Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record all transactions (in p.3-4) manually, using the journal template provided. 2. Post the transactions to the relevant ledger accounts, using the ledger template provided

- Record all transactions (in p.3-4) manually, using the journal template provided.

2. Post the transactions to the relevant ledger accounts, using the ledger template provided

3. Complete the transaction analysis, using the Excel template provided.

4. Prepare both the Income Statement and Balance Sheet for April 2020, using the Excel

template.

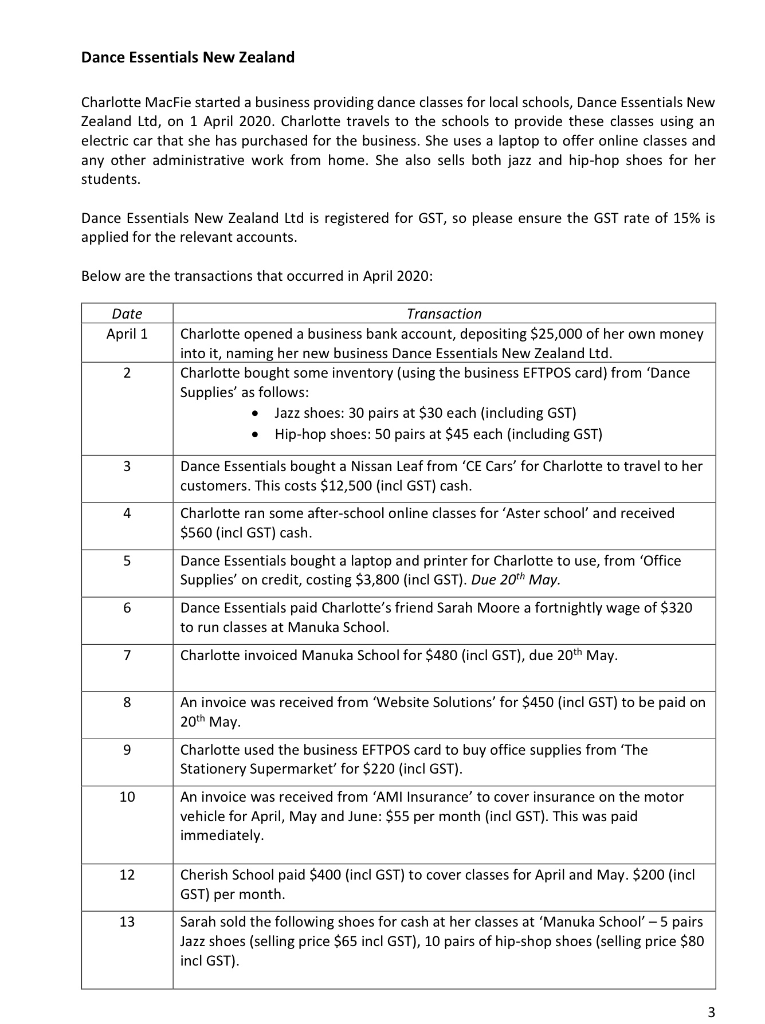

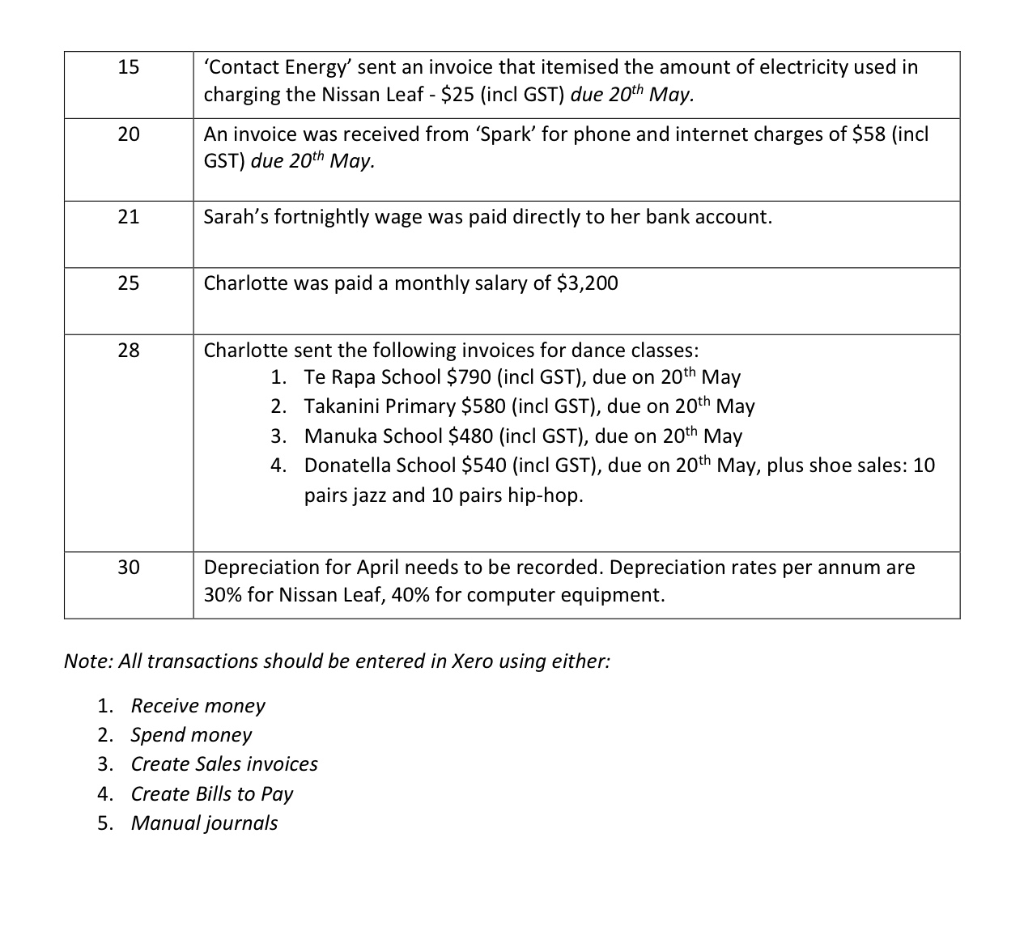

Dance Essentials New Zealand Charlotte MacFie started a business providing dance classes for local schools, Dance Essentials New Zealand Ltd, on 1 April 2020. Charlotte travels to the schools to provide these classes using an electric car that she has purchased for the business. She uses a laptop to offer online classes and any other administrative work from home. She also sells both jazz and hip-hop shoes for her students. Dance Essentials New Zealand Ltd is registered for GST, so please ensure the GST rate of 15% is applied for the relevant accounts. Below are the transactions that occurred in April 2020: Date April 1 Transaction Charlotte opened a business bank account, depositing $25,000 of her own money into it, naming her new business Dance Essentials New Zealand Ltd. Charlotte bought some inventory (using the business EFTPOS card) from 'Dance Supplies' as follows: Jazz shoes: 30 pairs at $30 each (including GST) Hip-hop shoes: 50 pairs at $45 each (including GST) Dance Essentials bought a Nissan Leaf from 'CE Cars' for Charlotte to travel to her customers. This costs $12,500 (incl GST) cash. Charlotte ran some after-school online classes for 'Aster school and received $560 (incl GST) cash. Dance Essentials bought a laptop and printer for Charlotte to use, from 'Office Supplies' on credit, costing $3,800 (incl GST). Due 20th May. Dance Essentials paid Charlotte's friend Sarah Moore a fortnightly wage of $320 to run classes at Manuka School. Charlotte invoiced Manuka School for $480 (incl GST), due 20th May. An invoice was received from 'Website Solutions' for $450 (incl GST) to be paid on 20th May. Charlotte used the business EFTPOS card to buy office supplies from 'The Stationery Supermarket' for $220 (incl GST). An invoice was received from 'AMI Insurance' to cover insurance on the motor vehicle for April, May and June: $55 per month (incl GST). This was paid immediately. Cherish School paid $400 (incl GST) to cover classes for April and May. $200 (incl GST) per month. Sarah sold the following shoes for cash at her classes at 'Manuka School' - 5 pairs Jazz shoes (selling price $65 incl GST), 10 pairs of hip-shop shoes (selling price $80 incl GST). 'Contact Energy' sent an invoice that itemised the amount of electricity used in charging the Nissan Leaf - $25 (incl GST) due 20th May. An invoice was received from 'Spark' for phone and internet charges of $58 (incl GST) due 20th May. Sarah's fortnightly wage was paid directly to her bank account. Charlotte was paid a monthly salary of $3,200 Charlotte sent the following invoices for dance classes: 1. Te Rapa School $790 (incl GST), due on 20th May 2. Takanini Primary $580 (incl GST), due on 20th May 3. Manuka School $480 (incl GST), due on 20th May 4. Donatella School $540 (incl GST), due on 20th May, plus shoe sales: 10 pairs jazz and 10 pairs hip-hop. 30 Depreciation for April needs to be recorded. Depreciation rates per annum are 30% for Nissan Leaf, 40% for computer equipment. Note: All transactions should be entered in Xero using either: 1. Receive money 2. Spend money 3. Create Sales invoices 4. Create Bills to Pay 5. Manual journals Dance Essentials New Zealand Charlotte MacFie started a business providing dance classes for local schools, Dance Essentials New Zealand Ltd, on 1 April 2020. Charlotte travels to the schools to provide these classes using an electric car that she has purchased for the business. She uses a laptop to offer online classes and any other administrative work from home. She also sells both jazz and hip-hop shoes for her students. Dance Essentials New Zealand Ltd is registered for GST, so please ensure the GST rate of 15% is applied for the relevant accounts. Below are the transactions that occurred in April 2020: Date April 1 Transaction Charlotte opened a business bank account, depositing $25,000 of her own money into it, naming her new business Dance Essentials New Zealand Ltd. Charlotte bought some inventory (using the business EFTPOS card) from 'Dance Supplies' as follows: Jazz shoes: 30 pairs at $30 each (including GST) Hip-hop shoes: 50 pairs at $45 each (including GST) Dance Essentials bought a Nissan Leaf from 'CE Cars' for Charlotte to travel to her customers. This costs $12,500 (incl GST) cash. Charlotte ran some after-school online classes for 'Aster school and received $560 (incl GST) cash. Dance Essentials bought a laptop and printer for Charlotte to use, from 'Office Supplies' on credit, costing $3,800 (incl GST). Due 20th May. Dance Essentials paid Charlotte's friend Sarah Moore a fortnightly wage of $320 to run classes at Manuka School. Charlotte invoiced Manuka School for $480 (incl GST), due 20th May. An invoice was received from 'Website Solutions' for $450 (incl GST) to be paid on 20th May. Charlotte used the business EFTPOS card to buy office supplies from 'The Stationery Supermarket' for $220 (incl GST). An invoice was received from 'AMI Insurance' to cover insurance on the motor vehicle for April, May and June: $55 per month (incl GST). This was paid immediately. Cherish School paid $400 (incl GST) to cover classes for April and May. $200 (incl GST) per month. Sarah sold the following shoes for cash at her classes at 'Manuka School' - 5 pairs Jazz shoes (selling price $65 incl GST), 10 pairs of hip-shop shoes (selling price $80 incl GST). 'Contact Energy' sent an invoice that itemised the amount of electricity used in charging the Nissan Leaf - $25 (incl GST) due 20th May. An invoice was received from 'Spark' for phone and internet charges of $58 (incl GST) due 20th May. Sarah's fortnightly wage was paid directly to her bank account. Charlotte was paid a monthly salary of $3,200 Charlotte sent the following invoices for dance classes: 1. Te Rapa School $790 (incl GST), due on 20th May 2. Takanini Primary $580 (incl GST), due on 20th May 3. Manuka School $480 (incl GST), due on 20th May 4. Donatella School $540 (incl GST), due on 20th May, plus shoe sales: 10 pairs jazz and 10 pairs hip-hop. 30 Depreciation for April needs to be recorded. Depreciation rates per annum are 30% for Nissan Leaf, 40% for computer equipment. Note: All transactions should be entered in Xero using either: 1. Receive money 2. Spend money 3. Create Sales invoices 4. Create Bills to Pay 5. Manual journals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started