Answered step by step

Verified Expert Solution

Question

1 Approved Answer

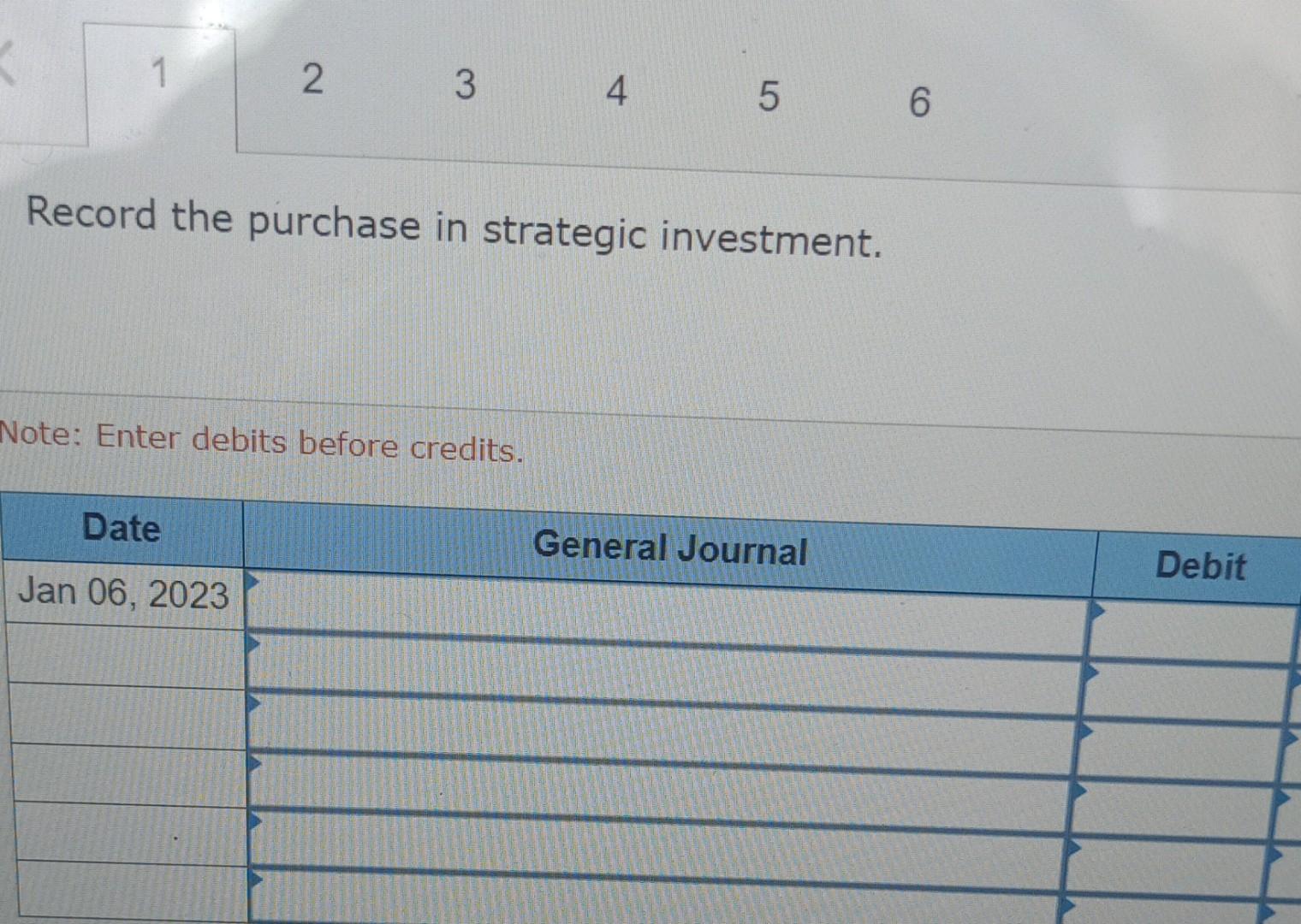

Record the purchase in strategic investment. Note: Enter debits before credits. Heritage Ltd. was organized on January 2, 2023. The following investment transactions and events

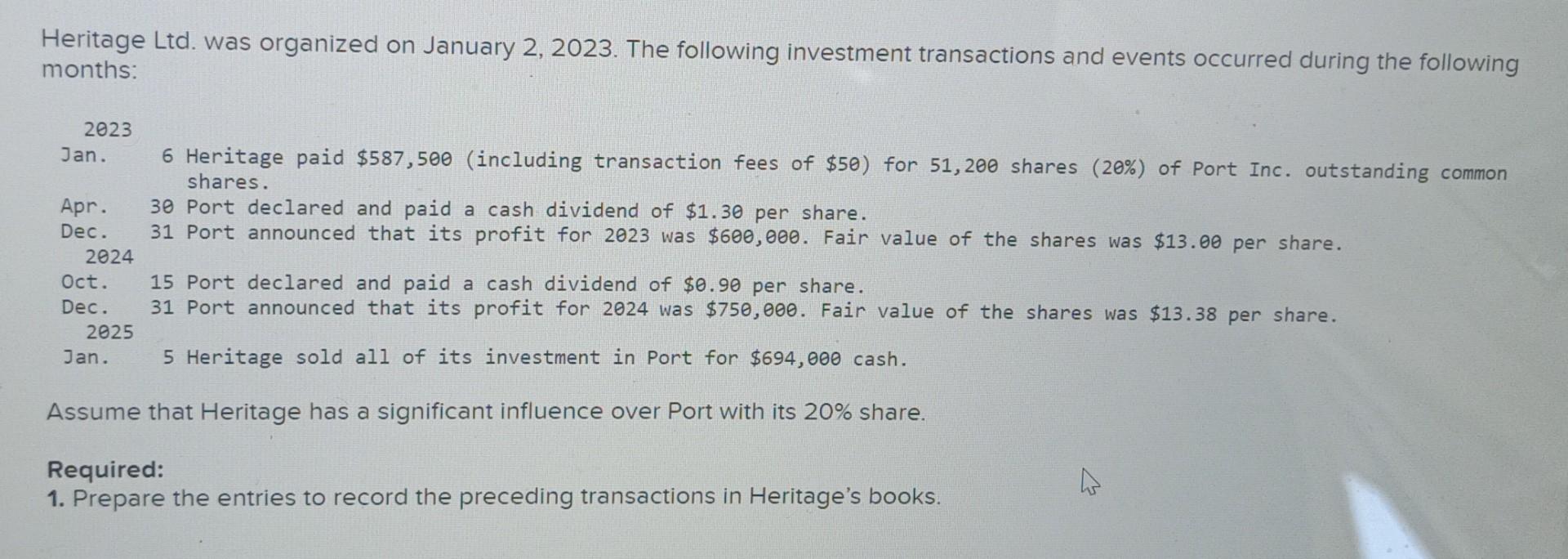

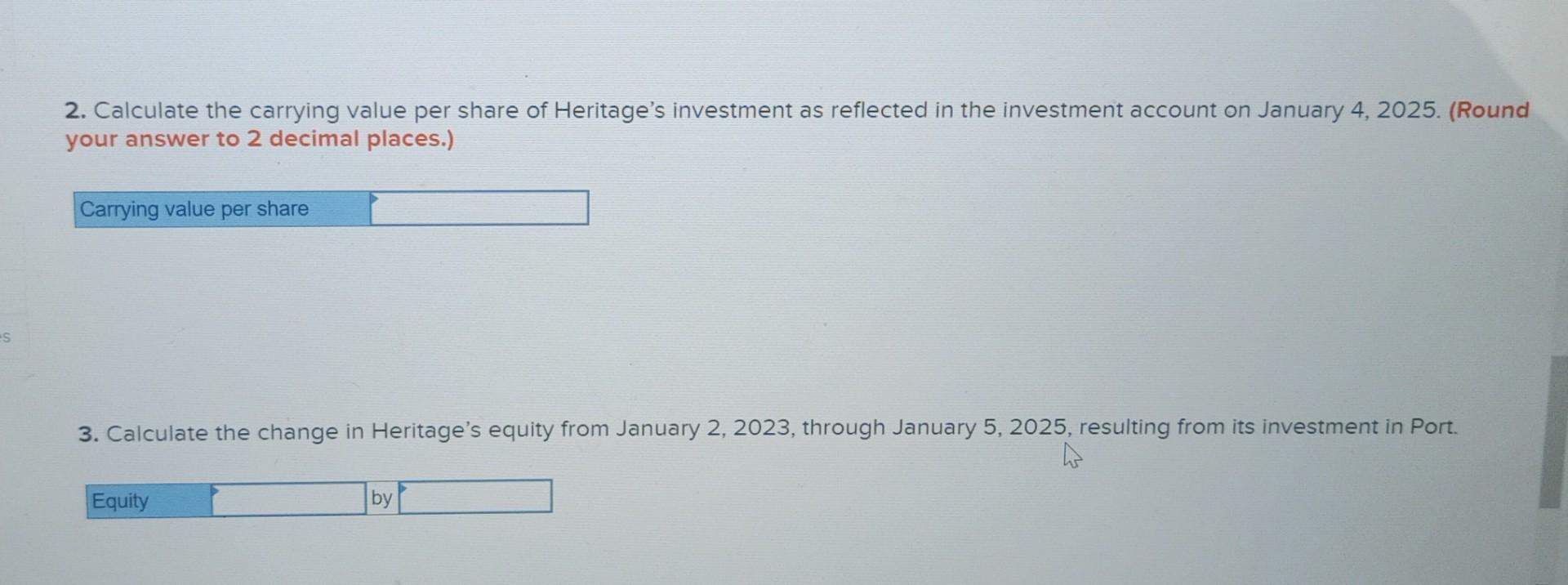

Record the purchase in strategic investment. Note: Enter debits before credits. Heritage Ltd. was organized on January 2, 2023. The following investment transactions and events occurred during the following months: 2023 Jan. 6 Heritage paid $587,500 (including transaction fees of $50 ) for 51,200 shares (20\%) of Port Inc. outstanding common shares. Apr. 30 Port declared and paid a cash dividend of $1.30 per share. Dec. 31 Port announced that its profit for 2023 was $600,000. Fair value of the shares was $13.00 per share. 2024 Oct. 15 Port declared and paid a cash dividend of $0.90 per share. Dec. 31 Port announced that its profit for 2024 was $750,000. Fair value of the shares was $13.38 per share. 2025 Jan. 5 Heritage sold all of its investment in Port for $694,000 cash. Assume that Heritage has a significant influence over Port with its 20% share. Required: 1. Prepare the entries to record the preceding transactions in Heritage's books. 2. Calculate the carrying value per share of Heritage's investment as reflected in the investment account on January 4 , 2025. (Rounc your answer to 2 decimal places.) 3. Calculate the change in Heritage's equity from January 2,2023 , through January 5,2025 , resulting from its investment in Port

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started