Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record the following transactions following the format we used in the lecture. Each transaction has its own row. Do not total up the account balances

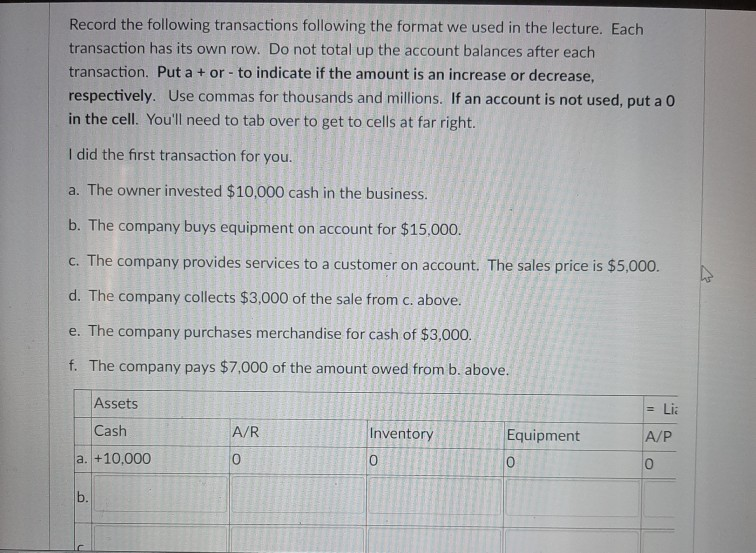

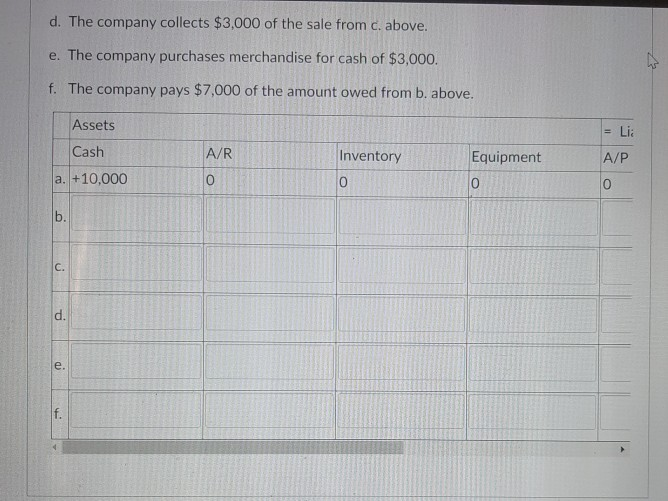

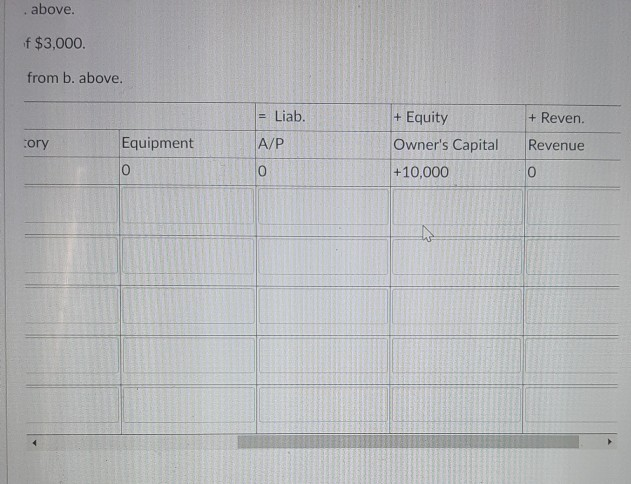

Record the following transactions following the format we used in the lecture. Each transaction has its own row. Do not total up the account balances after each transaction. Put a + or - to indicate if the amount is an increase or decrease, respectively. Use commas for thousands and millions. If an account is not used, put a 0 in the cell. You'll need to tab over to get to cells at far right. I did the first transaction for you. a. The owner invested $10,000 cash in the business. b. The company buys equipment on account for $15,000. c. The company provides services to a customer on account. The sales price is $5,000. d. The company collects $3,000 of the sale from c. above. e. The company purchases merchandise for cash of $3,000. f. The company pays $7,000 of the amount owed from b. above. Assets = Lic Cash A/R Equipment A/P Inventory o a. +10,000 0 0 o b. d. The company collects $3,000 of the sale from c. above. e. The company purchases merchandise for cash of $3,000. f. The company pays $7,000 of the amount owed from b. above. Assets = Lii Cash A/R Inventory Equipment A/P a. +10,000 0 0 0 o b. C. d. e. f. above. f $3,000. from b. above. = Liab. + Reven. cory Equipment A/P + Equity Owner's Capital +10,000 Revenue 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started