Question

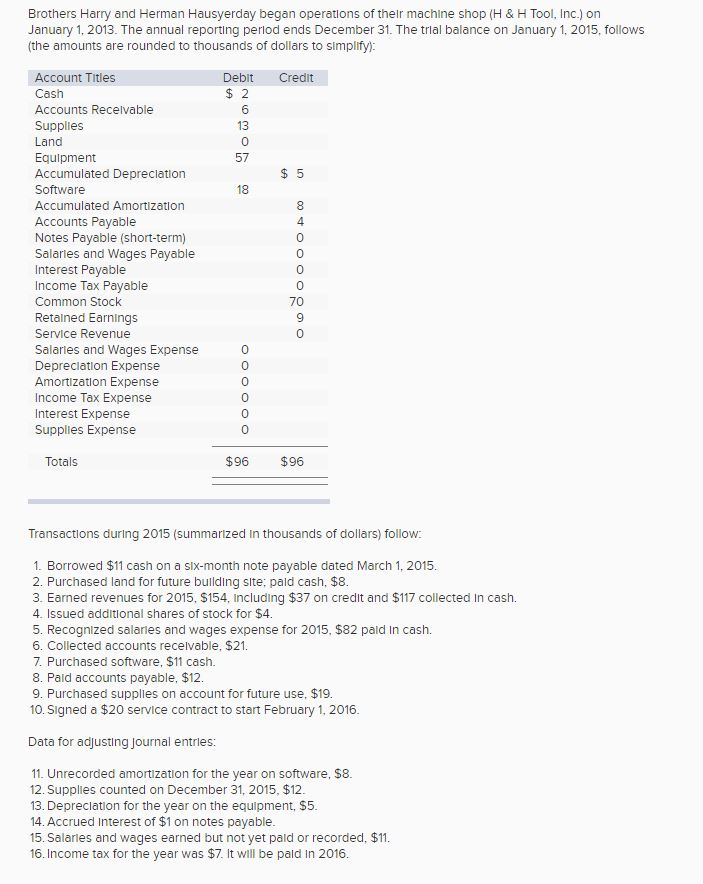

Record journal entries for transactions (1) through (10). (If no entry is required for a transaction/event, select No Journal Entry Required in the first account

Record journal entries for transactions (1) through (10). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.)

3, 5 and 8. Set up T-accounts for the accounts on the trial balance. Enter beginning balances and post the transactions 1-10, adjusting entries 11-16, and closing entry. (Enter your answers in thousands of dollars.)

3. Post the journal entries from requirement 2 to T-accounts and prepare an unadjusted trial balance. (Enter your answers in thousands of dollars.)

4. Record the adjusting journal entries (11) through (16). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.)

5. Post the adjusting entries from requirement 4 and prepare an adjusted trial balance. (Enter your answers in thousands of dollars.)

6.a Prepare an income statement.

6.b Prepare a statement of retained earnings.

6.c Prepare balance sheet. (Amounts to be deducted should be indicated by a minus sign.)

7. Prepare the closing journal entry. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.)

8. Post the closing entry from requirement 7 and prepare a post-closing trial balance. (Enter your answers in thousands of dollars.)

9-a. How much net income did H & H Tool, Inc., generate during 2015? What was its net profit margin? (Enter "Net Income" in thousands of dollars. Round "Net Profit Profit" to 2 decimal places.)

9-b. Is the company financed primarily by liabilities or stockholders equity?

9-c. What is its current ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started