Answered step by step

Verified Expert Solution

Question

1 Approved Answer

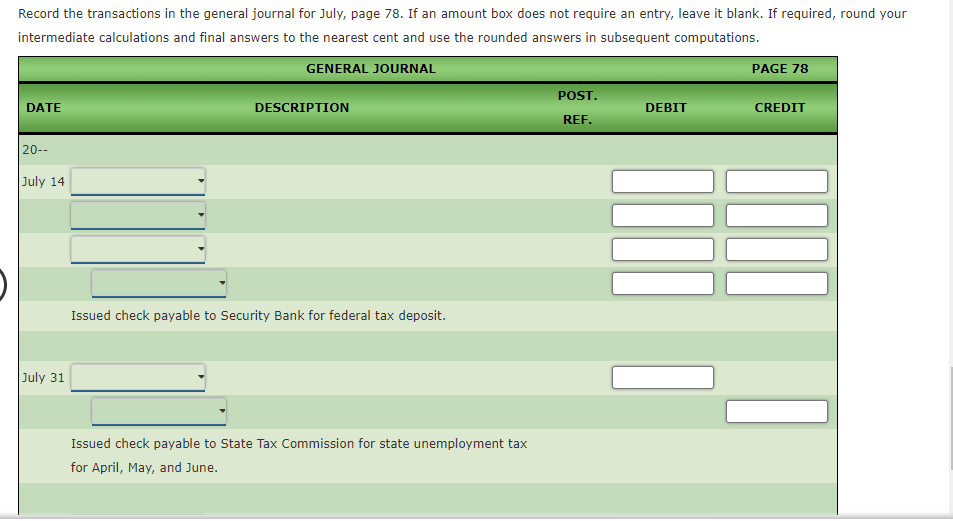

Record the transactions in the general journal for July, page 78. If an amount box does not require an entry, leave it blank. If required,

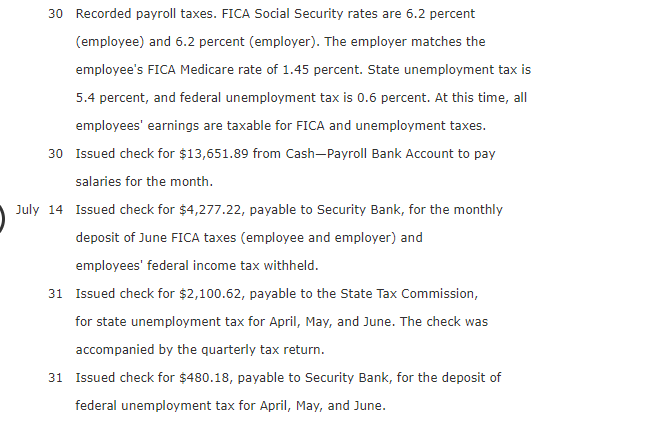

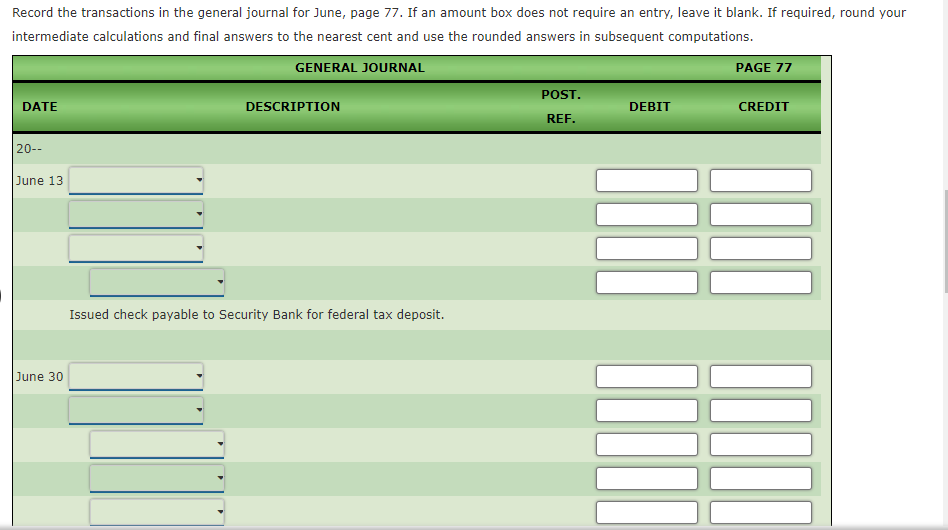

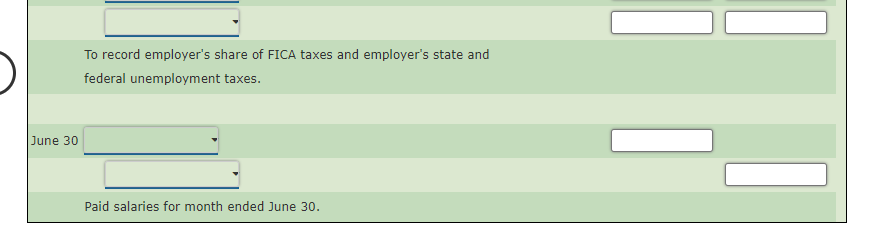

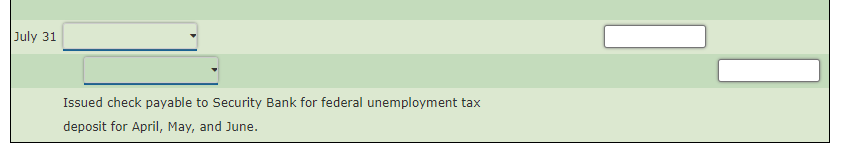

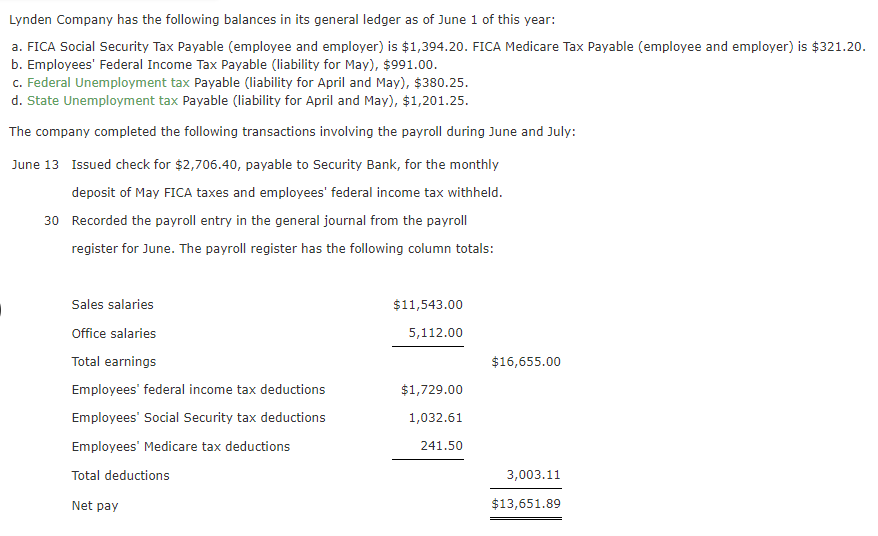

Record the transactions in the general journal for July, page 78. If an amount box does not require an entry, leave it blank. If required, round you intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations. Record the transactions in the general journal for June, page 77. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations. 30 Recorded payroll taxes. FICA Social Security rates are 6.2 percent (employee) and 6.2 percent (employer). The employer matches the employee's FICA Medicare rate of 1.45 percent. State unemployment tax is 5.4 percent, and federal unemployment tax is 0.6 percent. At this time, all employees' earnings are taxable for FICA and unemployment taxes. 30 Issued check for $13,651.89 from Cash-Payroll Bank Account to pay salaries for the month. 14 Issued check for $4,277.22, payable to Security Bank, for the monthly deposit of June FICA taxes (employee and employer) and employees' federal income tax withheld. 31 Issued check for $2,100.62, payable to the State Tax Commission, for state unemployment tax for April, May, and June. The check was accompanied by the quarterly tax return. 31 Issued check for $480.18, payable to Security Bank, for the deposit of federal unemployment tax for April, May, and June. July 31 Issued check payable to Security Bank for federal unemployment tax deposit for April, May, and June. Lynden Company has the following balances in its general ledger as of June 1 of this year: a. FICA Social Security Tax Payable (employee and employer) is $1,394.20. FICA Medicare Tax Payable (employee and employer) is $321.20. b. Employees' Federal Income Tax Payable (liability for May), $991.00. c. Federal Unemployment tax Payable (liability for April and May), $380.25. d. State Unemployment tax Payable (liability for April and May), $1,201.25. The company completed the following transactions involving the payroll during June and July: June 13 Issued check for $2,706.40, payable to Security Bank, for the monthly deposit of May FICA taxes and employees' federal income tax withheld. 30 Recorded the payroll entry in the general journal from the payroll register for June. The payroll register has the following column totals: To record employer's share of FICA taxes and employer's state and federal unemployment taxes

Record the transactions in the general journal for July, page 78. If an amount box does not require an entry, leave it blank. If required, round you intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations. Record the transactions in the general journal for June, page 77. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in subsequent computations. 30 Recorded payroll taxes. FICA Social Security rates are 6.2 percent (employee) and 6.2 percent (employer). The employer matches the employee's FICA Medicare rate of 1.45 percent. State unemployment tax is 5.4 percent, and federal unemployment tax is 0.6 percent. At this time, all employees' earnings are taxable for FICA and unemployment taxes. 30 Issued check for $13,651.89 from Cash-Payroll Bank Account to pay salaries for the month. 14 Issued check for $4,277.22, payable to Security Bank, for the monthly deposit of June FICA taxes (employee and employer) and employees' federal income tax withheld. 31 Issued check for $2,100.62, payable to the State Tax Commission, for state unemployment tax for April, May, and June. The check was accompanied by the quarterly tax return. 31 Issued check for $480.18, payable to Security Bank, for the deposit of federal unemployment tax for April, May, and June. July 31 Issued check payable to Security Bank for federal unemployment tax deposit for April, May, and June. Lynden Company has the following balances in its general ledger as of June 1 of this year: a. FICA Social Security Tax Payable (employee and employer) is $1,394.20. FICA Medicare Tax Payable (employee and employer) is $321.20. b. Employees' Federal Income Tax Payable (liability for May), $991.00. c. Federal Unemployment tax Payable (liability for April and May), $380.25. d. State Unemployment tax Payable (liability for April and May), $1,201.25. The company completed the following transactions involving the payroll during June and July: June 13 Issued check for $2,706.40, payable to Security Bank, for the monthly deposit of May FICA taxes and employees' federal income tax withheld. 30 Recorded the payroll entry in the general journal from the payroll register for June. The payroll register has the following column totals: To record employer's share of FICA taxes and employer's state and federal unemployment taxes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started