Answered step by step

Verified Expert Solution

Question

1 Approved Answer

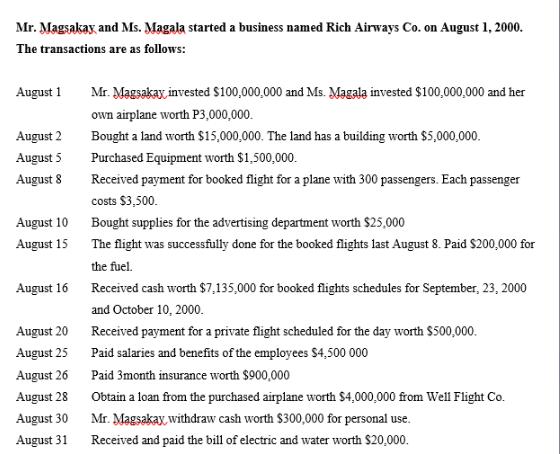

Record journal entries Mr. Magsakay, and Ms. Magala started a business named Rich Airways Co. on August 1, 2000. The transactions are as follows: August

Record journal entries

Record journal entries Mr. Magsakay, and Ms. Magala started a business named Rich Airways Co. on August 1, 2000. The transactions are as follows: August 1 August 2 August 5 August 8 August 10 August 15 August 20 August 25 Mr. Magsakax invested $100,000,000 and Ms. Magala invested $100,000,000 and her own airplane worth P3,000,000. Bought a land worth $15,000,000. The land has a building worth $5,000,000. Purchased Equipment worth $1,500,000. Received payment for booked flight for a plane with 300 passengers. Each passenger costs $3,500. August 16 Received cash worth $7,135,000 for booked flights schedules for September, 23, 2000 and October 10, 2000. Received payment for a private flight scheduled for the day worth $500,000. Paid salaries and benefits of the employees $4,500 000 Paid 3month insurance worth $900,000 Obtain a loan from the purchased airplane worth $4,000,000 from Well Flight Co. Mr. Magsakay, withdraw cash worth $300,000 for personal use. Received and paid the bill of electric and water worth $20,000. August 26 August 28 August 30 August 31 Bought supplies for the advertising department worth $25,000 The flight was successfully done for the booked flights last August 8. Paid $200,000 for the fuel.

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Lets summarize the transactions for Rich Airways Co in August August 1 Mr Magsakay invested 10000000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started