024. (Do not round Intermediate calculations. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet At the end of the year, the academy calculated that it owed $5,500 in income taxes. Those taxes won't be paid until next April 15. Record the adjusting entry for income taxes at its year-end of December 31. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started