record journal entries for each transaction shown and present financial statements for the two months of transactions. There should be an income statement and balance sheet for each month. Make sure your balance sheet balances.

a-dd have been answered i need help on ee-hhh

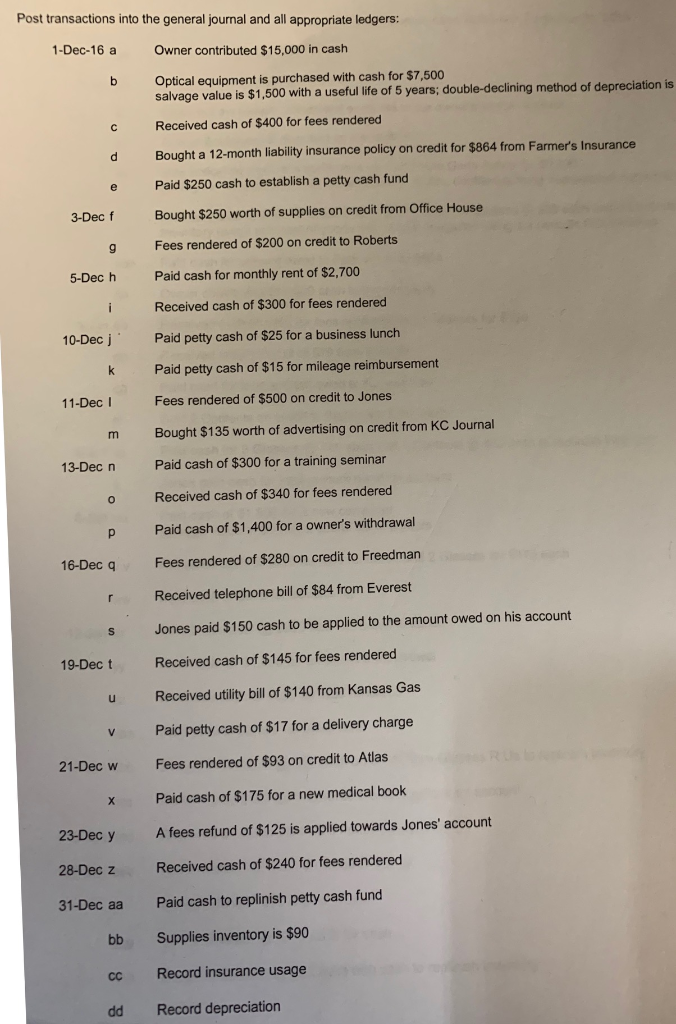

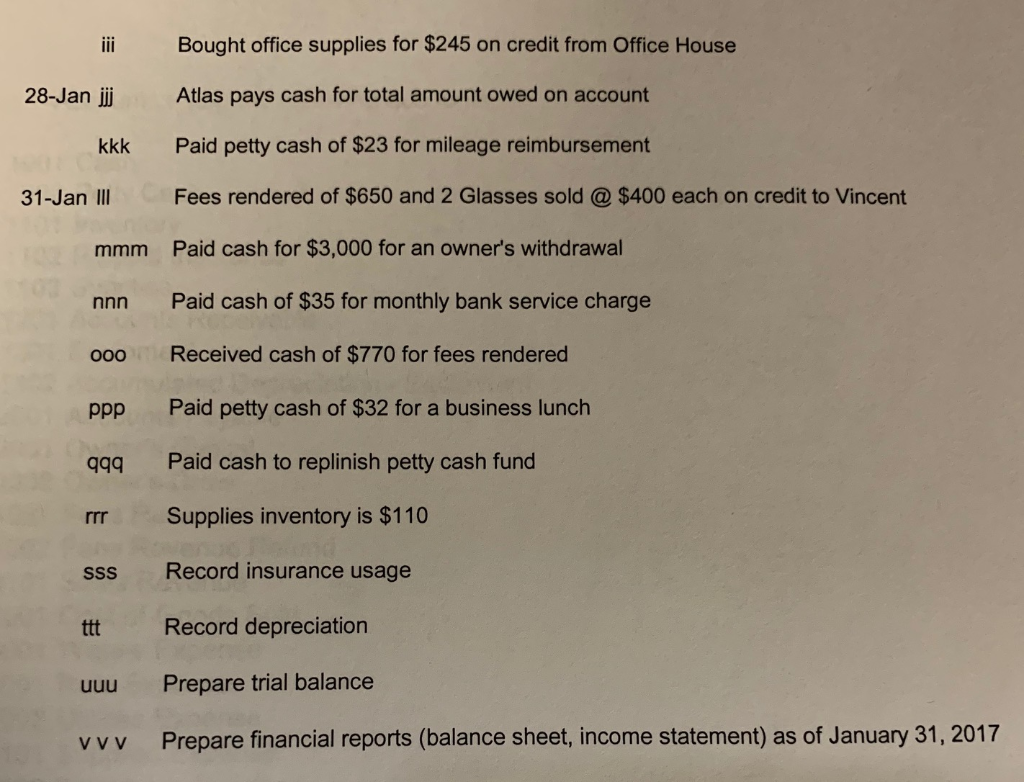

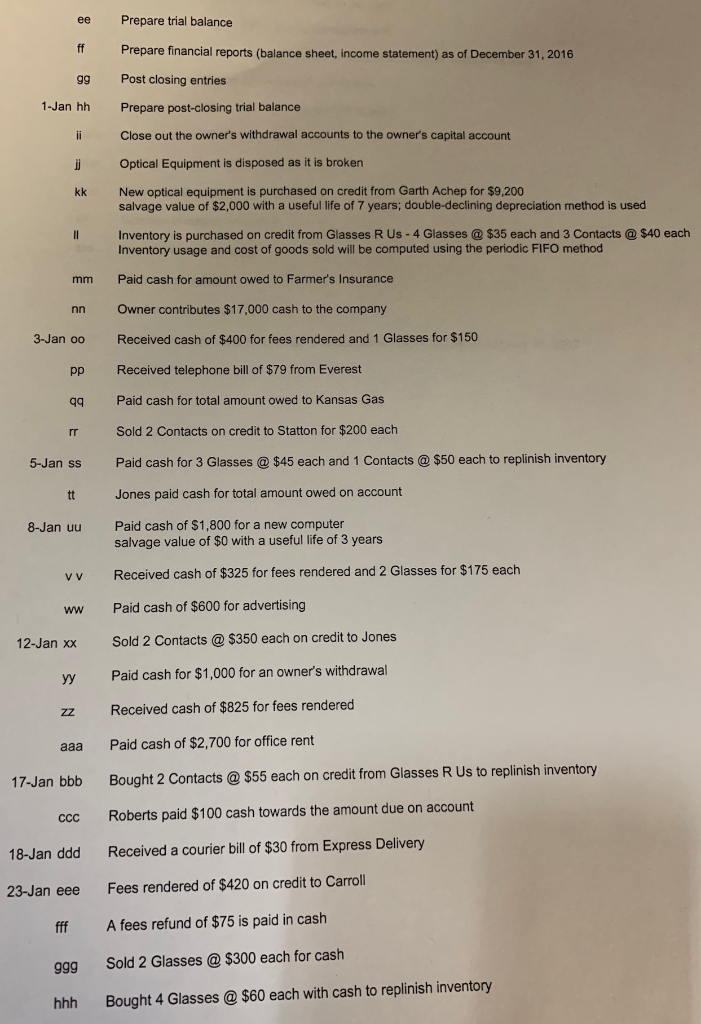

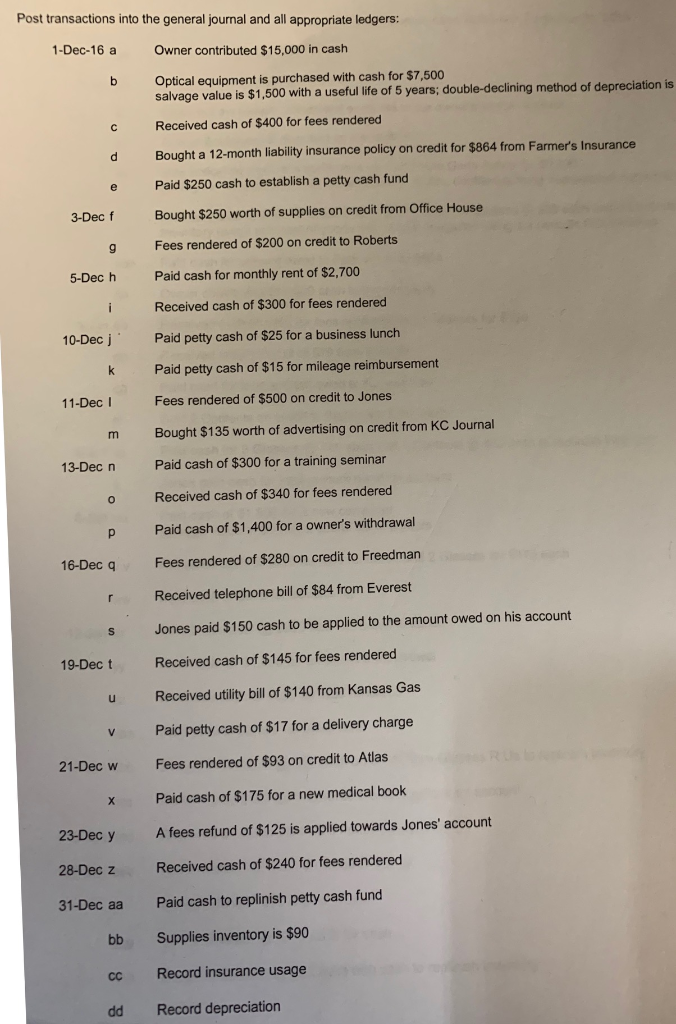

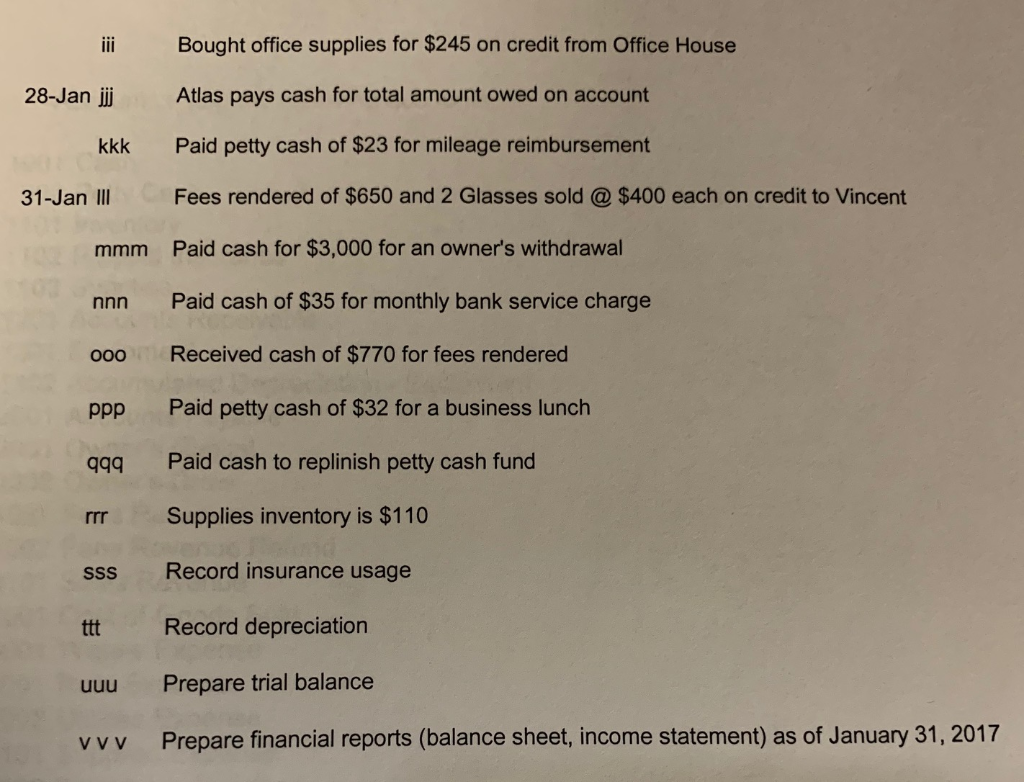

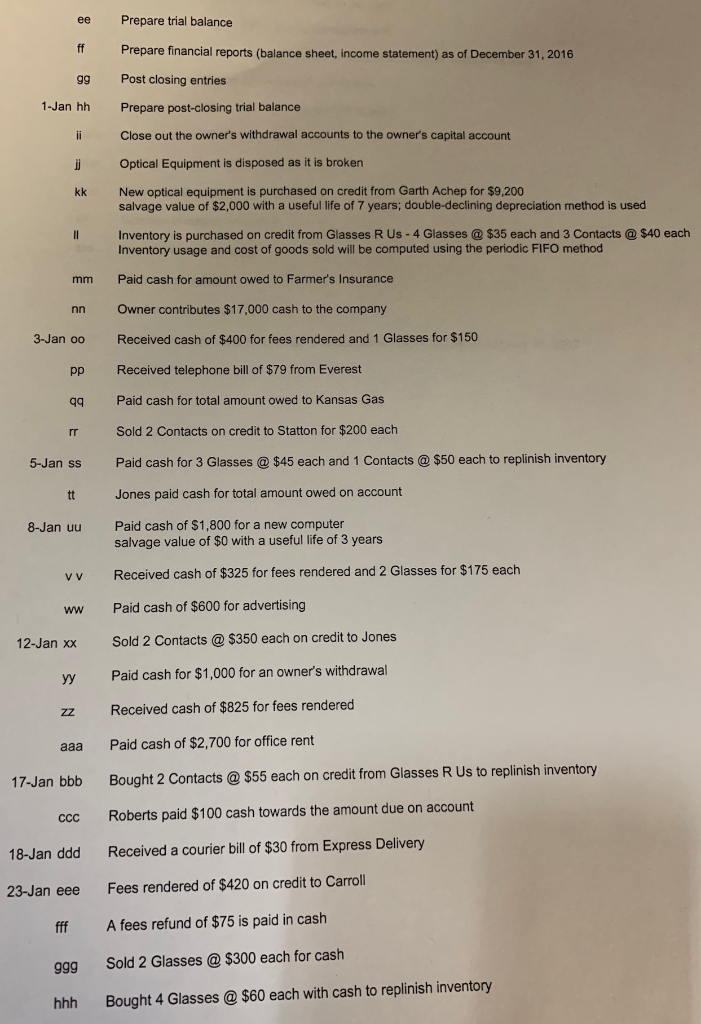

Post transactions into the general journal and all appropriate ledgers: 1-Dec-16 a Owner contributed $15,000 in cash Optical equipment is purchased with cash for $7,500 salvage value is $1,500 with a useful life of 5 years; double-declining method of depreciation is Received cash of $400 for fees rendered Bought a 12-month liability insurance policy on credit for $864 from Farmer's Insurance Paid $250 cash to establish a petty cash fund 3-Dec f Bought $250 worth of supplies on credit from Office House Fees rendered of $200 on credit to Roberts 5-Dec h Paid cash for monthly rent of $2,700 Received cash of $300 for fees rendered 10-Dec j' Paid petty cash of $25 for a business lunch k Paid petty cash of $15 for mileage reimbursement 11-Dec Fees rendered of $500 on credit to Jones Bought $135 worth of advertising on credit from KC Journal 13-Dec n Paid cash of $300 for a training seminar Received cash of $340 for fees rendered Paid cash of $1,400 for a owner's withdrawal 16-Dec a Fees rendered of $280 on credit to Freedman Received telephone bill of $84 from Everest S Jones paid $150 cash to be applied to the amount owed on his account 19-Dect Received cash of $145 for fees rendered Received utility bill of $140 from Kansas Gas Paid petty cash of $17 for a delivery charge 21-Dec w Fees rendered of $93 on credit to Atlas Paid cash of $175 for a new medical book 23-Dec y A fees refund of $125 is applied towards Jones' account 28-Dec z Received cash of $240 for fees rendered 31-Dec aa Paid cash to replinish petty cash fund bb Supplies inventory is $90 Record insurance usage dd Record depreciation Bought office supplies for $245 on credit from Office House 28-Jan ji Atlas pays cash for total amount owed on account kkk Paid petty cash of $23 for mileage reimbursement 31-Jan III Fees rendered of $650 and 2 Glasses sold @ $400 each on credit to Vincent mmm Paid cash for $3,000 for an owner's withdrawal nnn Paid cash of $35 for monthly bank service charge 000 Received cash of $770 for fees rendered ppp Paid petty cash of $32 for a business lunch Paid cash to replinish petty cash fund 999 rrr Supplies inventory is $110 SSS Record insurance usage ttt Record depreciation uuu Prepare trial balance vvv Prepare financial reports (balance sheet, income statement) as of January 31, 2017 Prepare trial balance Prepare financial reports (balance sheet, income statement) as of December 31, 2016 Post closing entries 1-Jan hh Prepare post-closing trial balance =: Close out the owner's withdrawal accounts to the owner's capital account E: Optical Equipment is disposed as it is broken New optical equipment is purchased on credit from Garth Achep for $9.200 salvage value of $2,000 with a useful life of 7 years; double-declining depreciation method is used Inventory is purchased on credit from Glasses R Us - 4 Glasses @ $35 each and 3 Contacts @ $40 each Inventory usage and cost of goods sold will be computed using the periodic FIFO method mm Paid cash for amount owed to Farmer's Insurance nn Owner contributes $17,000 cash to the company 3-Jan oo Received cash of $400 for fees rendered and 1 Glasses for $150 Received telephone bill of $79 from Everest Paid cash for total amount owed to Kansas Gas Sold 2 Contacts on credit to Statton for $200 each 5-Jan ss Paid cash for 3 Glasses @ $45 each and 1 Contacts @ $50 each to replinish inventory Jones paid cash for total amount owed on account 8-Jan uu Paid cash of $1,800 for a new computer salvage value of $0 with a useful life of 3 years v v Received cash of $325 for fees rendered and 2 Glasses for $175 each ww Paid cash of $600 for advertising 12-Jan xx Sold 2 Contacts @ $350 each on credit to Jones Paid cash for $1,000 for an owner's withdrawal Received cash of $825 for fees rendered Paid cash of $2,700 for office rent 17-Jan bbb Bought 2 Contacts @ $55 each on credit from Glasses R Us to replinish inventory CCC Roberts paid $100 cash towards the amount due on account 18-Jan ddd Received a courier bill of $30 from Express Delivery Fees rendered of $420 on credit to Carroll 23-Jan eee fff A fees refund of $75 is paid in cash ggg Sold 2 Glasses @ $300 each for cash hhh Bought 4 Glasses @ $60 each with cash to replinish inventory Post transactions into the general journal and all appropriate ledgers: 1-Dec-16 a Owner contributed $15,000 in cash Optical equipment is purchased with cash for $7,500 salvage value is $1,500 with a useful life of 5 years; double-declining method of depreciation is Received cash of $400 for fees rendered Bought a 12-month liability insurance policy on credit for $864 from Farmer's Insurance Paid $250 cash to establish a petty cash fund 3-Dec f Bought $250 worth of supplies on credit from Office House Fees rendered of $200 on credit to Roberts 5-Dec h Paid cash for monthly rent of $2,700 Received cash of $300 for fees rendered 10-Dec j' Paid petty cash of $25 for a business lunch k Paid petty cash of $15 for mileage reimbursement 11-Dec Fees rendered of $500 on credit to Jones Bought $135 worth of advertising on credit from KC Journal 13-Dec n Paid cash of $300 for a training seminar Received cash of $340 for fees rendered Paid cash of $1,400 for a owner's withdrawal 16-Dec a Fees rendered of $280 on credit to Freedman Received telephone bill of $84 from Everest S Jones paid $150 cash to be applied to the amount owed on his account 19-Dect Received cash of $145 for fees rendered Received utility bill of $140 from Kansas Gas Paid petty cash of $17 for a delivery charge 21-Dec w Fees rendered of $93 on credit to Atlas Paid cash of $175 for a new medical book 23-Dec y A fees refund of $125 is applied towards Jones' account 28-Dec z Received cash of $240 for fees rendered 31-Dec aa Paid cash to replinish petty cash fund bb Supplies inventory is $90 Record insurance usage dd Record depreciation Bought office supplies for $245 on credit from Office House 28-Jan ji Atlas pays cash for total amount owed on account kkk Paid petty cash of $23 for mileage reimbursement 31-Jan III Fees rendered of $650 and 2 Glasses sold @ $400 each on credit to Vincent mmm Paid cash for $3,000 for an owner's withdrawal nnn Paid cash of $35 for monthly bank service charge 000 Received cash of $770 for fees rendered ppp Paid petty cash of $32 for a business lunch Paid cash to replinish petty cash fund 999 rrr Supplies inventory is $110 SSS Record insurance usage ttt Record depreciation uuu Prepare trial balance vvv Prepare financial reports (balance sheet, income statement) as of January 31, 2017 Prepare trial balance Prepare financial reports (balance sheet, income statement) as of December 31, 2016 Post closing entries 1-Jan hh Prepare post-closing trial balance =: Close out the owner's withdrawal accounts to the owner's capital account E: Optical Equipment is disposed as it is broken New optical equipment is purchased on credit from Garth Achep for $9.200 salvage value of $2,000 with a useful life of 7 years; double-declining depreciation method is used Inventory is purchased on credit from Glasses R Us - 4 Glasses @ $35 each and 3 Contacts @ $40 each Inventory usage and cost of goods sold will be computed using the periodic FIFO method mm Paid cash for amount owed to Farmer's Insurance nn Owner contributes $17,000 cash to the company 3-Jan oo Received cash of $400 for fees rendered and 1 Glasses for $150 Received telephone bill of $79 from Everest Paid cash for total amount owed to Kansas Gas Sold 2 Contacts on credit to Statton for $200 each 5-Jan ss Paid cash for 3 Glasses @ $45 each and 1 Contacts @ $50 each to replinish inventory Jones paid cash for total amount owed on account 8-Jan uu Paid cash of $1,800 for a new computer salvage value of $0 with a useful life of 3 years v v Received cash of $325 for fees rendered and 2 Glasses for $175 each ww Paid cash of $600 for advertising 12-Jan xx Sold 2 Contacts @ $350 each on credit to Jones Paid cash for $1,000 for an owner's withdrawal Received cash of $825 for fees rendered Paid cash of $2,700 for office rent 17-Jan bbb Bought 2 Contacts @ $55 each on credit from Glasses R Us to replinish inventory CCC Roberts paid $100 cash towards the amount due on account 18-Jan ddd Received a courier bill of $30 from Express Delivery Fees rendered of $420 on credit to Carroll 23-Jan eee fff A fees refund of $75 is paid in cash ggg Sold 2 Glasses @ $300 each for cash hhh Bought 4 Glasses @ $60 each with cash to replinish inventory