Record the consolidated journal entries necessary to prepare consolidated accounts for the year ending 30 June 2021 for the group comprising Parent Ltd and Subsidiary Ltd

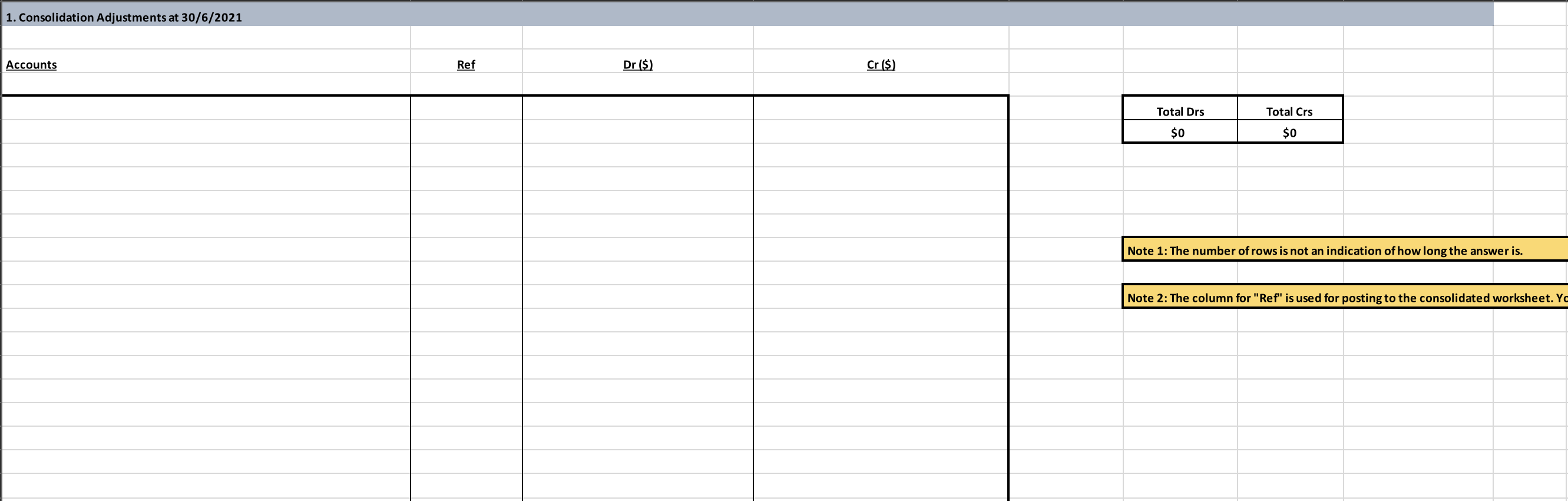

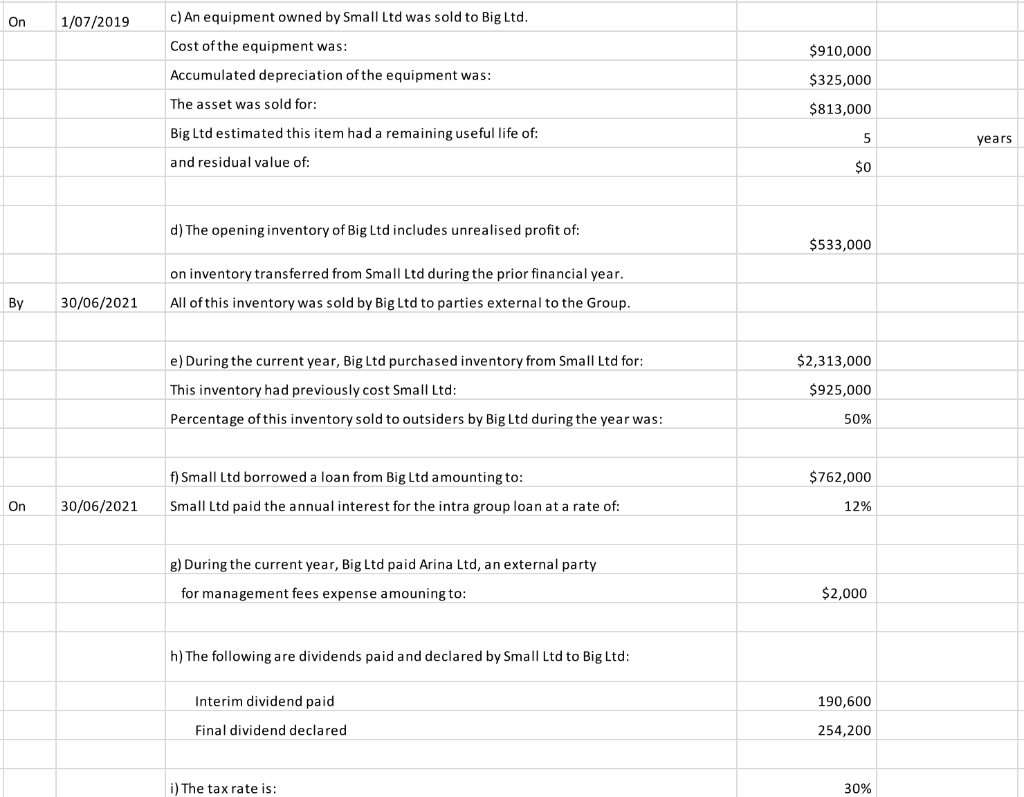

Record into the table below:

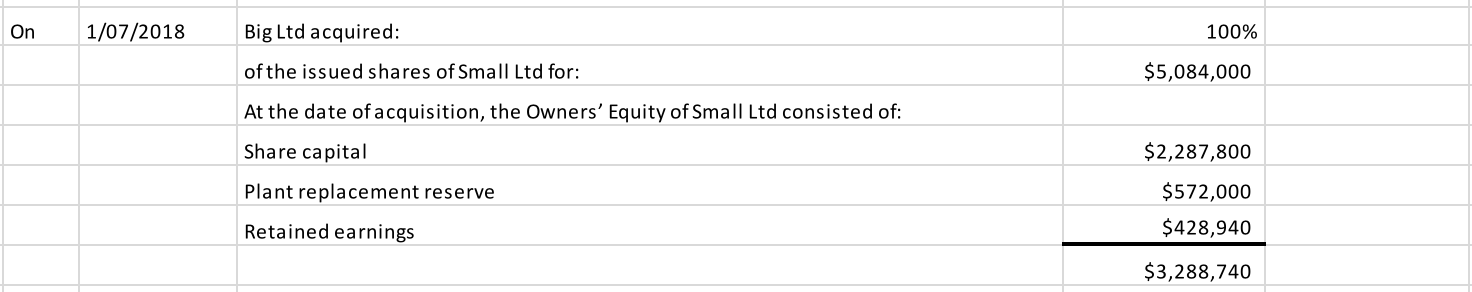

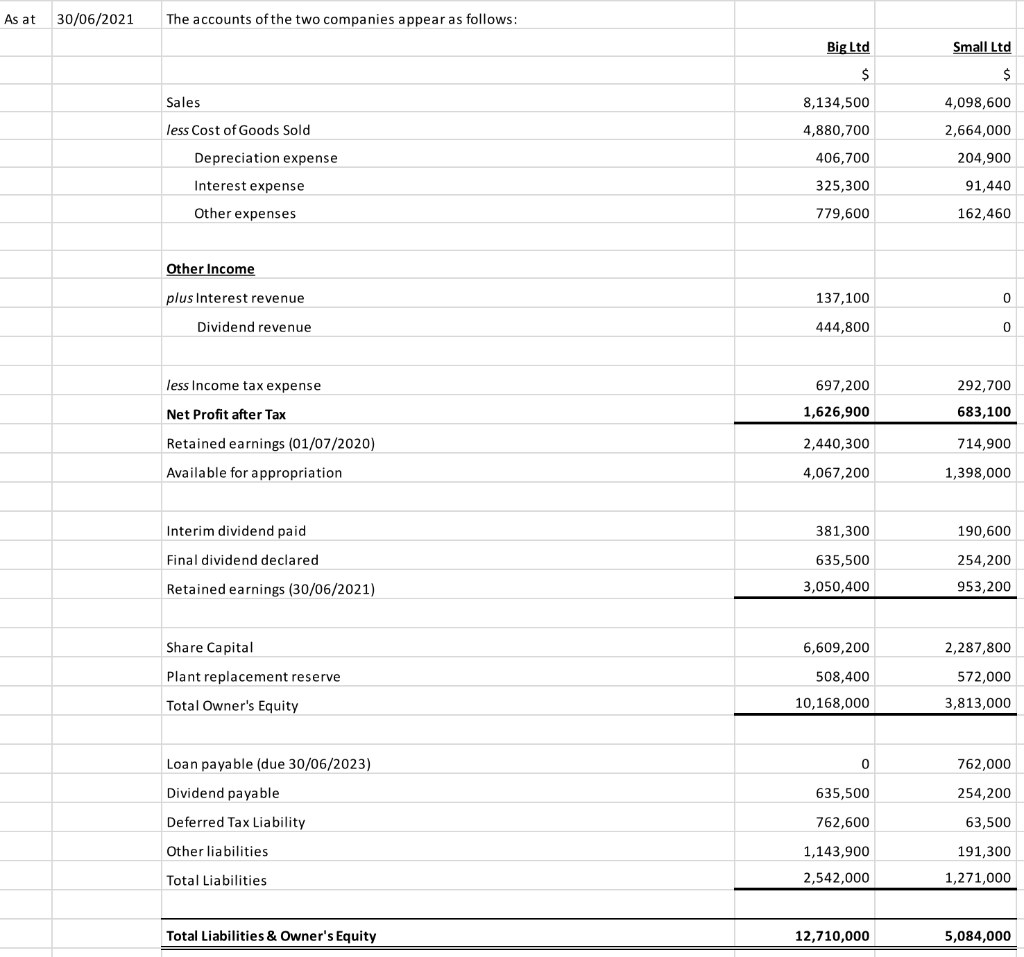

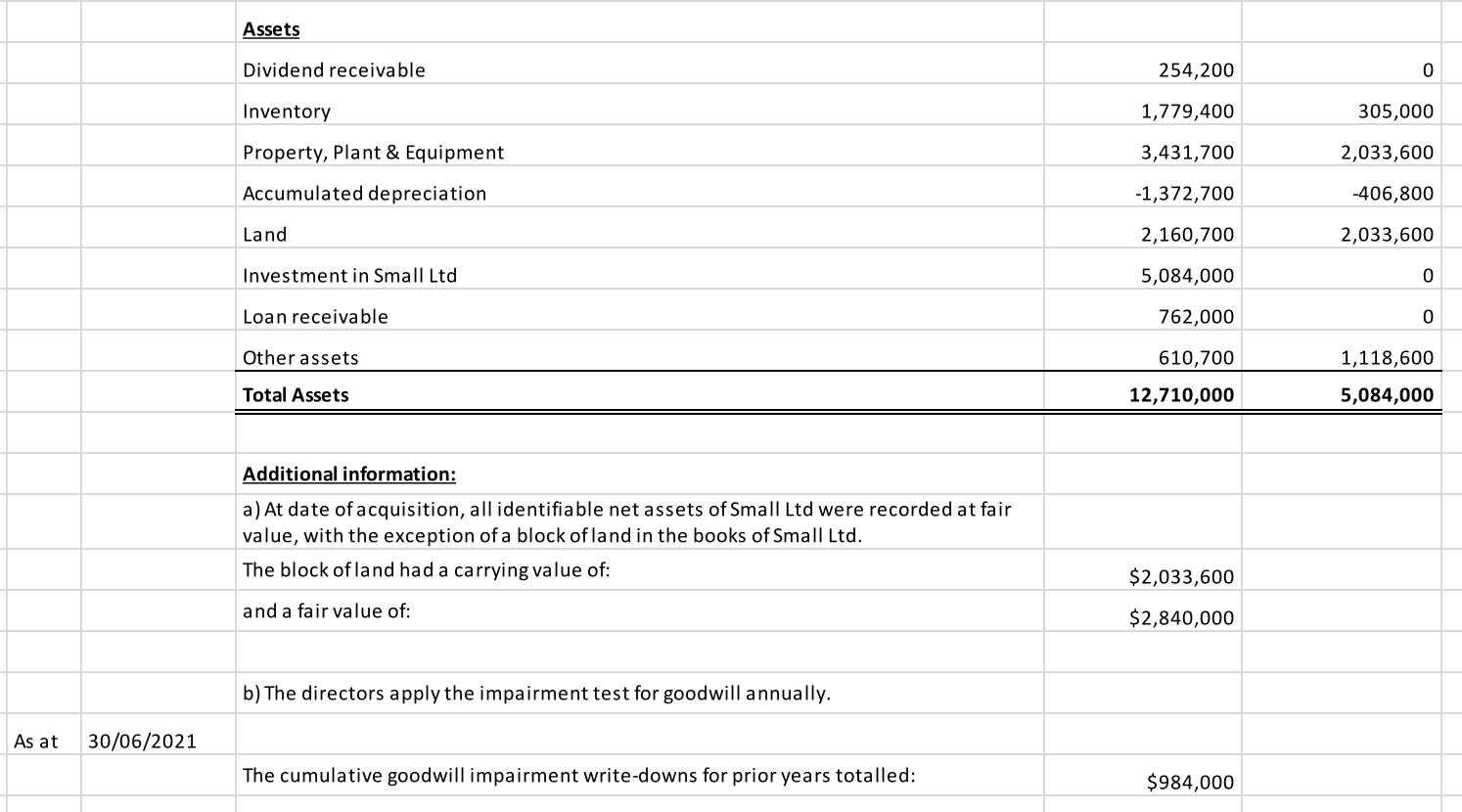

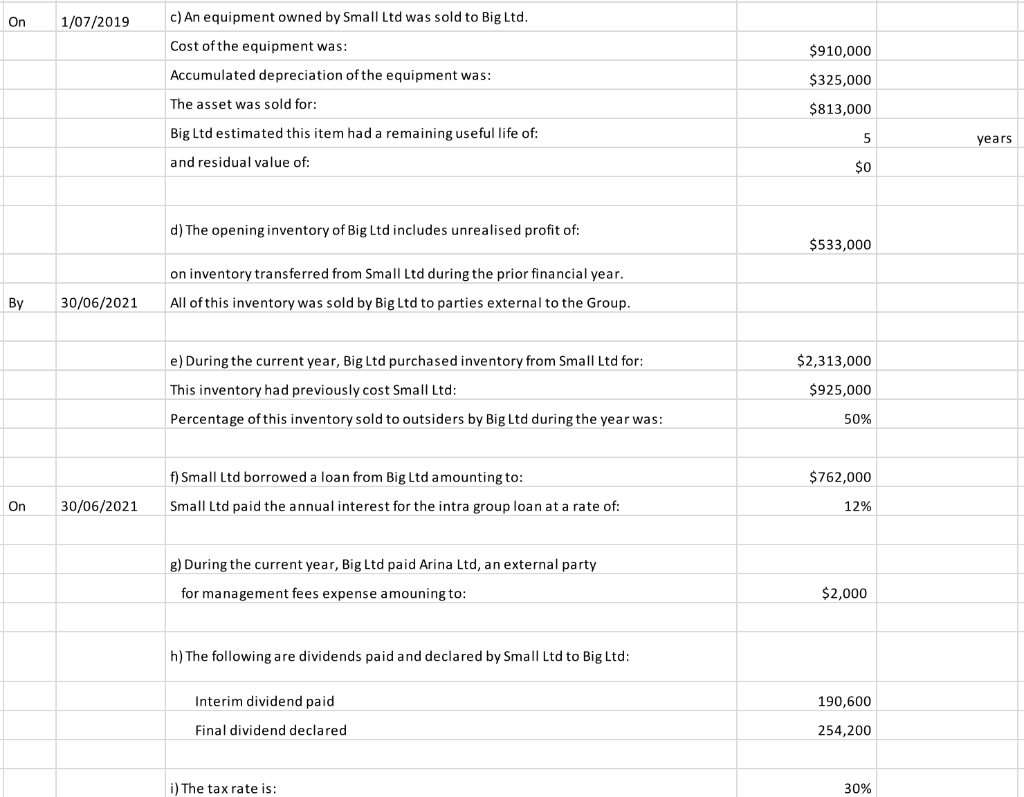

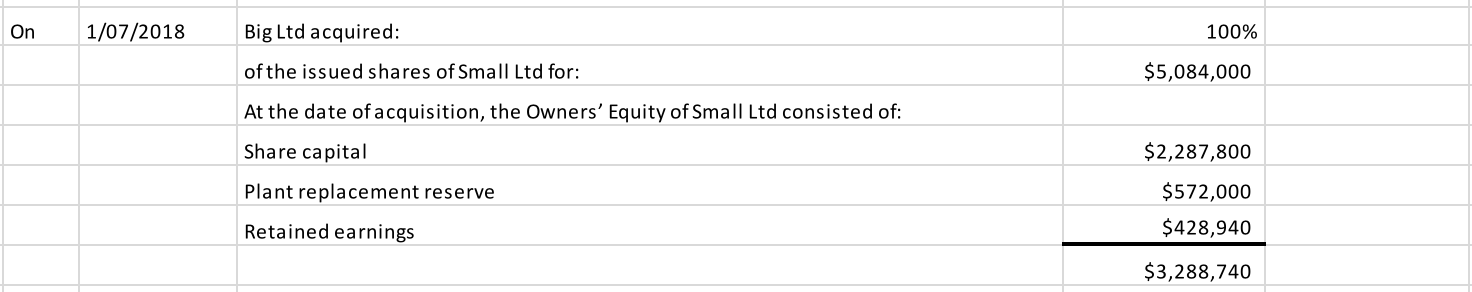

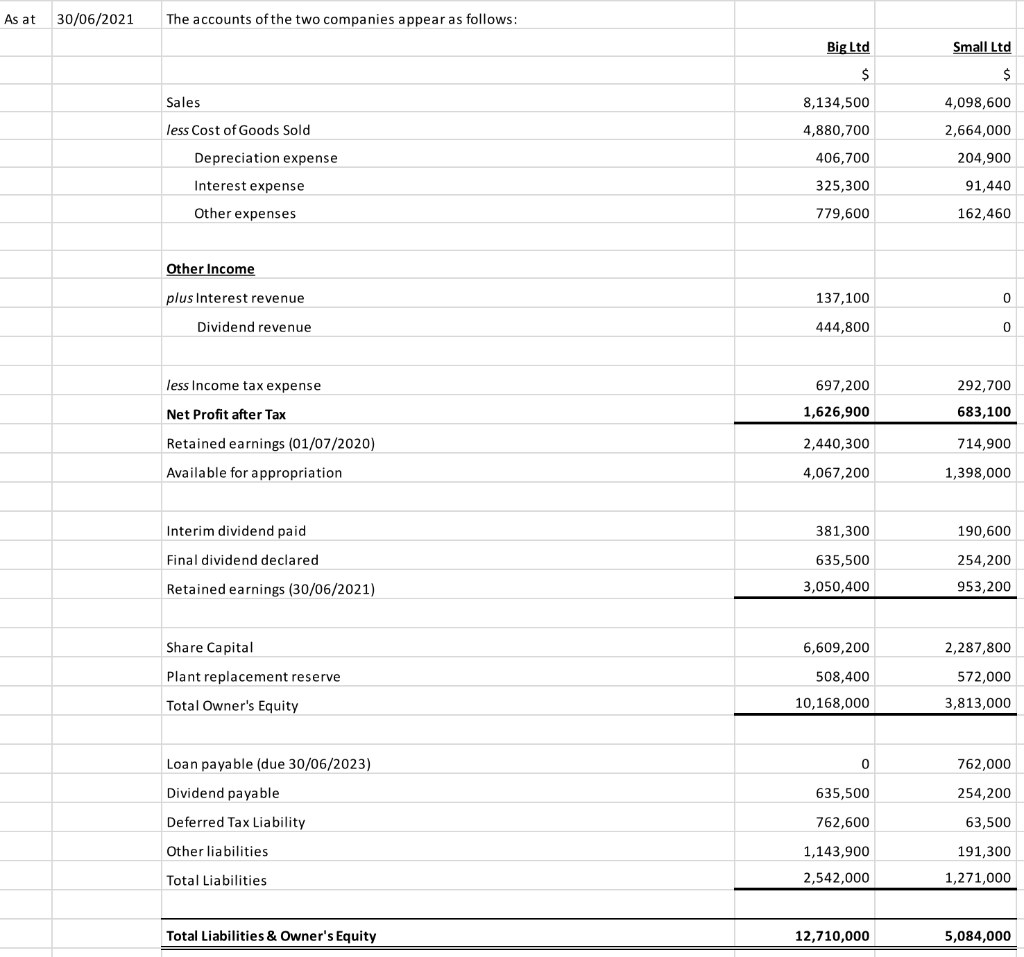

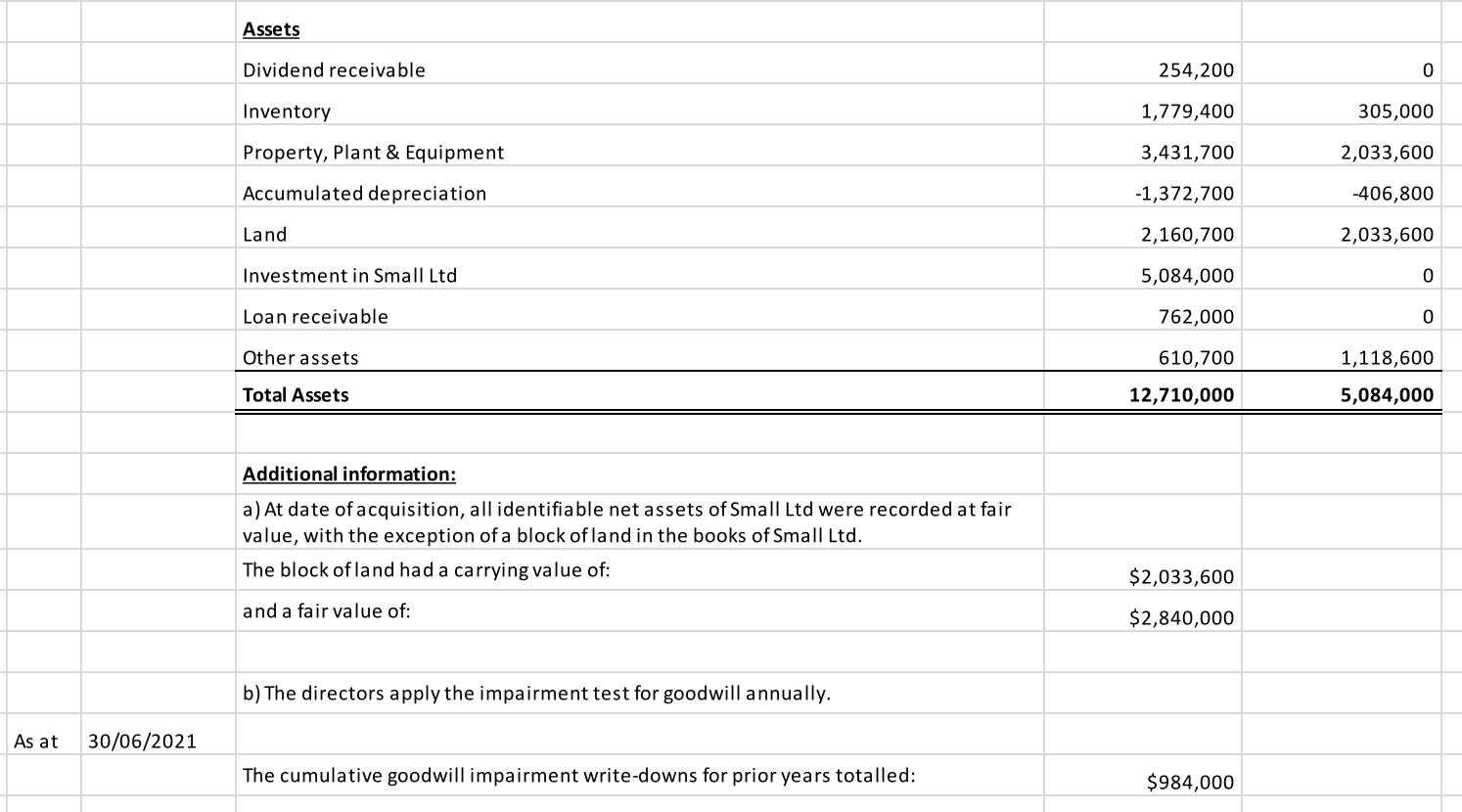

On 1/07/2018 Big Ltd acquired: 100% of the issued shares of Small Ltd for: $5,084,000 At the date of acquisition, the Owners' Equity of Small Ltd consisted of: Share capital Plant replacement reserve Retained earnings $2,287,800 $572,000 $428,940 $3,288,740 As at 30/06/2021 The accounts of the two companies appear as follows: Big Ltd Small Ltd $ $ Sales 8,134,500 4,098,600 less Cost of Goods Sold 4,880,700 2,664,000 Depreciation expense 406,700 204,900 Interest expense 325,300 91,440 Other expenses 779,600 162,460 Other Income plus Interest revenue 137,100 0 Dividend revenue 444,800 0 less Income tax expense 697,200 292,700 Net Profit after Tax 1,626,900 683,100 Retained earnings (01/07/2020) 2,440,300 714,900 Available for appropriation 4,067,200 1,398,000 Interim dividend paid 381,300 190,600 Final dividend declared 635,500 3,050,400 254,200 953,200 Retained earnings (30/06/2021) Share Capital 6,609,200 2,287,800 Plant replacement reserve 508,400 572,000 3,813,000 Total Owner's Equity 10,168,000 0 762,000 Loan payable (due 30/06/2023) Dividend payable 635,500 254,200 Deferred Tax Liability 762,600 63,500 Other liabilities 1,143,900 191,300 1,271,000 Total Liabilities 2,542,000 Total Liabilities & Owner's Equity 12,710,000 5,084,000 Assets Dividend receivable 254,200 0 Inventory 1,779,400 305,000 Property, Plant & Equipment 3,431,700 2,033,600 Accumulated depreciation -1,372,700 -406,800 Land 2,160,700 2,033,600 Investment in Small Ltd 5,084,000 0 Loan receivable 762,000 0 Other assets 610,700 1,118,600 Total Assets 12,710,000 5,084,000 Additional information: a) At date of acquisition, all identifiable net assets of Small Ltd were recorded at fair value, with the exception of a block of land in the books of Small Ltd. The block of land had a carrying value of: $2,033,600 and a fair value of: $2,840,000 b) The directors apply the impairment test for goodwill annually. As at 30/06/2021 The cumulative goodwill impairment write-downs for prior years totalled: $984,000 On 1/07/2019 c) An equipment owned by Small Ltd was sold to Big Ltd. Cost of the equipment was: $910,000 Accumulated depreciation of the equipment was: $325,000 The asset was sold for: $813,000 5 years Big Ltd estimated this item had a remaining useful life of: and residual value of: $0 d) The opening inventory of Big Ltd includes unrealised profit of: $533,000 on inventory transferred from Small Ltd during the prior financial year. All of this inventory was sold by Big Ltd to parties external to the Group. 30/06/2021 $2,313,000 e) During the current year, Big Ltd purchased inventory from Small Ltd for: This inventory had previously cost Small Ltd: Percentage of this inventory sold to outsiders by Big Ltd during the year was: $925,000 50% $762,000 f) Small Ltd borrowed a loan from Big Ltd amounting to: Small Ltd paid the annual interest for the intra group loan at a rate of: On 30/06/2021 12% g) During the current year, Big Ltd paid Arina Ltd, an external party for management fees expense amouning to: $2,000 h) The following are dividends paid and declared by Small Ltd to Big Ltd: Interim dividend paid 190,600 Final dividend declared 254,200 i) The tax rate is: 30% 1. Consolidation Adjustments at 30/6/2021 Accounts Ref Dr ($) Cr ($) Total Drs Total Crs $0 $0 Note 1: The number of rows is not an indication of how long the answer is. Note 2: The column for "Ref" is used for posting to the consolidated worksheet. Yo