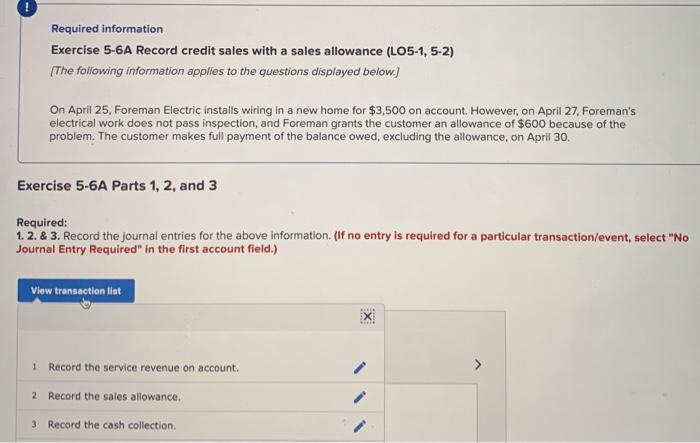

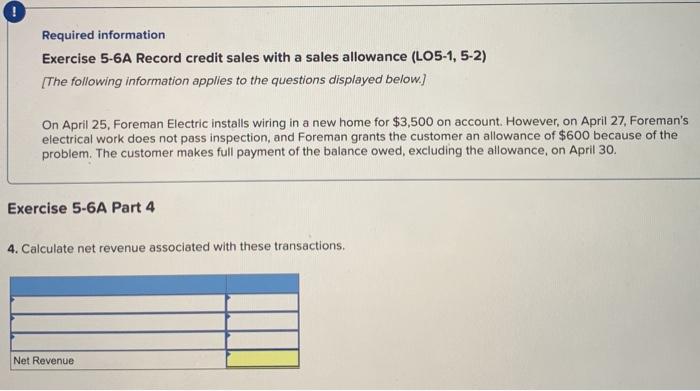

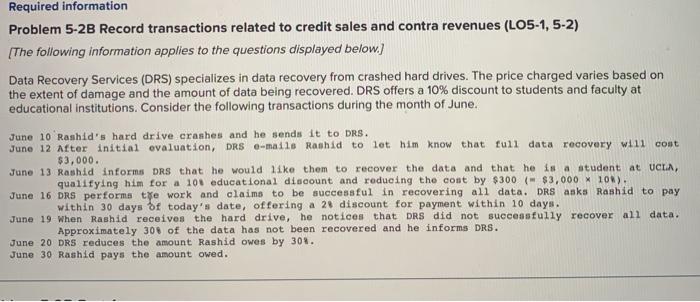

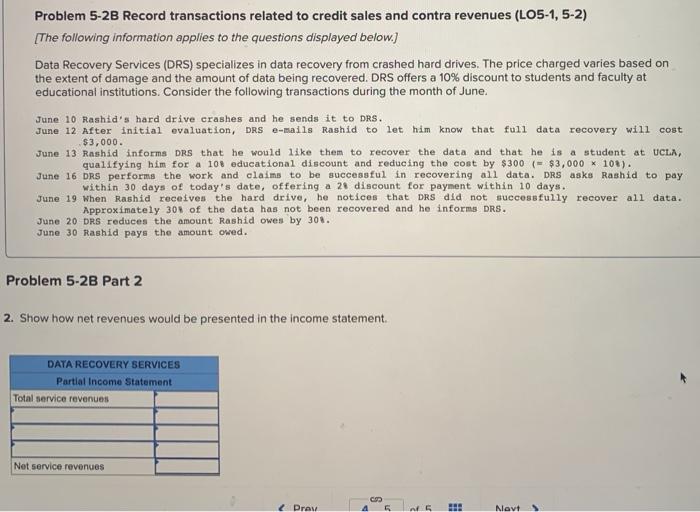

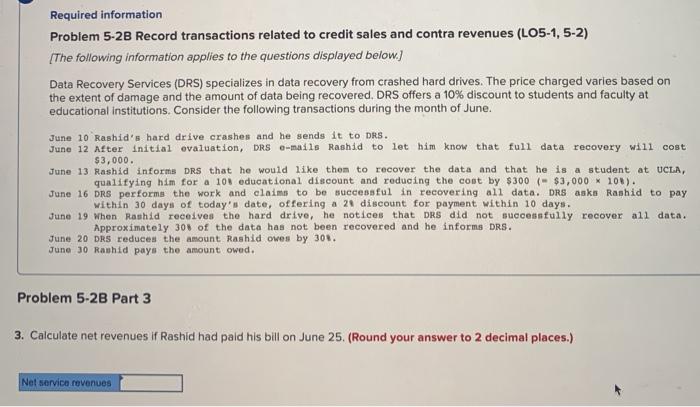

Required information Exercise 5-6A Record credit sales with a sales allowance (LO5-1, 5-2) (The following information applies to the questions displayed below.) On April 25, Foreman Electric installs wiring in a new home for $3,500 on account. However, on April 27. Foreman's electrical work does not pass inspection, and Foreman grants the customer an allowance of $600 because of the problem. The customer makes full payment of the balance owed, excluding the allowance, on April 30. Exercise 5-6A Parts 1, 2, and 3 Required: 1.2. & 3. Record the journal entries for the above information (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list X: 1 Record the service revenue on account. > 2 Record the sales allowance. 3 Record the cash collection Required information Exercise 5-6A Record credit sales with a sales allowance (LO5-1, 5-2) [The following information applies to the questions displayed below.) On April 25, Foreman Electric installs wiring in a new home for $3,500 on account. However, on April 27, Foreman's electrical work does not pass inspection, and Foreman grants the customer an allowance of $600 because of the problem. The customer makes full payment of the balance owed, excluding the allowance, on April 30. Exercise 5-6A Part 4 4. Calculate net revenue associated with these transactions, Net Revenue Required information Problem 5-2B Record transactions related to credit sales and contra revenues (LO5-1, 5-2) [The following information applies to the questions displayed below.) Data Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 10% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 Rashid's hard drive crashes and he sends it to DRS. June 12 After initial evaluation, DRS -mallo Rashid to let him know that full data recovery will cont $3,000. June 13 Rashid informs Drs that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 10educational discount and reducing the cont by $300 (- $3,000 10N). June 16 DRS performs to work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today's date, offering a 26 discount for payment within 10 days. June 19 When Rashid receives the hard drive, he notices that DRS did not successfully recover all data. Approximately 30% of the data has not been recovered and he informs DRS. June 20 DRS reduces the amount Rashid owes by 30%. June 30 Rashid pays the amount owed. Problem 5-2B Record transactions related to credit sales and contra revenues (LO5-1, 5-2) [The following information applies to the questions displayed below.) Data Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 10% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 Rashid's hard drive crashes and he sends it to DRS. June 12 After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $3,000. June 13 Rashid informs Drs that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 108 educational discount and reducing the cost by $300 (= $3,000 * 108). June 16 DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today's date, offering a 2 discount for payment within 10 days. June 19 When Rashid receives the hard drive, he notices that DRS did not successfully recover all data. Approximately 30% of the data has not been recovered and he informs Drs. June 20 DRS reduces the amount Rashid owes by 304. June 30 Rashid pays the amount owed. Problem 5-2B Part 2 2. Show how net revenues would be presented in the income statement DATA RECOVERY SERVICES Partial Income Statement Total service revenues Net service revenues