Answered step by step

Verified Expert Solution

Question

1 Approved Answer

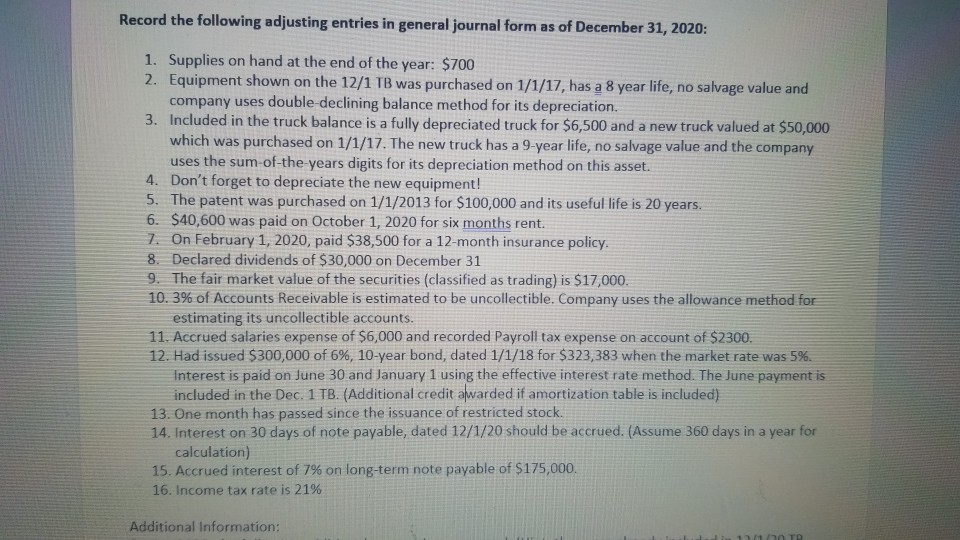

Record the following adjusting entries in general journal form as of December 31, 2020: 1. Supplies on hand at the end of the year: $700

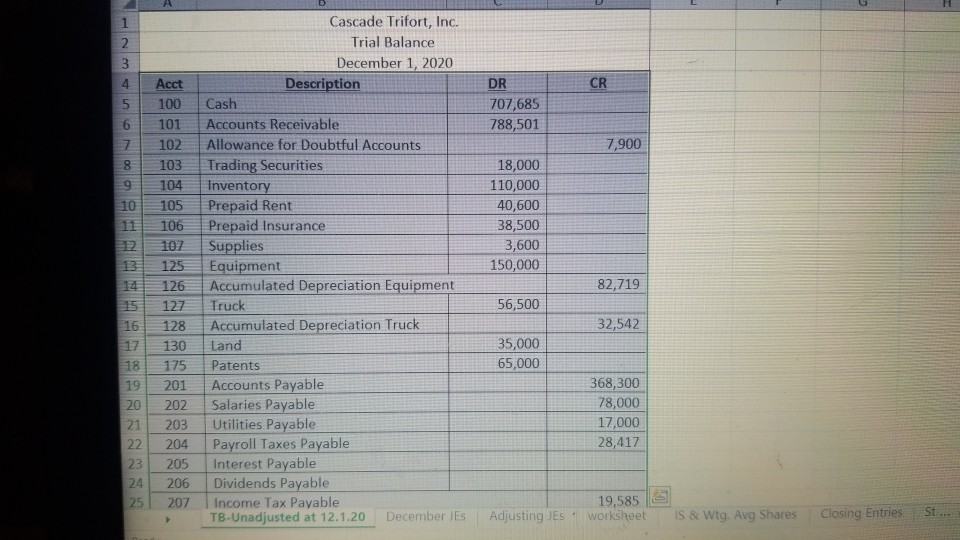

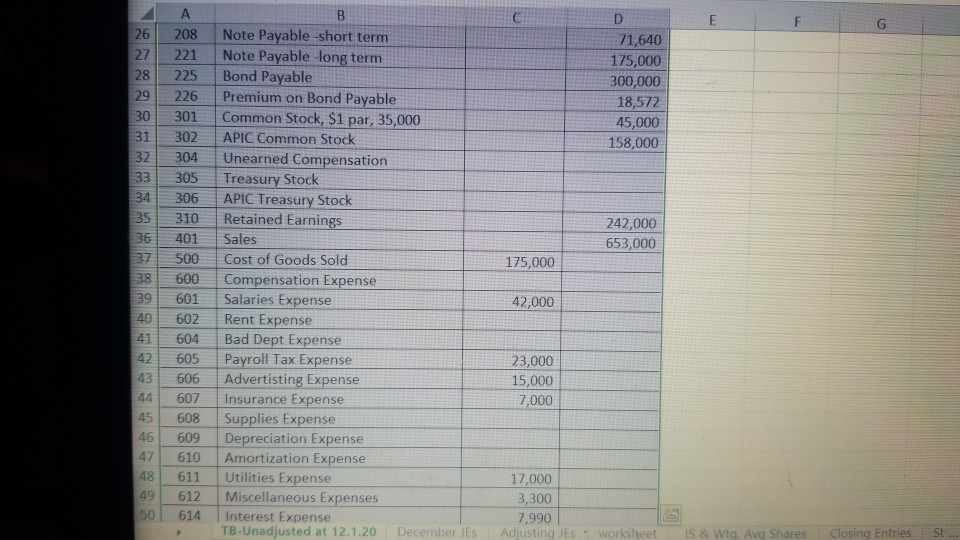

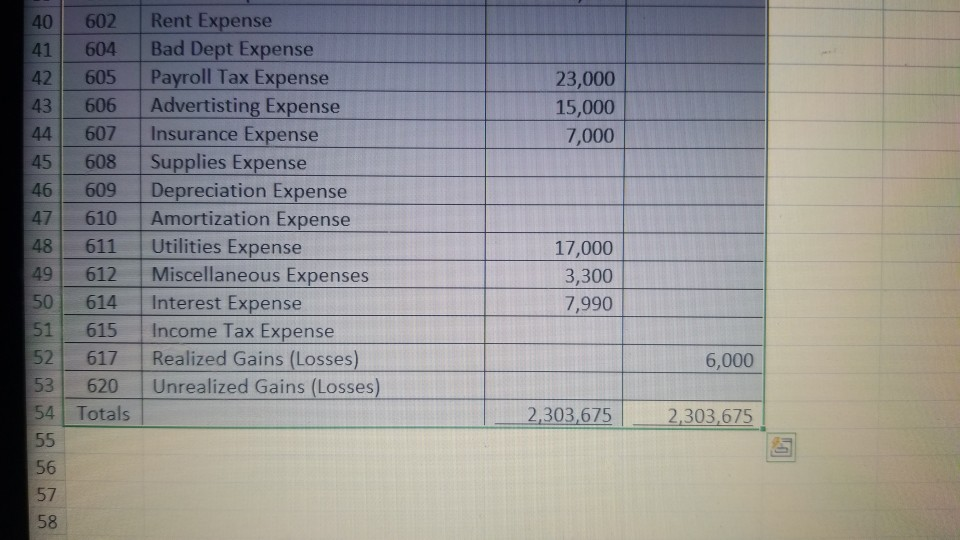

Record the following adjusting entries in general journal form as of December 31, 2020: 1. Supplies on hand at the end of the year: $700 2. Equipment shown on the 12/1 TB was purchased on 1/1/17, has a 8 year life, no salvage value and company uses double-declining balance method for its depreciation. 3. Included in the truck balance is a fully depreciated truck for $6,500 and a new truck valued at $50,000 which was purchased on 1/1/17. The new truck has a 9-year life, no salvage value and the company uses the sum of the years digits for its depreciation method on this asset. 4. Don't forget to depreciate the new equipment! 5. The patent was purchased on 1/1/2013 for $100,000 and its useful life is 20 years. 6. $40,600 was paid on October 1, 2020 for six months rent. 7. On February 1, 2020, paid $38,500 for a 12-month insurance policy. 8. Declared dividends of $30,000 on December 31 9. The fair market value of the securities (classified as trading) is $17,000. 10.3% of Accounts Receivable is estimated to be uncollectible. Company uses the allowance method for estimating its uncollectible accounts. 11. Accrued salaries expense of $6,000 and recorded Payroll tax expense on account of $2300. 12. Had issued $300,000 of 6%, 10-year bond, dated 1/1/18 for $323,383 when the market rate was 5%. Interest is paid on June 30 and January 1 using the effective interest rate method. The June payment is included in the Dec. 1 TB. (Additional credit awarded if amortization table is included) 13. One month has passed since the issuance of restricted stock. 14. Interest on 30 days of note payable, dated 12/1/20 should be accrued. (Assume 360 days in a year for calculation) 15. Accrued interest of 7% on long-term note payable of $175,000. 16. Income tax rate is 21% Additional Information: MTD NOWN Acct 100 101 102 103 DR 707,685 788,501 7,900 104 Cascade Trifort, Inc. Trial Balance December 1, 2020 Description Cash Accounts Receivable Allowance for Doubtful Accounts Trading Securities Inventory Prepaid Rent Prepaid Insurance Supplies Equipment Accumulated Depreciation Equipment Truck Accumulated Depreciation Truck Land Patents Accounts Payable Salaries Payable Utilities Payable Payroll Taxes Payable Interest Payable Dividends Payable Income Tax Payable TB-Unadjusted at 12.1.20 December JES 18,000 110,000 40,600 38,500 3,600 150,000 82,719 56,500 105 106 12 107 125 126 15 127 128 130 175 201 201 202 203 204 23 205 24 206 251 207 32,542 35,000 65,000 368,300 78,000 17,000 28,417 19,585 Adjusting JES - worksheet S & Wt. Avg Shares Closing Entries St... 26 208 221 225 71,640 175,000 300,000 18,572 45,000 158,000 242,000 653,000 175,000 226 301 302 304 305 306 310 401 500 600 601 602 604 605 606 607 608 609 610 611 612 614 Note Payable -short term Note Payable long term Bond Payable Premium on Bond Payable Common Stock, $1 par, 35,000 APIC Common Stock Unearned Compensation Treasury Stock APIC Treasury Stock Retained Earnings Sales Cost of Goods Sold Compensation Expense Salaries Expense Rent Expense Bad Dept Expense Payroll Tax Expense Advertisting Expense Insurance Expense Supplies Expense Depreciation Expense Amortization Expense Utilities Expense Miscellaneous Expenses Interest Expense TB-Unadjusted at 12.1.20 December ES 42,000 23,000 15,000 7,000 17,000 3,300 7,990 Adjusting JES 50 worksheet S & Wa Ava Shares Closing Ent 41 42 23,000 15,000 7,000 45 46 602 604 605 606 607 608 609 610 611 612 614 615 617 620 Totals Rent Expense Bad Dept Expense Payroll Tax Expense Advertisting Expense Insurance Expense Supplies Expense Depreciation Expense Amortization Expense Utilities Expense Miscellaneous Expenses Interest Expense Income Tax Expense Realized Gains (Losses) Unrealized Gains (Losses) 17,000 3,300 7,990 6,000 2,303,675 2,303,675

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started