Answered step by step

Verified Expert Solution

Question

1 Approved Answer

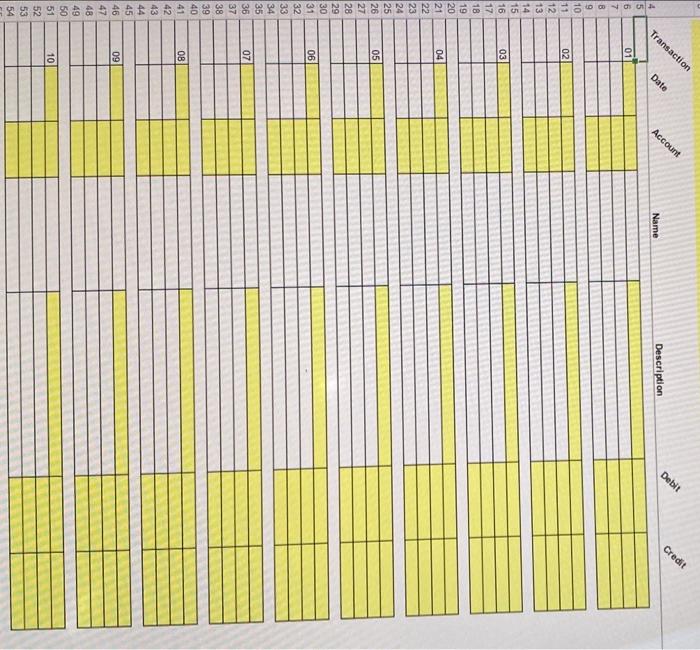

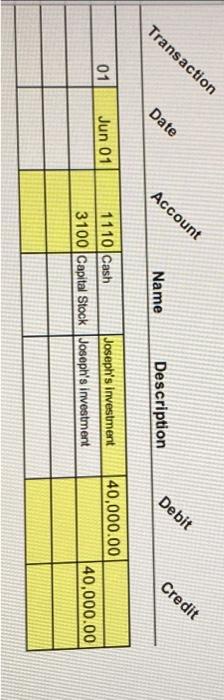

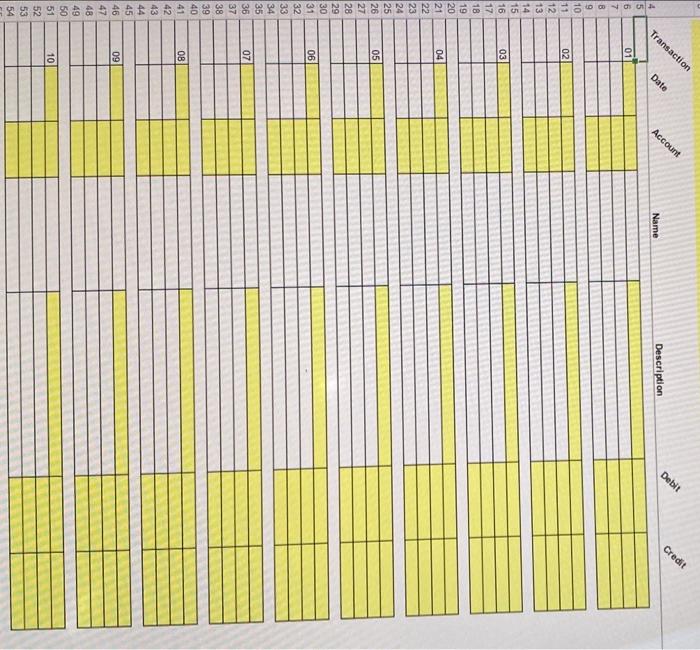

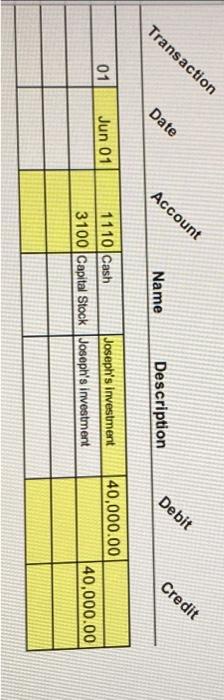

-Record the transaction in general journal entry, rounding TWO decimal places Chart of Accounts Transactions 1-10 General Journal (Only fill in yellow boxes) *EXAMPLE* Number

-Record the transaction in general journal entry, rounding TWO decimal places

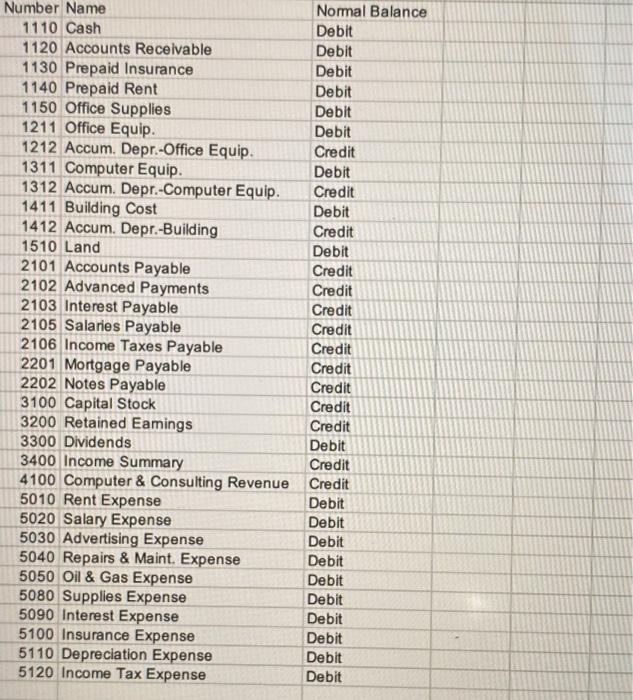

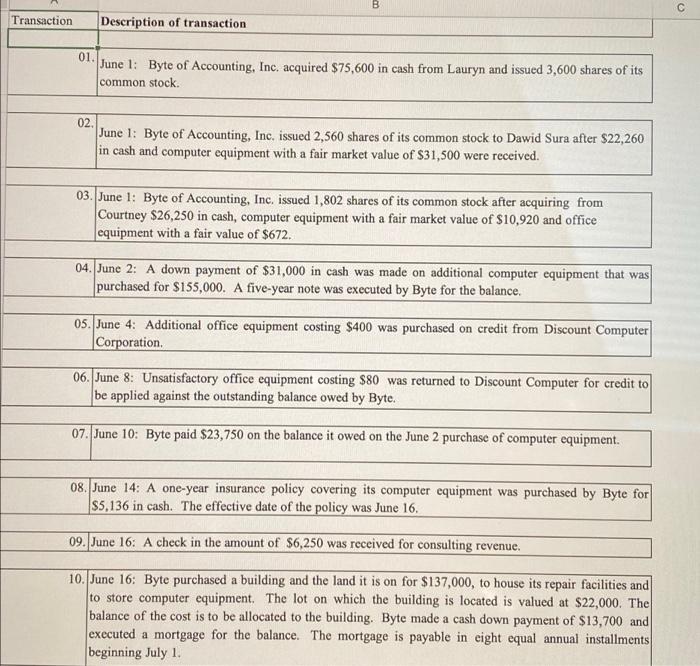

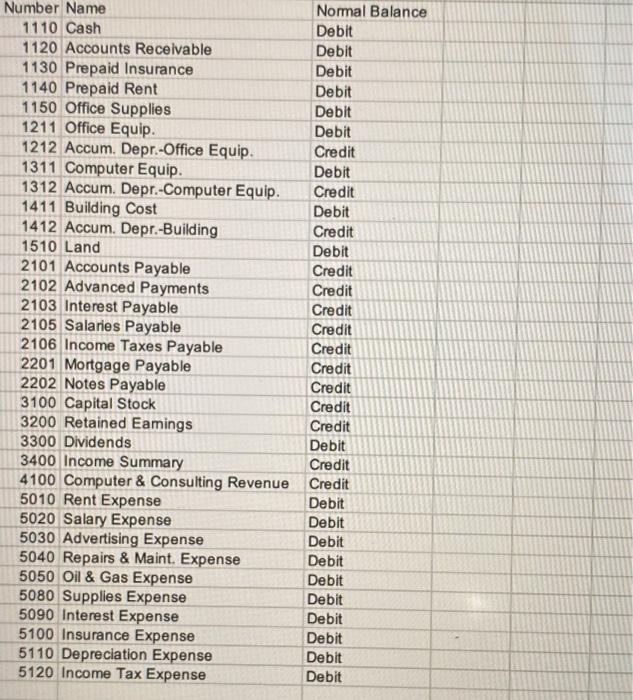

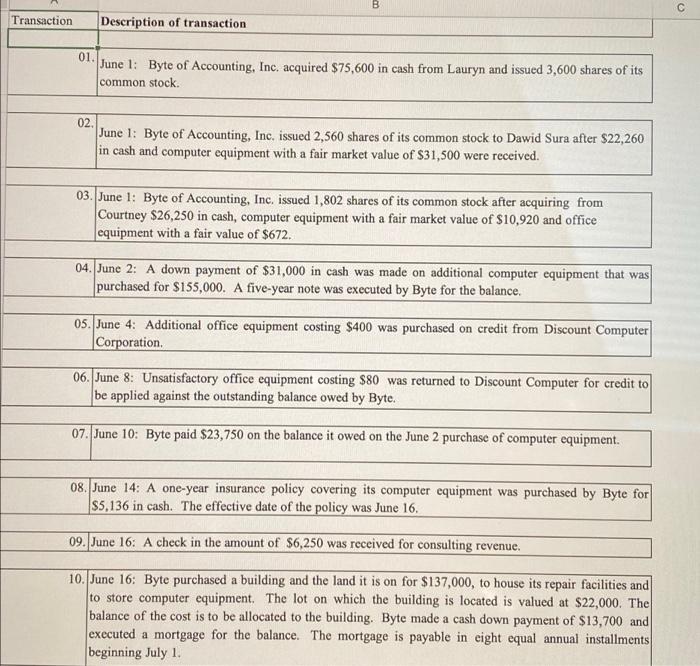

Number Name Normal Balance 1110 Cash Debit 1120 Accounts Receivable Debit 1130 Prepaid Insurance Debit 1140 Prepaid Rent Debit 1150 Office Supplies Debit 1211 Office Equip Debit 1212 Accum. Depr.-Office Equip. Credit 1311 Computer Equip. Debit 1312 Accum. Depr.-Computer Equip. Credit 1411 Building Cost Debit 1412 Accum. Depr.-Building Credit 1510 Land Debit 2101 Accounts Payable Credit 2102 Advanced Payments Credit 2103 Interest Payable Credit 2105 Salaries Payable Credit 2106 Income Taxes Payable Credit 2201 Mortgage Payable Credit 2202 Notes Payable Credit 3100 Capital Stock Credit 3200 Retained Eamings Credit 3300 Dividends Debit 3400 Income Summary Credit 4100 Computer & Consulting Revenue Credit 5010 Rent Expense Debit 5020 Salary Expense Debit 5030 Advertising Expense Debit 5040 Repairs & Maint. Expense Debit 5050 Oil & Gas Expense Debit 5080 Supplies Expense Debit 5090 Interest Expense Debit 5100 Insurance Expense Debit 5110 Depreciation Expense Debit 5120 Income Tax Expense Debit B c Transaction Description of transaction 01. June 1: Byte of Accounting, Inc. acquired $75,600 in cash from Lauryn and issued 3,600 shares of its common stock 02. June 1: Byte of Accounting, Inc. issued 2,560 shares of its common stock to Dawid Sura after $22,260 in cash and computer equipment with a fair market value of $31,500 were received. 03. June 1: Byte of Accounting, Inc. issued 1,802 shares of its common stock after acquiring from Courtney $26,250 in cash, computer equipment with a fair market value of $10,920 and office equipment with a fair value of $672. 04. June 2: A down payment of $31,000 in cash was made on additional computer equipment that was purchased for $155,000. A five-year note was executed by Byte for the balance. 05. June 4: Additional office equipment costing $400 was purchased on credit from Discount Computer Corporation 06. June 8: Unsatisfactory office equipment costing $80 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Byte paid $23,750 on the balance it owed on the June 2 purchase of computer equipment. 08. June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $5,136 in cash. The effective date of the policy was June 16. 09. June 16: A check in the amount of $6,250 was received for consulting revenue. 10. June 16: Byte purchased a building and the land it is on for $137,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $22,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $13,700 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments beginning July 1. a Transaction Account Debit Credit Date Name Description 4. 5 6 7 B 01 Do 02 03 04 05 06 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 07 09 o 10 Date Account Debit Name Transaction Credit Description 01 Jun 01 1110|Cash Joseph's investment 3100 Capital Stock Joseph's investment 40,000.00 40,000.00 Chart of Accounts

Transactions 1-10

General Journal (Only fill in yellow boxes)

*EXAMPLE*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started