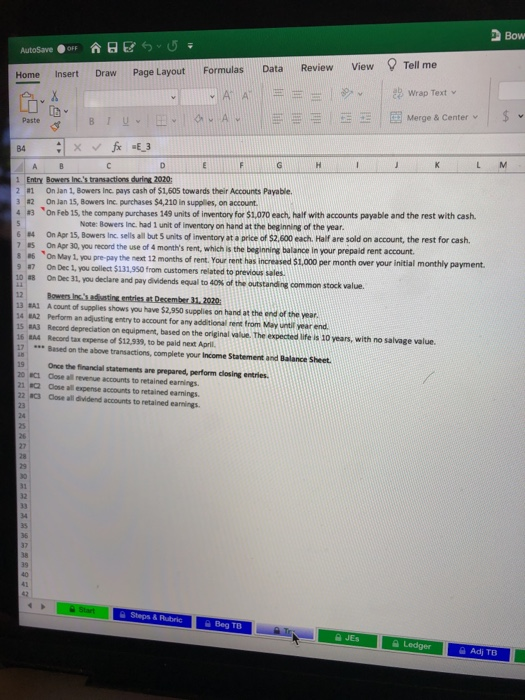

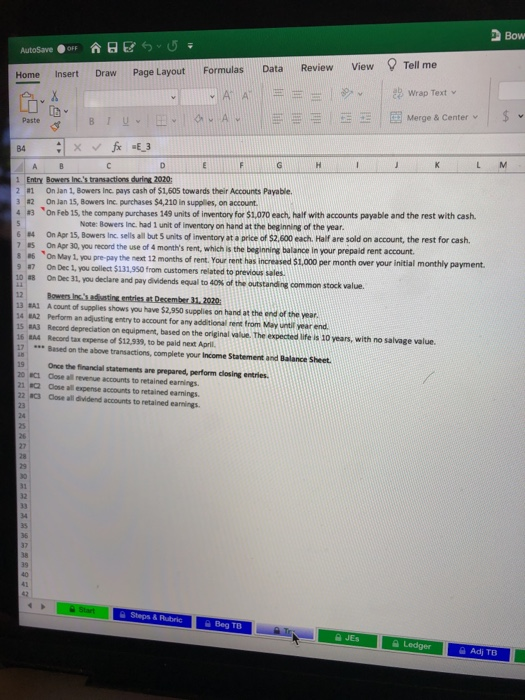

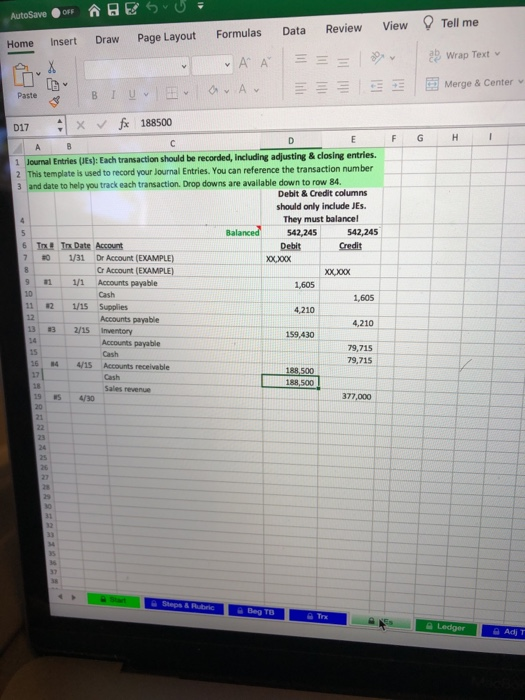

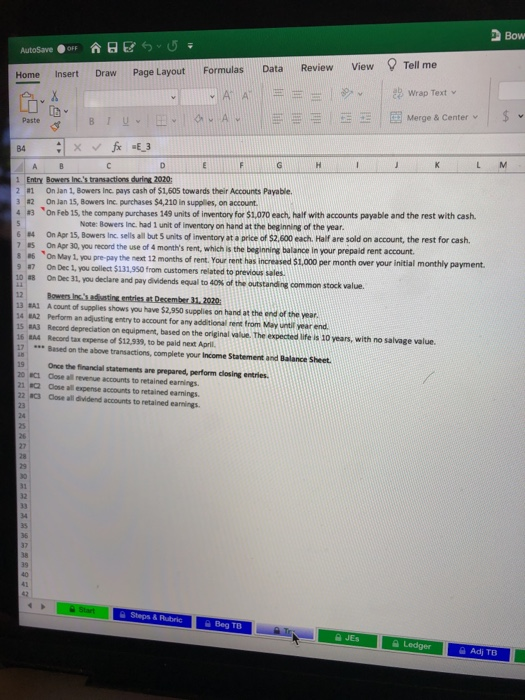

Record the journal entries for the following transactions during 2020

Bow AutoSave | OFF Review Data View Tell me Home Insert Draw Formulas Page Layout A A y Wrap Text Paste B TU Uv CA Merge & Center M B4 Xfx =E_3 1 K G L H B D E F 1 Entry Bowers Inc.'s transactions during 2020: 21 On Jan 1, Bowers Inc.pays cash of $1,605 towards their Accounts Payable. 382 On Jan 15, Bowers Inc. purchases $4,210 in supplies, on account 4 #on Feb 15, the company purchases 149 units of inventory for $1,070 each, half with accounts payable and the rest with cash. 5 Note: Bowers Inc. had 1 unit of inventory on hand at the beginning of the year. 644 On Apr 15, Bowers Inc. sells all but 5 units of inventory at a price of $2,600 each. Half are sold on account, the rest for cash. 75 On Apr 30, you record the use of 4 month's rent, which is the beginning balance in your prepaid rent account. On May 1. you pre-pay the next 12 months of rent. Your rent has increased $1,000 per month over your initial monthly payment. 9 27 On Dec 1. you collect $131,950 from customers related to previous sales 108 On Dec 31, you declare and pay dividends equal to 40% of the outstanding common stock value. 12 Bowers Inc.'s disting entries at December 31, 2020 13 BAL A count of supplies shows you have $2,950 supplies on hand at the end of the year. 14 A2 Perform an adjusting entry to account for any additional rent from May until year end 15 BAB Record depreciation on equipment, based on the original value. The expected life is 10 years, with no salvage value 16 A Record tax expense of $12,939, to be paid next April 17 * Based on the above transactions, complete your Income Statement and Balance Sheet. 19 Once the financial statements are prepared, perform closing entries 20 ct Close all revenue accounts to retained earnings 21 Close all expense accounts to retained earnings 22 C3 Cose all vidend accounts to retained earnings. 24 Steps & Rube Beg TB JES Ledger Adj TB OF AutoSave View Tell me Data Review Formulas Home Insert Draw Page Layout ' = X 2 Wrap Text y Merge & Center F G H 1 Paste BIU a. Av D17 x fx 188500 D E B 1 Journal Entries (JES): Each transaction should be recorded, including adjusting & closing entries. 2 This template is used to record your Journal Entries. You can reference the transaction number 3 and date to help you track each transaction. Drop downs are available down to row 84. Debit & Credit columns should only include Jes. They must balancel 5 Balanced 542,245 542,245 6 Trx Trx Date Account Debit Credit 7 30 1/31 Dr Account (EXAMPLE) xx.xox 8 Or Account (EXAMPLE) XX.XOX 9 1/1 Accounts payable 1,605 10 Cash 1,605 #2 1/15 Supplies 4,210 12 Accounts payable 4,210 33 2/15 inventory 159,430 Accounts payable 79,715 15 Cash 16 79,715 34 4/15 Accounts receivable 188,500 Cash 18 188,500 Sales revenue 19 4/30 377,000 m 22 24 25 36 Beg TB Ledger AdjT