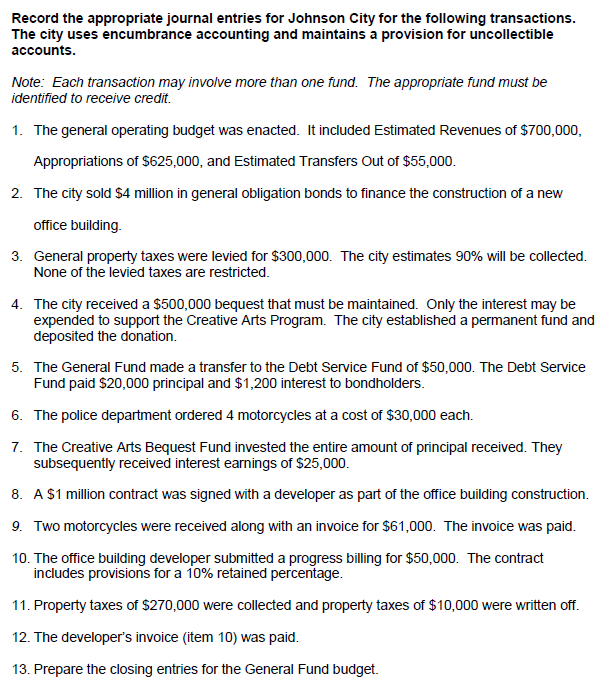

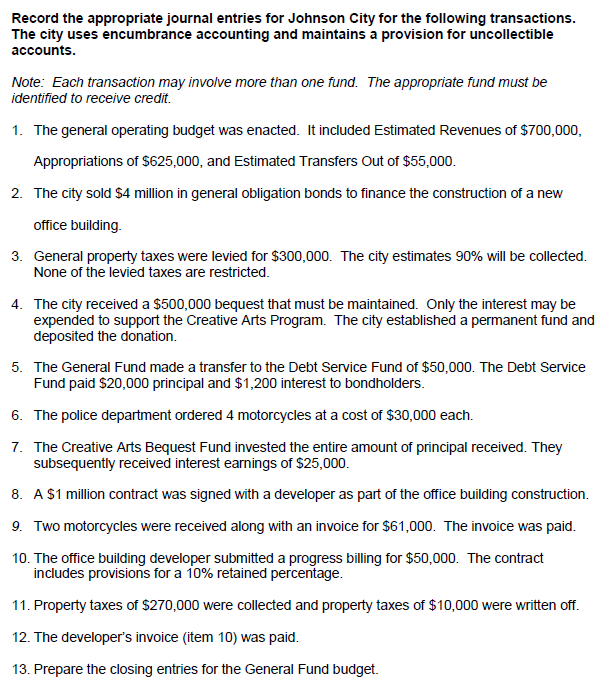

Record the appropriate journal entries for Johnson City for the following transactions. The city uses encumbrance accounting and maintains a provision for uncollectible accounts. Note: Each transaction may involve more than one fund. The appropriate fund must be identified to receive credit. 1. The general operating budget was enacted. It included Estimated Revenues of $700,000, Appropriations of $625,000, and Estimated Transfers Out of $55,000. 2. The city sold $4 million in general obligation bonds to finance the construction of a new office building. 3. General property taxes were levied for $300,000. The city estimates 90% will be collected. None of the levied taxes are restricted. 4. The city received a $500,000 bequest that must be maintained. Only the interest may be expended to support the Creative Arts Program. The city established a permanent fund and deposited the donation. 5. The General Fund made a transfer to the Debt Service Fund of $50,000. The Debt Service Fund paid $20,000 principal and $1,200 interest to bondholders. 6. The police department ordered 4 motorcycles at a cost of $30,000 each. 7. The Creative Arts Bequest Fund invested the entire amount of principal received. They subsequently received interest earnings of $25,000 8. A $1 million contract was signed with a developer as part of the office building construction. 9. Two motorcycles were received along with an invoice for $61,000. The invoice was paid. 10. The office building developer submitted a progress billing for $50,000. The contract includes provisions for a 10% retained percentage. 11. Property taxes of $270,000 were collected and property taxes of $10,000 were written off. 12. The developer's invoice (item 10) was paid. 13. Prepare the closing entries for the General Fund budget. Record the appropriate journal entries for Johnson City for the following transactions. The city uses encumbrance accounting and maintains a provision for uncollectible accounts. Note: Each transaction may involve more than one fund. The appropriate fund must be identified to receive credit. 1. The general operating budget was enacted. It included Estimated Revenues of $700,000, Appropriations of $625,000, and Estimated Transfers Out of $55,000. 2. The city sold $4 million in general obligation bonds to finance the construction of a new office building. 3. General property taxes were levied for $300,000. The city estimates 90% will be collected. None of the levied taxes are restricted. 4. The city received a $500,000 bequest that must be maintained. Only the interest may be expended to support the Creative Arts Program. The city established a permanent fund and deposited the donation. 5. The General Fund made a transfer to the Debt Service Fund of $50,000. The Debt Service Fund paid $20,000 principal and $1,200 interest to bondholders. 6. The police department ordered 4 motorcycles at a cost of $30,000 each. 7. The Creative Arts Bequest Fund invested the entire amount of principal received. They subsequently received interest earnings of $25,000 8. A $1 million contract was signed with a developer as part of the office building construction. 9. Two motorcycles were received along with an invoice for $61,000. The invoice was paid. 10. The office building developer submitted a progress billing for $50,000. The contract includes provisions for a 10% retained percentage. 11. Property taxes of $270,000 were collected and property taxes of $10,000 were written off. 12. The developer's invoice (item 10) was paid. 13. Prepare the closing entries for the General Fund budget