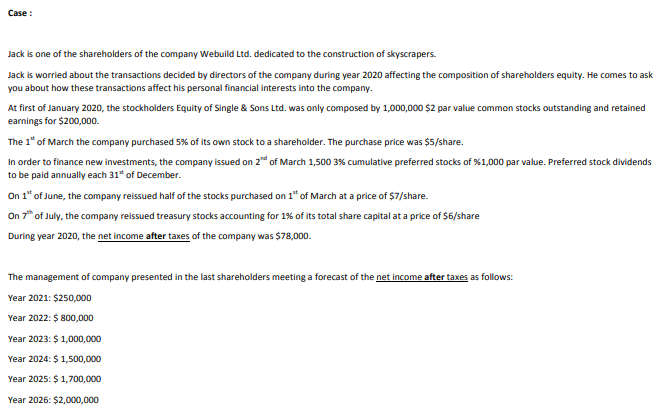

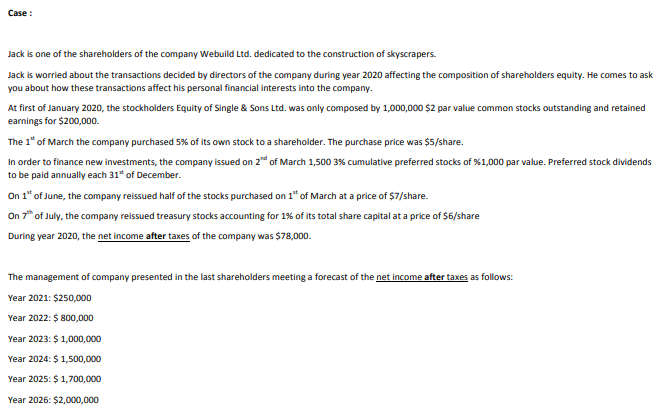

Record the above-mentioned transactions in the general Journal for year 2020 then calculate and record in the general journal the preferred stock dividend and its payment for year 2020 ( explain your calculations.) Following the forecast provided by the management of the company, calculate the maximum dividend per share of common stock for year 2021 to 2026 (explain your answer) then calculate the maximum dividend per share of common stock for years 2020 to 2026 in case preferred stocks would be non- cumulative (explain the answer) Case : Jack is one of the shareholders of the company Webuild Ltd. dedicated to the construction of skyscrapers. Jack is worried about the transactions decided by directors of the company during year 2020 affecting the composition of shareholders equity. He comes to ask you about how these transactions affect his personal financial interests into the company. At first of January 2020, the stockholders Equity of Single & Sons Ltd. was only composed by 1,000,000 $2 par value common stocks outstanding and retained earnings for $200,000 The 1* of March the company purchased 5% of its own stock to a shareholder. The purchase price was $5/share. In order to finance new investments, the company issued on 20 of March 1,500 3% cumulative preferred stocks of %1,000 par value. Preferred stock dividends to be paid annually each 31* of December. On 1" of June, the company reissued half of the stocks purchased on 1" of March at a price of $7/share. On th of July, the company reissued treasury stock accounting for 1% of its total share capital at a price of $6/share During year 2020, the net income after taxes of the company was $78,000 The management of company presented in the last shareholders meeting a forecast of the net income after taxes as follows: Year 2021: $250,000 Year 2022: $ 800,000 Year 2023: $ 1,000,000 Year 2024: $ 1,500,000 Year 2025: $ 1,700,000 Year 2026: $2,000,000 Record the above-mentioned transactions in the general Journal for year 2020 then calculate and record in the general journal the preferred stock dividend and its payment for year 2020 ( explain your calculations.) Following the forecast provided by the management of the company, calculate the maximum dividend per share of common stock for year 2021 to 2026 (explain your answer) then calculate the maximum dividend per share of common stock for years 2020 to 2026 in case preferred stocks would be non- cumulative (explain the answer) Case : Jack is one of the shareholders of the company Webuild Ltd. dedicated to the construction of skyscrapers. Jack is worried about the transactions decided by directors of the company during year 2020 affecting the composition of shareholders equity. He comes to ask you about how these transactions affect his personal financial interests into the company. At first of January 2020, the stockholders Equity of Single & Sons Ltd. was only composed by 1,000,000 $2 par value common stocks outstanding and retained earnings for $200,000 The 1* of March the company purchased 5% of its own stock to a shareholder. The purchase price was $5/share. In order to finance new investments, the company issued on 20 of March 1,500 3% cumulative preferred stocks of %1,000 par value. Preferred stock dividends to be paid annually each 31* of December. On 1" of June, the company reissued half of the stocks purchased on 1" of March at a price of $7/share. On th of July, the company reissued treasury stock accounting for 1% of its total share capital at a price of $6/share During year 2020, the net income after taxes of the company was $78,000 The management of company presented in the last shareholders meeting a forecast of the net income after taxes as follows: Year 2021: $250,000 Year 2022: $ 800,000 Year 2023: $ 1,000,000 Year 2024: $ 1,500,000 Year 2025: $ 1,700,000 Year 2026: $2,000,000