Answered step by step

Verified Expert Solution

Question

1 Approved Answer

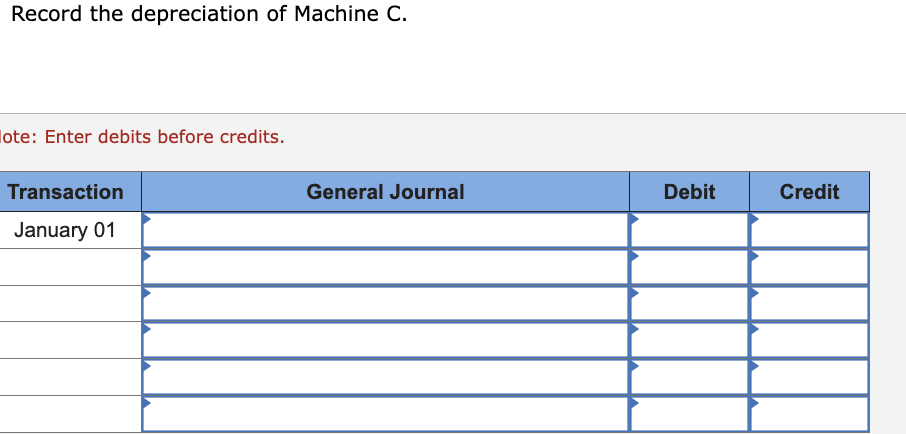

Record the depreciation of Machine C. ote: Enter debits before credits. Required information [The following information applies to the questions displayed below.] During the current

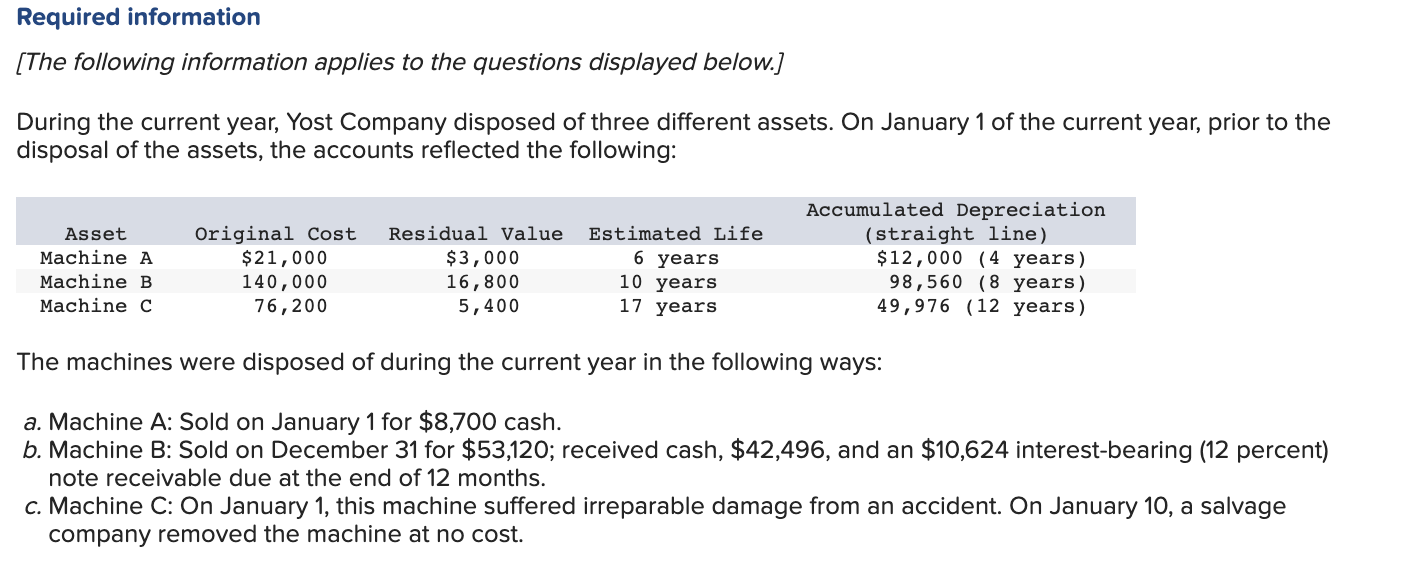

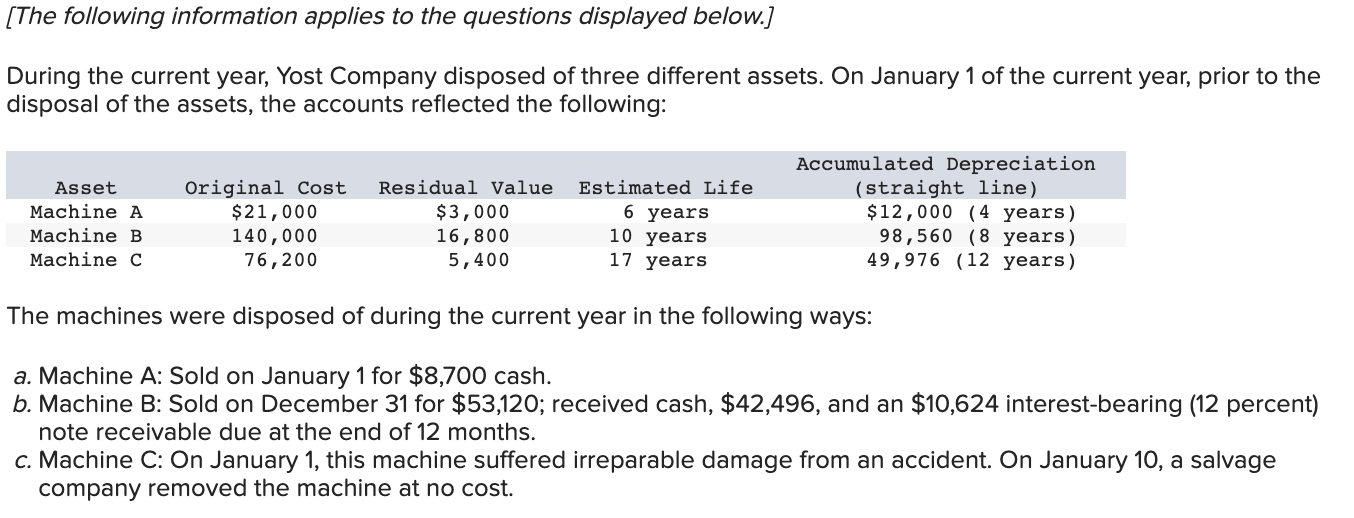

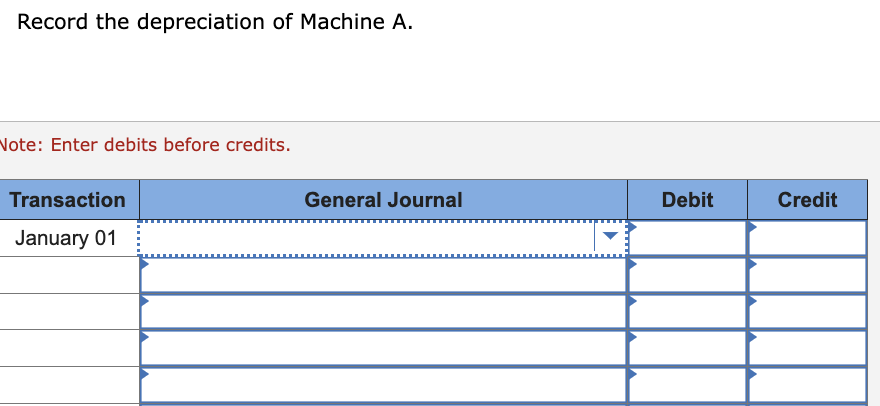

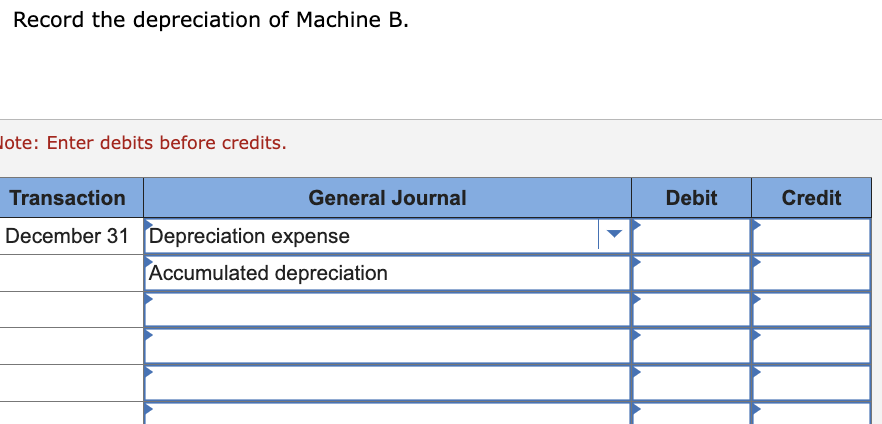

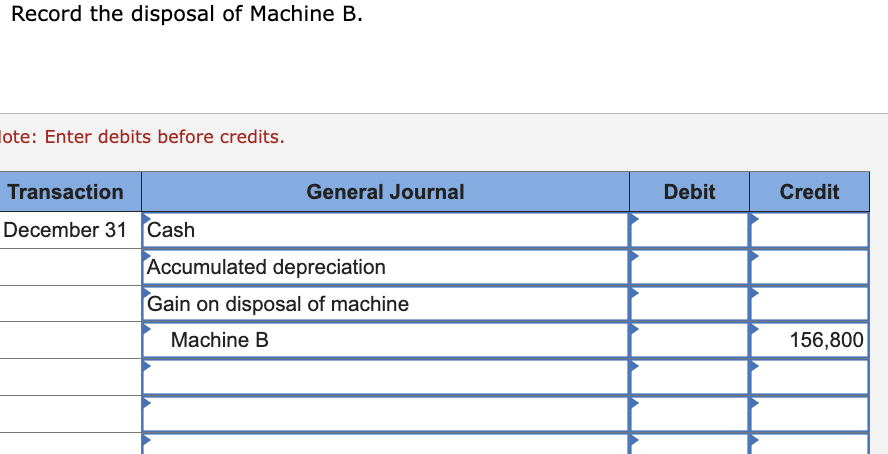

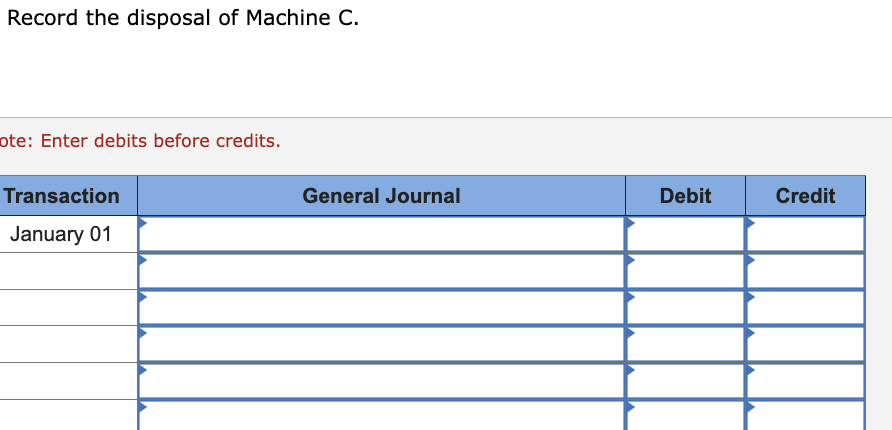

Record the depreciation of Machine C. ote: Enter debits before credits. Required information [The following information applies to the questions displayed below.] During the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $8,700 cash. b. Machine B: Sold on December 31 for $53,120; received cash, $42,496, and an $10,624 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. Record the disposal of Machine C. Enter debits before credits. Record the depreciation of Machine A. Note: Enter debits before credits. Record the disposal of Machine B. ote: Enter debits before credits. [The following information applies to the questions displayed below.] During the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $8,700 cash. b. Machine B: Sold on December 31 for $53,120; received cash, $42,496, and an $10,624 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. Record the depreciation of Machine B. lote: Enter debits before credits

Record the depreciation of Machine C. ote: Enter debits before credits. Required information [The following information applies to the questions displayed below.] During the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $8,700 cash. b. Machine B: Sold on December 31 for $53,120; received cash, $42,496, and an $10,624 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. Record the disposal of Machine C. Enter debits before credits. Record the depreciation of Machine A. Note: Enter debits before credits. Record the disposal of Machine B. ote: Enter debits before credits. [The following information applies to the questions displayed below.] During the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $8,700 cash. b. Machine B: Sold on December 31 for $53,120; received cash, $42,496, and an $10,624 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. Record the depreciation of Machine B. lote: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started