Question

Record Depreciation on assets Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method. For assets

Record Depreciation on assets

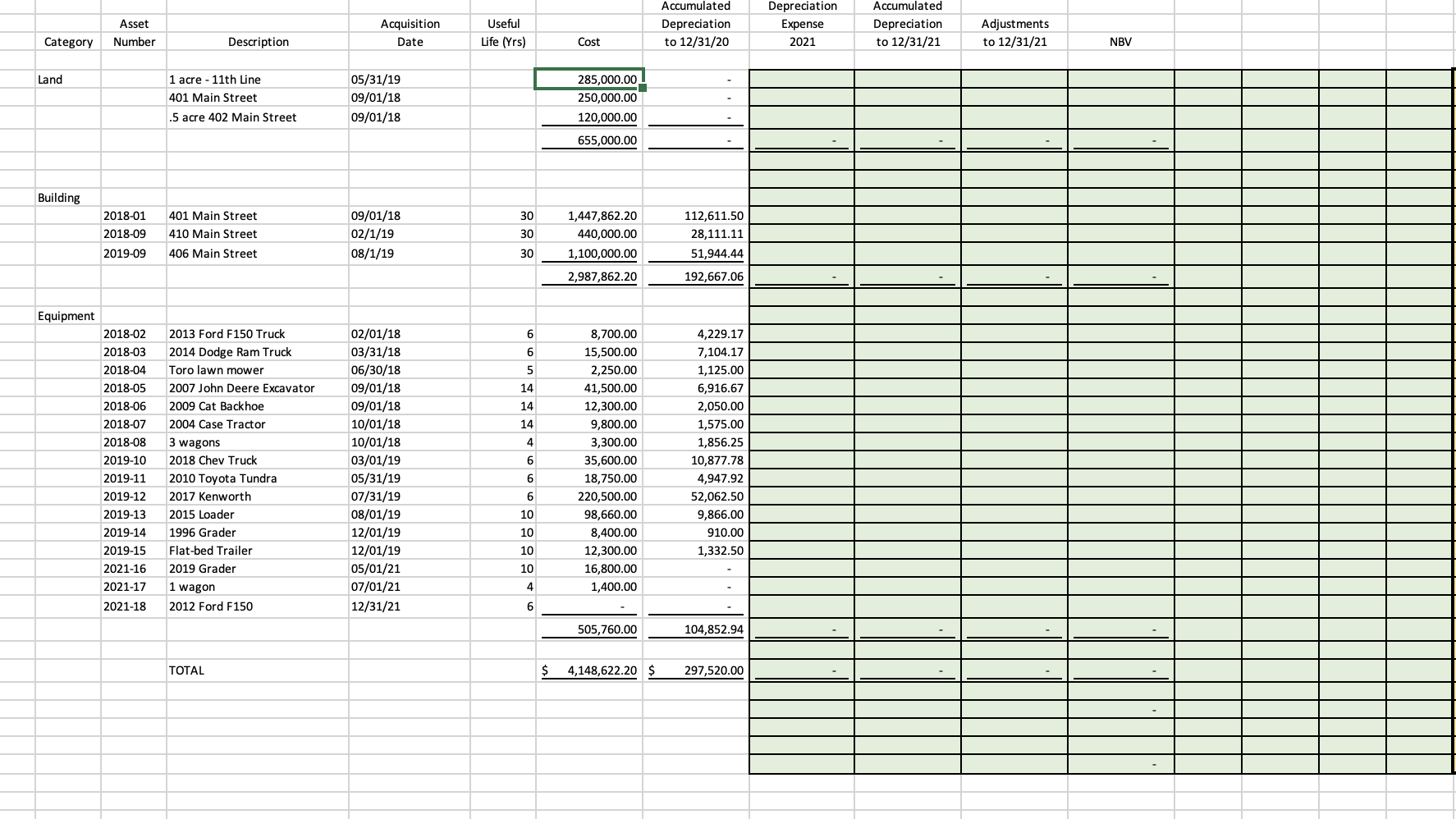

Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method.

For assets purchased during the year, round to the nearest month when calculating depreciation.

Note two assets were purchased during the year. In the Excel spreadsheet, see the tab Fixed Asset Details to perform any necessary calculations. Details on asset 2021-18 are provided below.

b)

Traded a vehicle

On December 31, 2021 (after recording depreciation); the company traded asset #2018-03 for a used 2012 Ford F150. In addition to the trade, the company paid $1,750 cash for the new truck. The fair value of asset # 2018-03 was $9,000. Assume that this transaction HAS commercial substance. Once this new asset is purchased and recorded on the fixed asset list, do not depreciate it. The above data should be used to populate financial information regarding asset number 2021-18 on the fixed asset listing.

NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial Balance (on the Cash & Equivalents tab, the amount paid should flow thru the BMO Chequing account).

In the Excel spreadsheet, see the tab Fixed Asset Details to perform any necessary calculations; and update the schedule as needed.

c)

Revalue an Asset

On December 31, 2021 (after recording depreciation); the company reviewed assets for revaluation. The building at 410 Main Street was appraised with a new value of $420,000. The company uses the revaluation asset adjustment method to account for revaluations.

In the Excel spreadsheet, see the tab Fixed Asset Details to perform any necessary calculations; and update the schedule as needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started