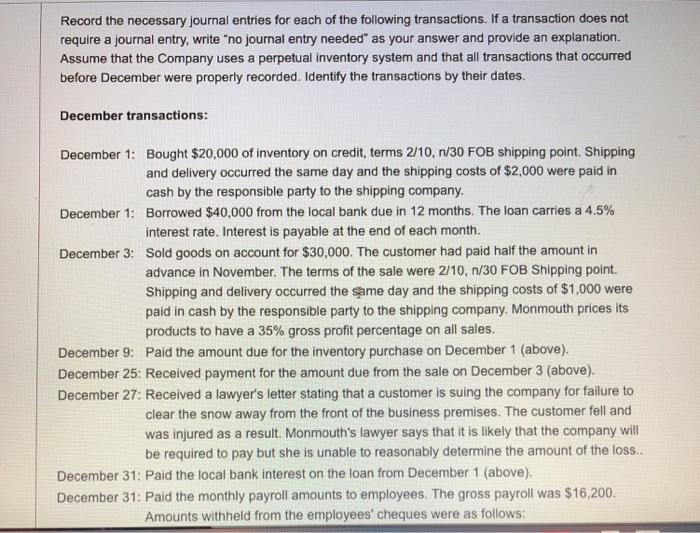

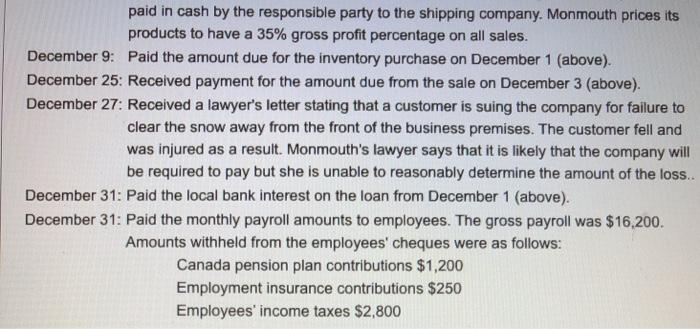

Record the necessary journal entries for each of the following transactions. If a transaction does not require a journal entry, write "no journal entry needed" as your answer and provide an explanation. Assume that the Company uses a perpetual inventory system and that all transactions that occurred before December were properly recorded. Identify the transactions by their dates. December transactions: December 1: Bought $20,000 of inventory on credit, terms 2/10, 1/30 FOB shipping point. Shipping and delivery occurred the same day and the shipping costs of $2,000 were paid in cash by the responsible party to the shipping company. December 1: Borrowed $40,000 from the local bank due in 12 months. The loan carries a 4.5% interest rate. Interest is payable at the end of each month. December 3: Sold goods on account for $30,000. The customer had paid half the amount in advance in November. The terms of the sale were 2/10,n/30 FOB Shipping point. Shipping and delivery occurred the same day and the shipping costs of $1,000 were paid in cash by the responsible party to the shipping company. Monmouth prices its products to have a 35% gross profit percentage on all sales. December 9: Paid the amount due for the inventory purchase on December 1 (above). December 25: Received payment for the amount due from the sale on December 3 (above). December 27: Received a lawyer's letter stating that a customer is suing the company for failure to clear the snow away from the front of the business premises. The customer fell and was injured as a result. Monmouth's lawyer says that it is likely that the company will be required to pay but she is unable to reasonably determine the amount of the loss.. December 31: Paid the local bank interest on the loan from December 1 (above). December 31: Paid the monthly payroll amounts to employees. The gross payroll was $16,200. Amounts withheld from the employees' cheques were as follows: paid in cash by the responsible party to the shipping company. Monmouth prices its products to have a 35% gross profit percentage on all sales. December 9: Paid the amount due for the inventory purchase on December 1 (above). December 25: Received payment for the amount due from the sale on December 3 (above). December 27: Received a lawyer's letter stating that a customer is suing the company for failure to clear the snow away from the front of the business premises. The customer fell and was injured as a result. Monmouth's lawyer says that it is likely that the company will be required to pay but she is unable to reasonably determine the amount of the loss.. December 31: Paid the local bank interest on the loan from December 1 (above). December 31: Paid the monthly payroll amounts to employees. The gross payroll was $16,200. Amounts withheld from the employees' cheques were as follows: Canada pension plan contributions $1,200 Employment insurance contributions $250 Employees' income taxes $2,800