Answered step by step

Verified Expert Solution

Question

1 Approved Answer

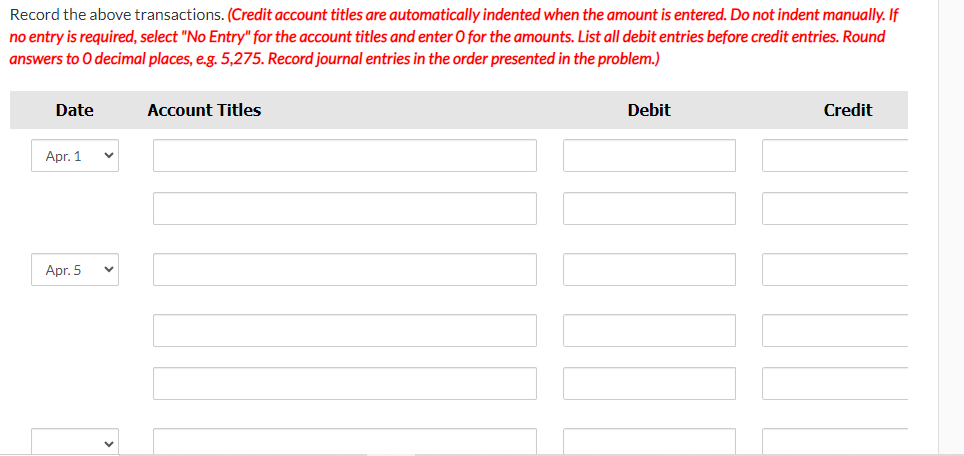

Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required,

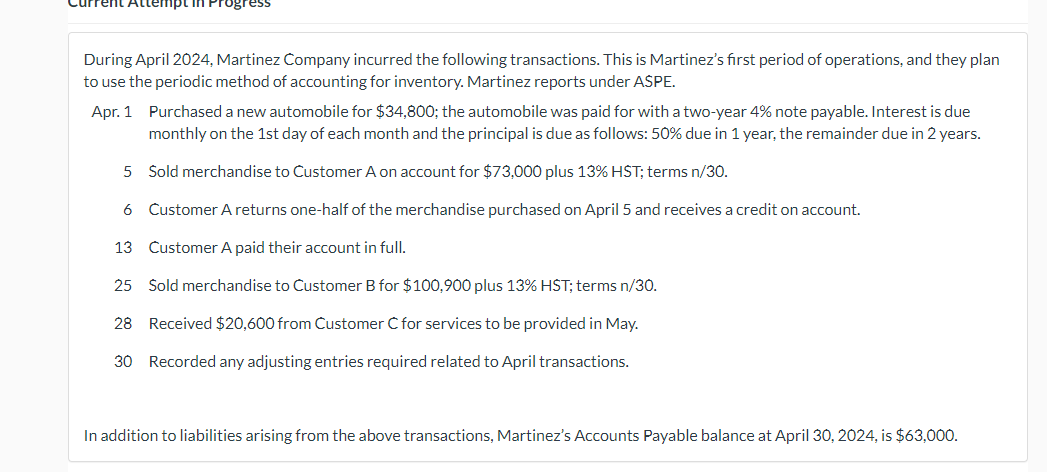

Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Round answers to O decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Date Apr. 1 Apr. 5 Account Titles Debit Credit ress During April 2024, Martinez Company incurred the following transactions. This is Martinez's first period of operations, and they plan to use the periodic method of accounting for inventory. Martinez reports under ASPE. Apr. 1 Purchased a new automobile for $34,800; the automobile was paid for with a two-year 4% note payable. Interest is due monthly on the 1st day of each month and the principal is due as follows: 50% due in 1 year, the remainder due in 2 years. 5 Sold merchandise to Customer A on account for $73,000 plus 13% HST; terms n/30. 6 Customer A returns one-half of the merchandise purchased on April 5 and receives a credit on account. 13 Customer A paid their account in full. 25 Sold merchandise to Customer B for $100,900 plus 13% HST; terms n/30. 28 Received $20,600 from Customer for services to be provided in May. 30 Recorded any adjusting entries required related to April transactions. In addition to liabilities arising from the above transactions, Martinez's Accounts Payable balance at April 30, 2024, is $63,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started