Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Record the joirnal entry 1-4 1. Recird the entry for bad debt expenses under the percentage of credit sales method 2. Record the entry for

Record the joirnal entry 1-4

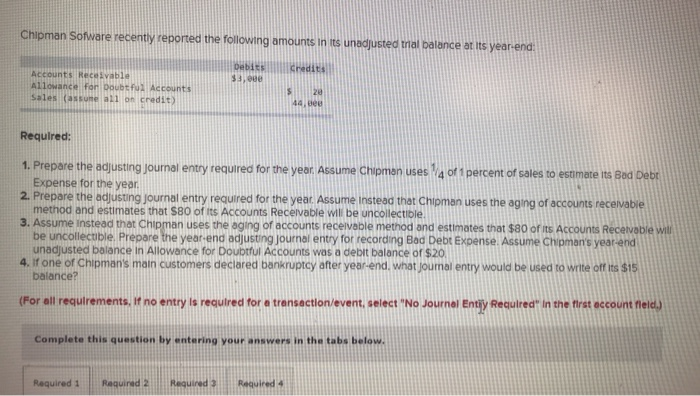

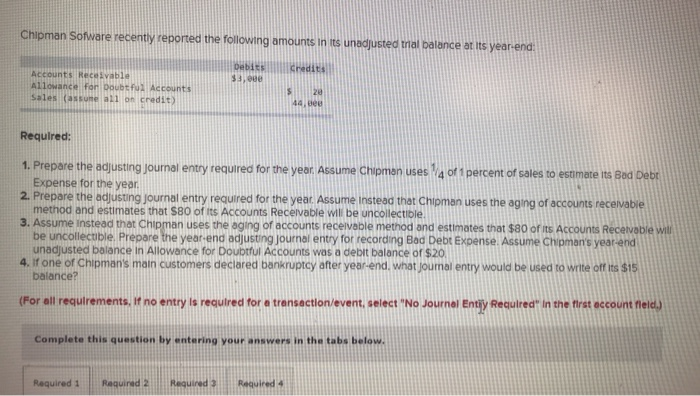

Chipman Sofware recently reported the following amounts in its unadjusted trial balance at its year end: Debits 33, Credits Accounts Receivable Allowance for Doubtful Accounts Sales (assume 1 on credit) $ 44. deu Required: 1. Prepare the adjusting journal entry required for the year. Assume Chipmon uses 4 of 1 percent of sales to estimate its Bad Debr Expense for the year. 2. Prepare the adjusting journal entry required for the year. Assume Instead that Chipman uses the aging of accounts receivable method and estimates that S80 of its Accounts Receivable will be uncollectible. 3. Assume instead that Chipman uses the aging of accounts receivable method and estimates that $80 of its Accounts Receivable will be uncollectible. Prepare the year-end adjusting journal entry for recording Bad Debt Expense. Assume Chipman's year-end unadjusted balance in Allowance for Doubtful Accounts was a debit balance of $20 4. If one of Chipman's main customers declared bankruptcy after year-end, what Journal entry would be used to write off its $15 balance? (For all requirements. If no entry is required for a transaction/event, select "No Journal Entiy Required" In the first account field.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4

1. Recird the entry for bad debt expenses under the percentage of credit sales method

2. Record the entry for bad debt expenses under rhe aging of accounta recievavke method

3. Record the adjusting entry for bad debts, using the aging of accounts recievable method

4. Record the write off certain customer account which is not collectabke due to bankruptcy declared by the customer totalling 15$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started