Answered step by step

Verified Expert Solution

Question

1 Approved Answer

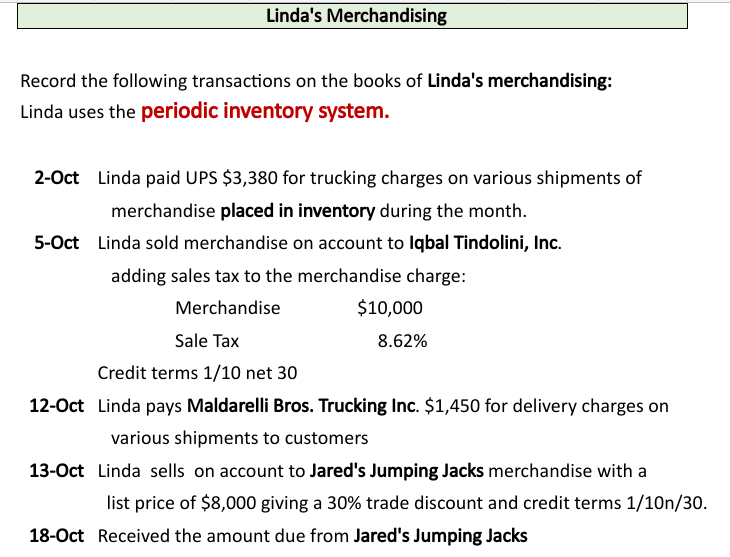

Record the following transactions on the books of Linda's merchandising: Linda uses the periodic inventory system. 2-Oct Linda paid UPS $3,380 for trucking charges on

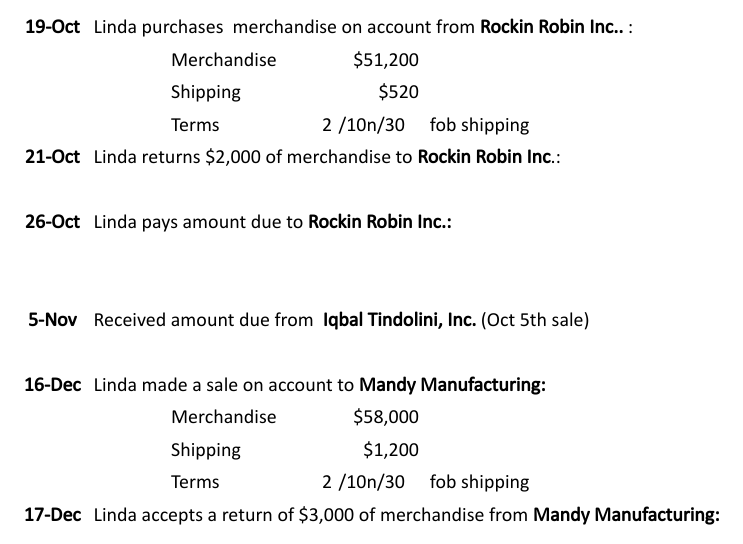

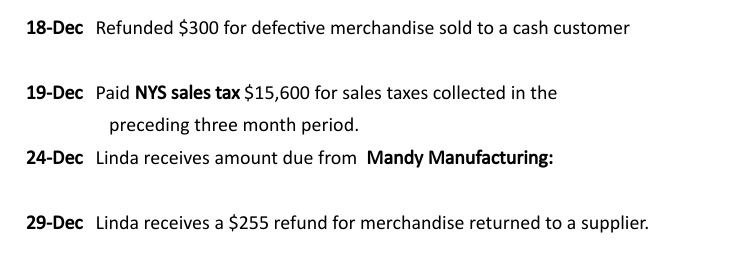

Record the following transactions on the books of Linda's merchandising: Linda uses the periodic inventory system. 2-Oct Linda paid UPS $3,380 for trucking charges on various shipments of merchandise placed in inventory during the month. 5-Oct Linda sold merchandise on account to lqbal Tindolini, Inc. adding sales tax to the merchandise charge: Credit terms 1/10 net 30 12-Oct Linda pays Maldarelli Bros. Trucking Inc. $1,450 for delivery charges on various shipments to customers 13-Oct Linda sells on account to Jared's Jumping Jacks merchandise with a list price of $8,000 giving a 30% trade discount and credit terms 1/10n/30. 18-Oct Received the amount due from Jared's Jumping Jacks 19-Oct Linda purchases merchandise on account from Rockin Robin Inc.. : Jping 21-Oct Linda returns $2,000 of merchandise to Rockin Robin Inc.: 26-Oct Linda pays amount due to Rockin Robin Inc.: 5-Nov Received amount due from Iqbal Tindolini, Inc. (Oct 5th sale) 16-Dec Linda made a sale on account to Mandy Manufacturing: 17-Dec Linda accepts a return of $3,000 of merchandise from Mandy Manufacturing: 18-Dec Refunded $300 for defective merchandise sold to a cash customer 19-Dec Paid NYS sales tax $15,600 for sales taxes collected in the preceding three month period. 24-Dec Linda receives amount due from Mandy Manufacturing: 29-Dec Linda receives a $255 refund for merchandise returned to a supplier

Record the following transactions on the books of Linda's merchandising: Linda uses the periodic inventory system. 2-Oct Linda paid UPS $3,380 for trucking charges on various shipments of merchandise placed in inventory during the month. 5-Oct Linda sold merchandise on account to lqbal Tindolini, Inc. adding sales tax to the merchandise charge: Credit terms 1/10 net 30 12-Oct Linda pays Maldarelli Bros. Trucking Inc. $1,450 for delivery charges on various shipments to customers 13-Oct Linda sells on account to Jared's Jumping Jacks merchandise with a list price of $8,000 giving a 30% trade discount and credit terms 1/10n/30. 18-Oct Received the amount due from Jared's Jumping Jacks 19-Oct Linda purchases merchandise on account from Rockin Robin Inc.. : Jping 21-Oct Linda returns $2,000 of merchandise to Rockin Robin Inc.: 26-Oct Linda pays amount due to Rockin Robin Inc.: 5-Nov Received amount due from Iqbal Tindolini, Inc. (Oct 5th sale) 16-Dec Linda made a sale on account to Mandy Manufacturing: 17-Dec Linda accepts a return of $3,000 of merchandise from Mandy Manufacturing: 18-Dec Refunded $300 for defective merchandise sold to a cash customer 19-Dec Paid NYS sales tax $15,600 for sales taxes collected in the preceding three month period. 24-Dec Linda receives amount due from Mandy Manufacturing: 29-Dec Linda receives a $255 refund for merchandise returned to a supplier Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started