Answered step by step

Verified Expert Solution

Question

1 Approved Answer

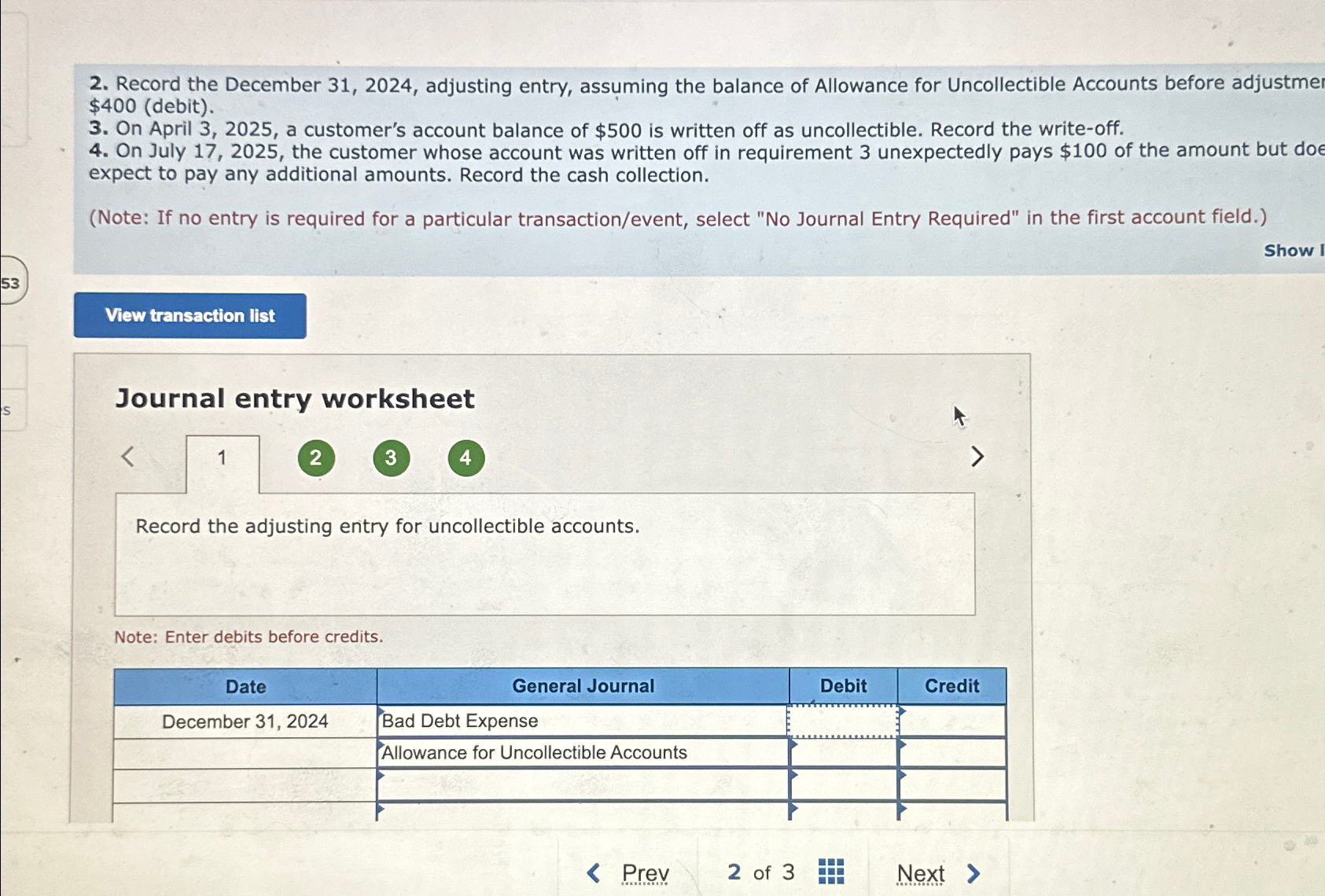

Record the December 3 1 , 2 0 2 4 , adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustmer $ 4

Record the December adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustmer $debit

On April a customer's account balance of $ is written off as uncollectible. Record the writeoff.

On July the customer whose account was written off in requirement unexpectedly pays $ of the amount but doe expect to pay any additional amounts. Record the cash collection.

Note: If no entry is required for a particular transactionevent select No Journal Entry Required" in the first account field.

Show I

Journal entry worksheet

Record the adjusting entry for uncollectible accounts.

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditDecember Bad Debt Expense,,Allowance for Uncollectible Accounts,,

of

Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started