Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record the following transactions in general journal form related to the debt activities of the City of Layton described below. Journal entries should be

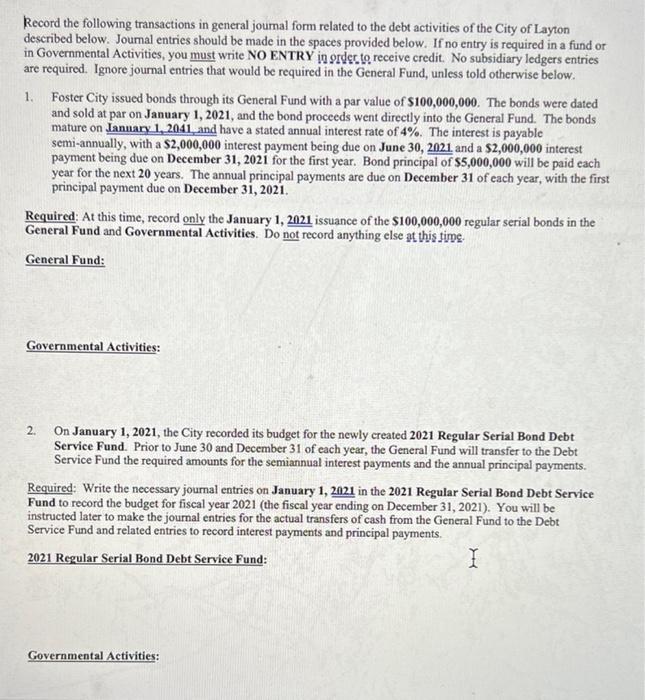

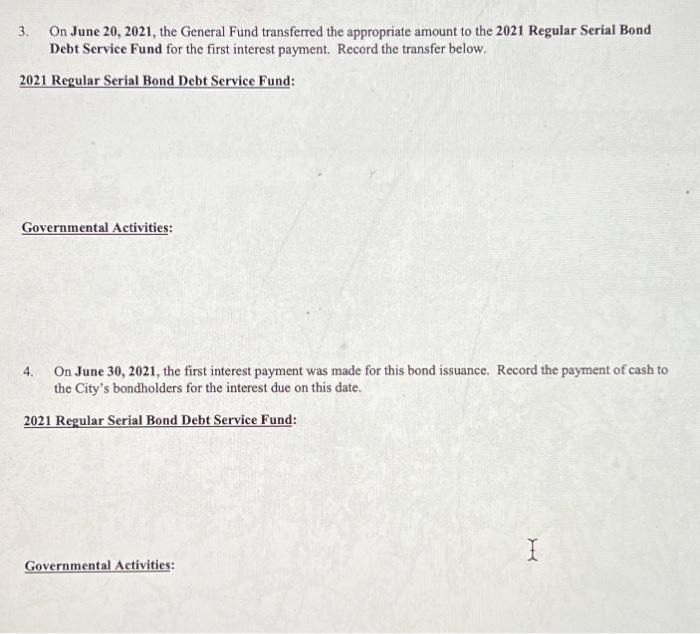

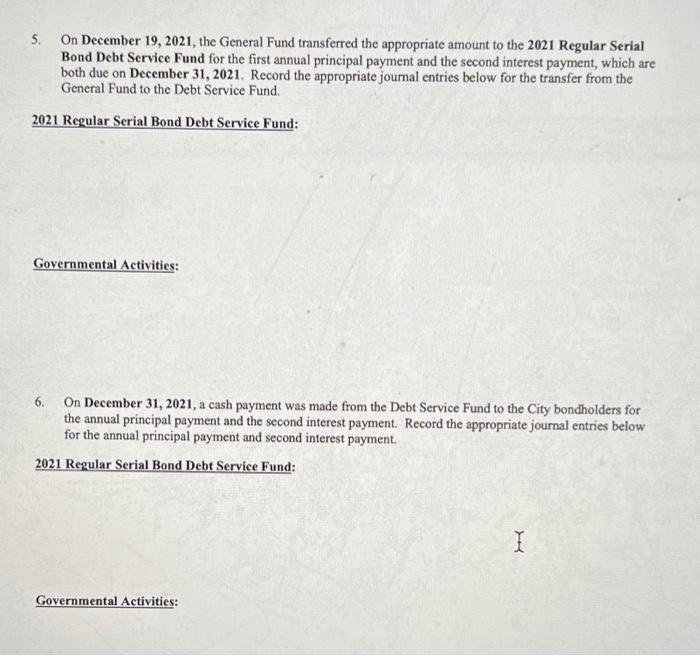

Record the following transactions in general journal form related to the debt activities of the City of Layton described below. Journal entries should be made in the spaces provided below. If no entry is required in a fund or in Governmental Activities, you must write NO ENTRY in order to receive credit. No subsidiary ledgers entries are required. Ignore journal entries that would be required in the General Fund, unless told otherwise below. 1. Foster City issued bonds through its General Fund with a par value of $100,000,000. The bonds were dated and sold at par on January 1, 2021, and the bond proceeds went directly into the General Fund. The bonds mature on January 1, 2041, and have a stated annual interest rate of 4%. The interest is payable semi-annually, with a $2,000,000 interest payment being due on June 30, 2021. and a $2,000,000 interest payment being due on December 31, 2021 for the first year. Bond principal of $5,000,000 will be paid each year for the next 20 years. The annual principal payments are due on December 31 of each year, with the first principal payment due on December 31, 2021. Required: At this time, record only the January 1, 2021 issuance of the $100,000,000 regular serial bonds in the General Fund and Governmental Activities. Do not record anything else at this time. General Fund: Governmental Activities: 2. On January 1, 2021, the City recorded its budget for the newly created 2021 Regular Serial Bond Debt Service Fund. Prior to June 30 and December 31 of each year, the General Fund will transfer to the Debt Service Fund the required amounts for the semiannual interest payments and the annual principal payments. Required: Write the necessary journal entries on January 1, 2021 in the 2021 Regular Serial Bond Debt Service Fund to record the budget for fiscal year 2021 (the fiscal year ending on December 31, 2021). You will be instructed later to make the journal entries for the actual transfers of cash from the General Fund to the Debt Service Fund and related entries to record interest payments and principal payments. 2021 Regular Serial Bond Debt Service Fund: I Governmental Activities: 3. On June 20, 2021, the General Fund transferred the appropriate amount to the 2021 Regular Serial Bond Debt Service Fund for the first interest payment. Record the transfer below. 2021 Regular Serial Bond Debt Service Fund: Governmental Activities: On June 30, 2021, the first interest payment was made for this bond issuance. Record the payment of cash to the City's bondholders for the interest due on this date. 2021 Regular Serial Bond Debt Service Fund: 4. Governmental Activities: 5. On December 19, 2021, the General Fund transferred the appropriate amount to the 2021 Regular Serial Bond Debt Service Fund for the first annual principal payment and the second interest payment, which are both due on December 31, 2021. Record the appropriate journal entries below for the transfer from the General Fund to the Debt Service Fund. 2021 Regular Serial Bond Debt Service Fund: Governmental Activities: On December 31, 2021, a cash payment was made from the Debt Service Fund to the City bondholders for the annual principal payment and the second interest payment. Record the appropriate journal entries below for the annual principal payment and second interest payment. 2021 Regular Serial Bond Debt Service Fund: 6. Governmental Activities: I

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 General Fund Debit Credit Cash 100000000 Governmental Activities Debit Credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started