Question

. Record each transaction in the journal, using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Building; Furniture; Accounts Payable; Utilities

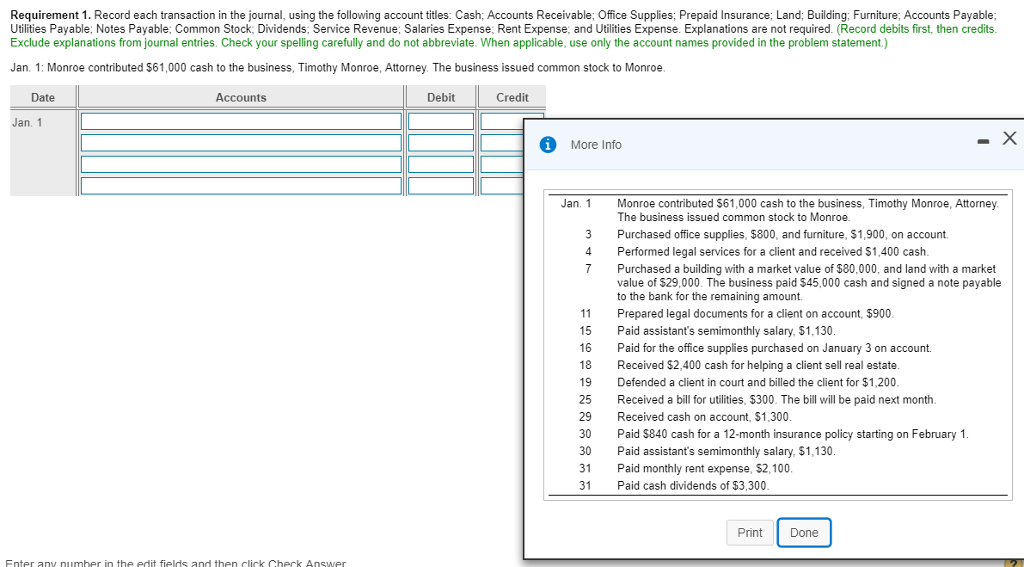

. Record each transaction in the journal, using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Building; Furniture; Accounts Payable; Utilities Payable; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; and Utilities Expense. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Check your spelling carefully and do not abbreviate. When applicable, use only the account names provided in the problem statement.)

. Record each transaction in the journal, using the following account titles: Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Land; Building; Furniture; Accounts Payable; Utilities Payable; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; and Utilities Expense. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Check your spelling carefully and do not abbreviate. When applicable, use only the account names provided in the problem statement.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started