Answered step by step

Verified Expert Solution

Question

1 Approved Answer

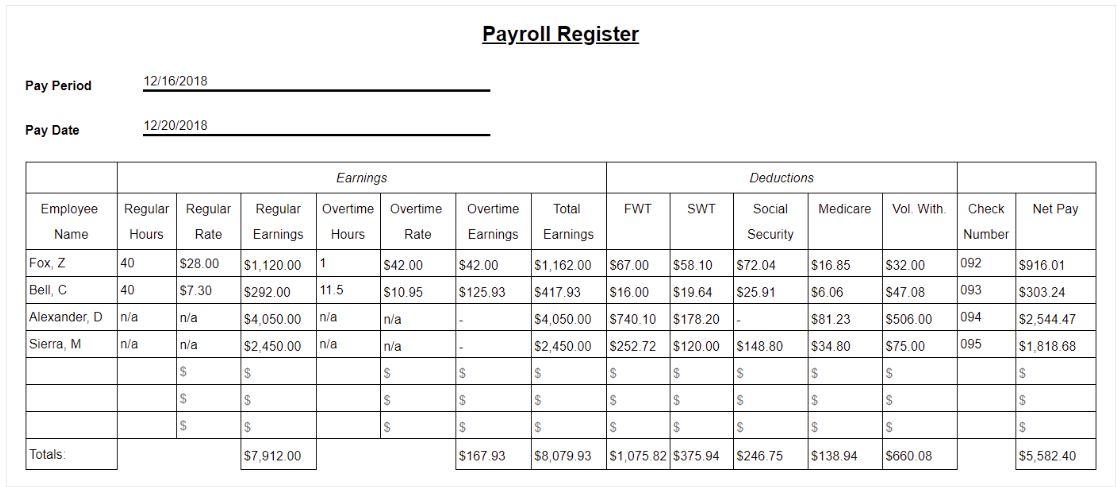

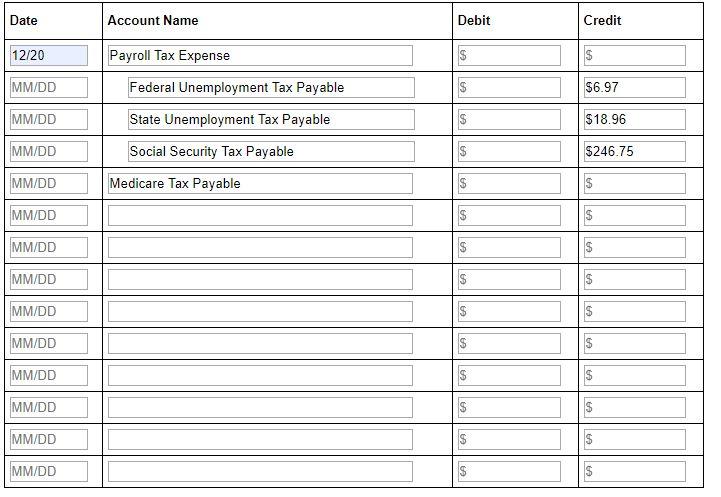

Record the journal entry to account for employer payroll taxes based on the totals in the payroll register and the FUTA and SUTA calculations. Book

Record the journal entry to account for employer payroll taxes based on the totals in the payroll register and the FUTA and SUTA calculations. Book the entry on the date paychecks are distributed. Recall that Zachary Fox and Michael Sierra are married,while Calvin Bell and David Alexander are single. Year-to-date taxable earnings for FICA taxes,prior to the current pay period,are as follows:

- Zachary Fox:$0

- Calvin Bell:$20,478.57

- David Alexander:$198,450

- Michael Sierra:$117,600

Notes:

- Enter the transaction date on the first line only (if multiple transactions are required, enter the date on the first line of each transaction). Enter all debits within the transaction prior to entering any credits.

- See the Chart of Accounts provided for the proper account names to use.

- To earn any credit for a given line within the journal entry,the account name must be correct. Partial credit will be given for a correct account name with an incorrect amount,while full credit will be given for a correct account name with a correct amount.

- Do not include journal entry explanation when submitting your answer.

| FUTA Tax - Zachary Fox | $6.97 |

| SUTA Tax - Zachary Fox | $13.94 |

| FUTA Tax - Calvin Bell | $0 |

| SUTA Tax - Calvin Bell | $5.02 |

| FUTA Tax -David Alexander | $0 |

| SUTA Tax -David Alexander | $0 |

| FUTA Tax - Michael Sierra | $0 |

| SUTA Tax - Michael Sierra | $0 |

Pay Period Pay Date Employee Name Fox, Z Bell, C 40 Alexander, D In/a Sierra, M Totals: 40 12/16/2018 Regular Regular Regular Overtime Overtime Hours Rate Rate Earnings Hours $1,120.00 1 $292.00 11.5 $4,050.00 n/a $2,450.00 n/a n/a 12/20/2018 $28.00 $7.30 n/a n/a $ $ S $ $ $ Earnings $7,912.00 $42.00 $10.95 n/a n/a $ $ S - Payroll Register Overtime Total Earnings Earnings $42.00 $125.93 $ $ $ $167.93 $ $ $ FWT S S $ SWT $1,162.00 $67.00 $58.10 $72.04 $417.93 $16.00 $19.64 $25.91 $4,050.00 $740.10 $178.20 $2,450.00 $252.72 $120.00 $148.80 $ $ $ $8,079.93 $1,075.82 $375.94 $ Deductions S S Social Security $246.75 Medicare Vol. With $16.85 $6.06 $81.23 $34.80 $ $ $ $138.94 $32.00 $47.08 $506.00 $75.00 $ S S $660.08 Check Number 092 093 094 095 Net Pay $916.01 $303.24 $2,544.47 $1.818.68 $ $ $ $5,582 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you with that Here is the journal entry to account for employer payroll taxes Date 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started