Question

Record the following transactions in the appropriate special journals or general journal for the month of June. Record and post all transactions in accordance with

Record the following transactions in the appropriate special journals or general journal for the month of June. Record and post all transactions in accordance with accounting procedures. Once you have recorded all of the transactions, total the columns in each journal and cross check that they balance before submitting for assessment. (Note: In each journal, enter transactions in order of transaction date and then in the order they appear in the transaction list below. For example, enter transactions from 12 June before transactions from 15 June and then enter the 12 June transactions in the order they appear in the transaction list below. If an account total or balance returns to zero, enter 0 in the required field, otherwise leave the field blank.)

Help me to answer all of these questions please! I will give a like after! Thank you

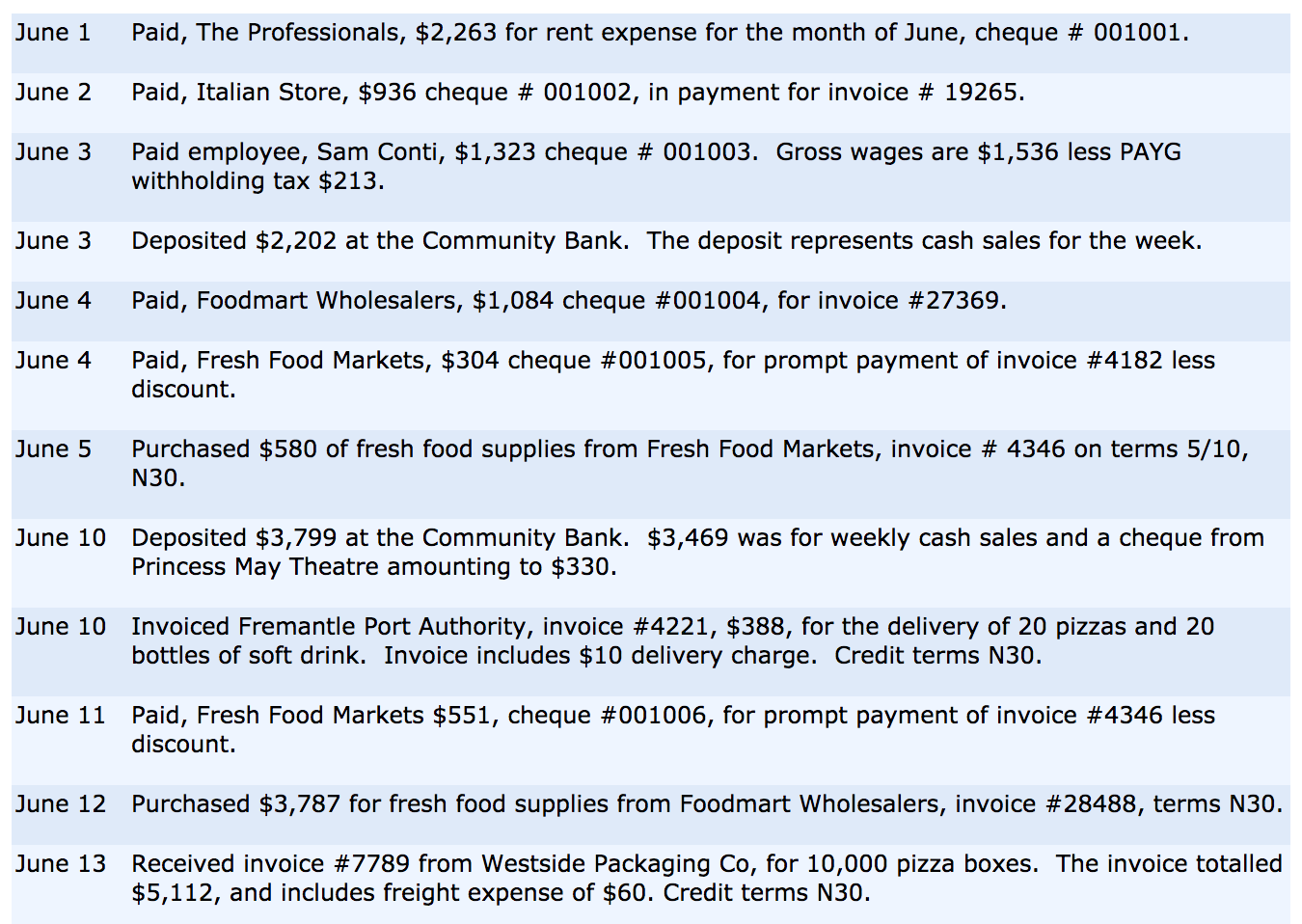

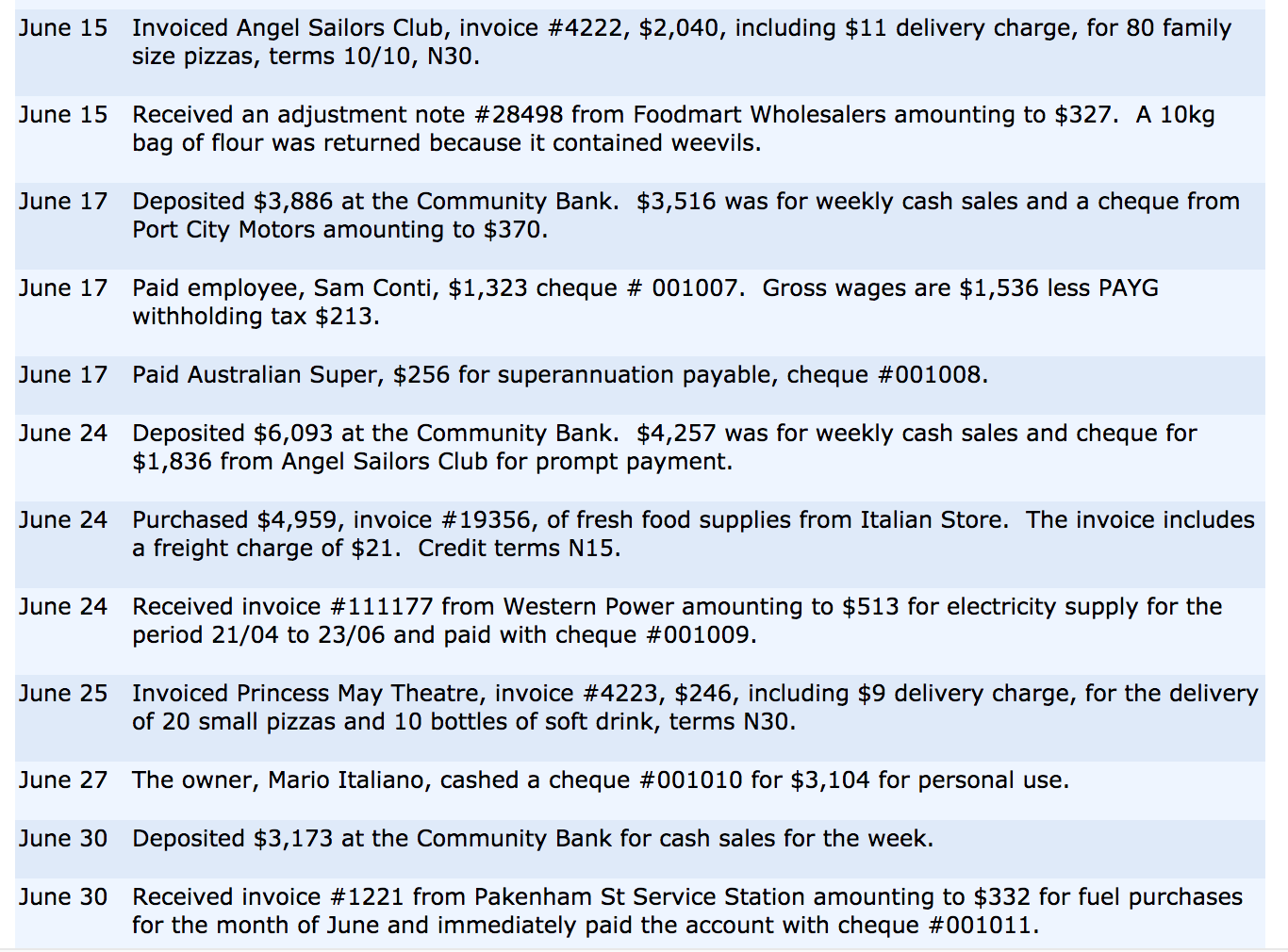

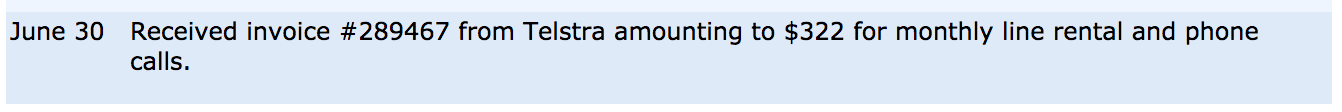

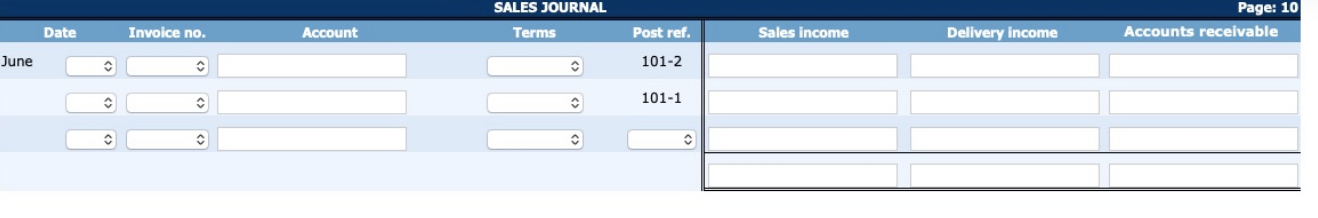

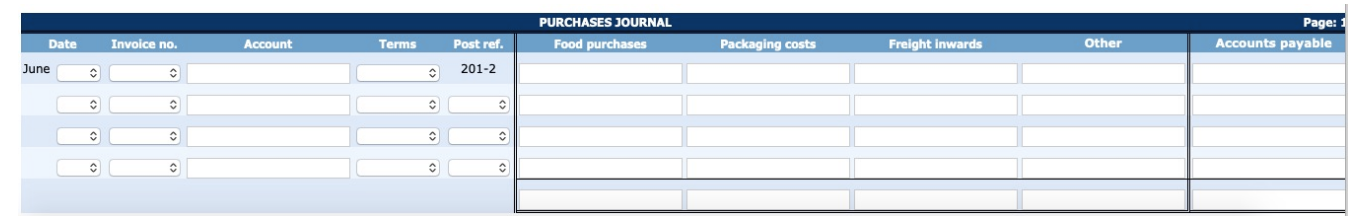

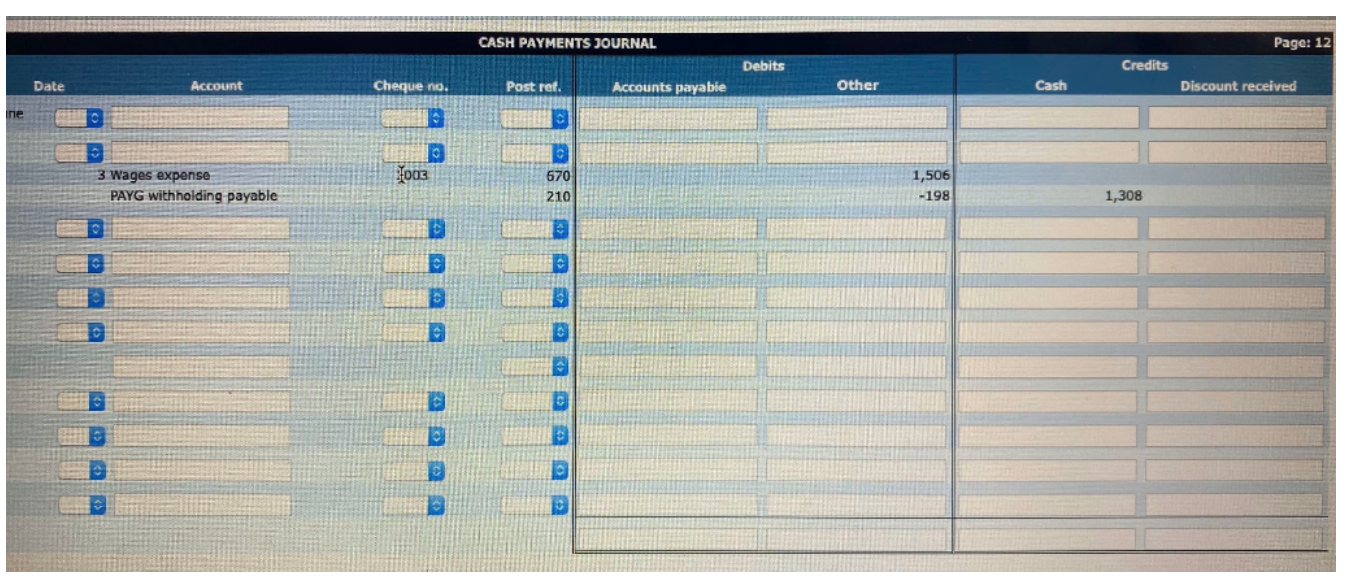

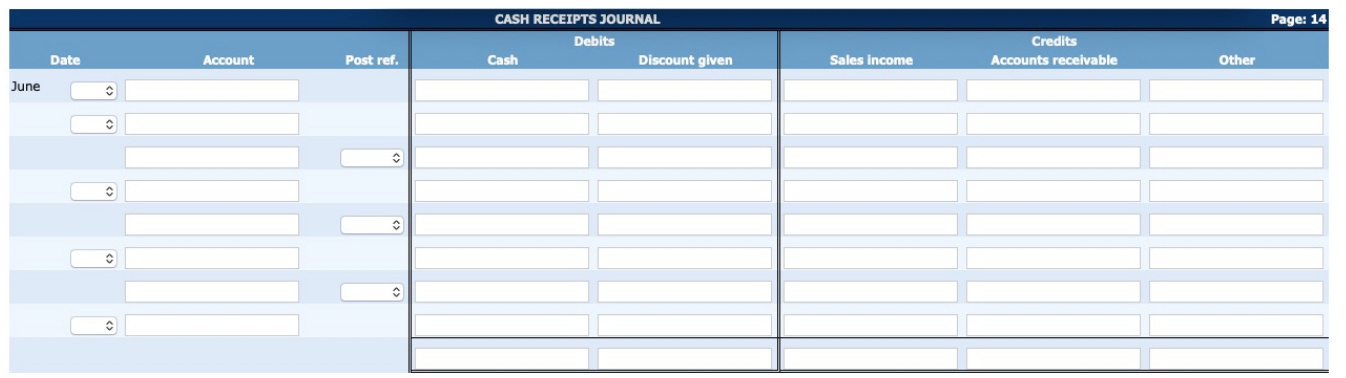

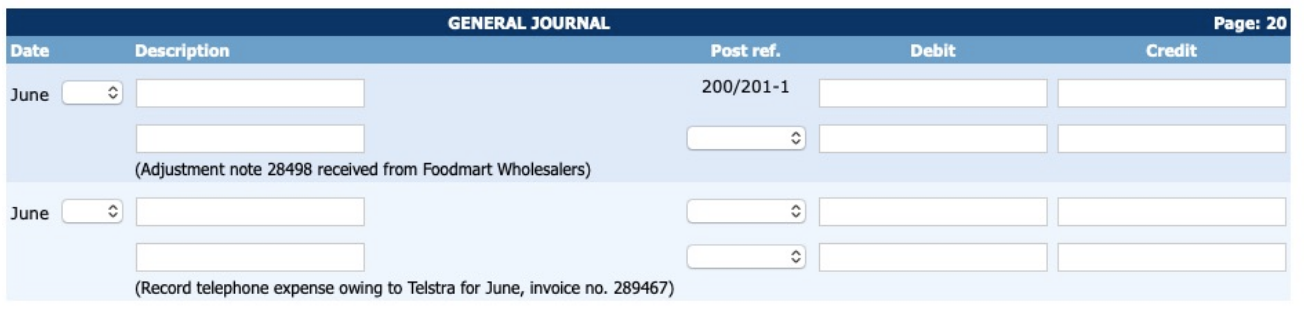

June 1 Paid, The Professionals, $2,263 for rent expense for the month of June, cheque # 001001. June 2 Paid, Italian Store, $936 cheque # 001002, in payment for invoice # 19265. June 3 Paid employee, Sam Conti, $1,323 cheque # 001003. Gross wages are $1,536 less PAYG withholding tax $213. June 3 Deposited $2,202 at the Community Bank. The deposit represents cash sales for the week. June 4 Paid, Foodmart Wholesalers, $1,084 cheque #001004, for invoice #27369. June 4 Paid, Fresh Food Markets, $304 cheque #001005, for prompt payment of invoice #4182 less discount. June 5 Purchased $580 of fresh food supplies from Fresh Food Markets, invoice # 4346 on terms 5/10, N30. June 10 Deposited $3,799 at the Community Bank. $3,469 was for weekly cash sales and a cheque from Princess May Theatre amounting to $330. June 10 Invoiced Fremantle Port Authority, invoice #4221, $388, for the delivery of 20 pizzas and 20 bottles of soft drink. Invoice includes $10 delivery charge. Credit terms N30. June 11 Paid, Fresh Food Markets $551, cheque #001006, for prompt payment of invoice #4346 less discount. June 12 Purchased $3,787 for fresh food supplies from Foodmart Wholesalers, invoice #28488, terms N30. June 13 Received invoice #7789 from Westside Packaging Co, for 10,000 pizza boxes. The invoice totalled $5,112, and includes freight expense of $60. Credit terms N30. June 15 Invoiced Angel Sailors Club, invoice #4222, $2,040, including $11 delivery charge, for 80 family size pizzas, terms 10/10, N30. June 15 Received an adjustment note #28498 from Foodmart Wholesalers amounting to $327. A 10kg bag of flour was returned because it contained weevils. June 17 Deposited $3,886 at the Community Bank. $3,516 was for weekly cash sales and a cheque from Port City Motors amounting to $370. June 17 Paid employee, Sam Conti, $1,323 cheque # 001007. Gross wages are $1,536 less PAYG withholding tax $213. June 17 Paid Australian Super, $256 for superannuation payable, cheque #001008. June 24 Deposited $6,093 at the Community Bank. $4,257 was for weekly cash sales and cheque for $1,836 from Angel Sailors Club for prompt payment. June 24 Purchased $4,959, invoice #19356, of fresh food supplies from Italian Store. The invoice includes a freight charge of $21. Credit terms N15. June 24 Received invoice #111177 from Western Power amounting to $513 for electricity supply for the period 21/04 to 23/06 and paid with cheque #001009. June 25 Invoiced Princess May Theatre, invoice #4223, $246, including $9 delivery charge, for the delivery of 20 small pizzas and 10 bottles of soft drink, terms N30. June 27 The owner, Mario Italiano, cashed a cheque #001010 for $3,104 for personal use. June 30 Deposited $3,173 at the Community Bank for cash sales for the week. June 30 Received invoice #1221 from Pakenham St Service Station amounting to $332 for fuel purchases for the month of June and immediately paid the account with cheque #001011. June 30 Received invoice #289467 from Telstra amounting to $322 for monthly line rental and phone calls. SALES JOURNAL Terms Page: 10 Accounts receivable Date Invoice no. Account Post ref. Sales Income Delivery income June 101-2 101-1 Page: 1 PURCHASES JOURNAL Food purchases Invoice no. Account Terms Post ref. Packaging costs Freight inwards Other Accounts payable Date June 201-2 CASH PAYMENTS JOURNAL Page: 12 Debits Credits Date Account Cheque no. Post ret Accounts payable Other Cash Discount received ne 10 003 3 Wages expense PAYG withholding payable 670 210 1,506 -198 1,308 D C Page: 14 CASH RECEIPTS JOURNAL Debits Cash Discount given Credits Accounts receivable Date Account Post ref. Sales income Other June GENERAL JOURNAL Page: 20 Date Description Post ref. Debit Credit June 200/201-1 (Adjustment note 28498 received from Foodmart Wholesalers) June (Record telephone expense owing to Telstra for June, invoice no. 289467)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started