Answered step by step

Verified Expert Solution

Question

1 Approved Answer

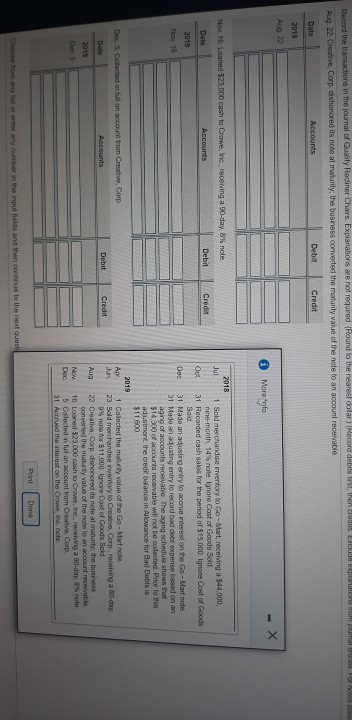

Record the transactions in the journal of Quality Rediner Chairs. Explanations are not required (Round to the nearest dolar Record debilst, en considers om journal

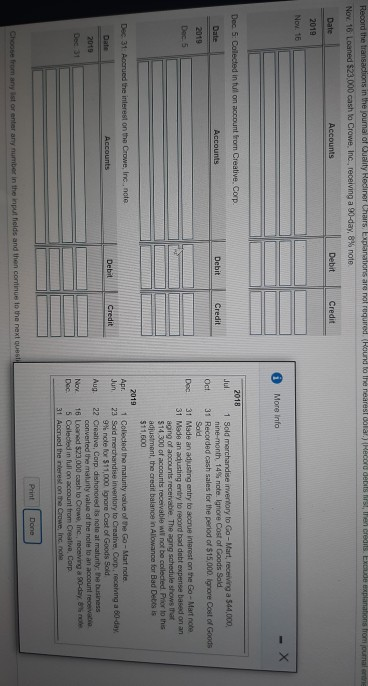

Record the transactions in the journal of Quality Rediner Chairs. Explanations are not required (Round to the nearest dolar Record debilst, en considers om journal Aug 22 Creative Corp dishonored its nole al maturily; the business converted the maturity value of the note to an account receivable Date Accounts Debit Credit 2019 Aug 22 -X Moreno Now 16:Loaned $23.000 cash to Crowe, Inc., recoming a 90-day 8% note Date Accounts Debit Credit 2019 Nov. 16 2018 Jul 1 Sold merchandise inventory to Go-Mart, receiving a 544,000, nine month, 14% not ignore Cost of Goods Sold Oct 31 Recorded cash sales for the period of 515,000 Ignore Cost of Goods Sald Dec 31 Made an adjusting entry to accrue interest on the Go-Mart nole 31 Made an adjusting entry to record bad debe expense based on an aging of accounts receivable. The aging schedule shows that $14,300 of accounts receivable will not be colected. Prior to this adusimont, the credit balance in Allowance for Bad Debts is $11.600 2019 An 1 Colected the maturity value of the Go- Marnote Jun 23 Sold merchandise nentory to Creative Corp.recching a 60 day, 9% nos for $11,000. Ignore Cost of Goods Sold Aug 22 Creative Corp. dishonored its nole al maturity, the business converted the maturity value of the note to an account receivable Now 16 Looned $23.000 cash to Crowe, Inc., receiving a 90-day, 8% pole Dec 5 Collected in Jul on account from Creative Corp 31 Accrued the interest on the Crow, ine note Dec 5 Colected in tvil on account from Creative Corp Accounts Debit Credit 2015 Print Done Corom any or any number in the input fields and then continue to the next quash Record the transactions in the journal of Quality Recliner Chairs, Explanations are not required (Round late nates dolar) Record des rencodis EXUdo explanations from ournal Nov. 16 Loaned $23.000 cash to Crowe, Inc., receiving a 90-day, 8% noto Date Accounts Debit Credit 2019 Nov. 16 More Info Dec 5: Collected in tull on account from Creative. Corp. Accounts Debit Credit 2019 Dec. 5 2018 1 Sold merchandise inventory to Go-Mart, receiving a 544,000, nine-month 14% note. Ignore Cost of Goods Sald Oct 31 Recorded cash sales for the period of $15,000. Ignore Cost of Goods Sold Dec 31 Made an adjusting entry to accrue interest on the Go - Mart note 31 Made an adjusting entry to record bad debt expense based on an aging of accounts receivable. The aging schedule shows that 514 300 of accounts receivable will not be collected Prior to this adjustment, the credit balance in Allowance for Bad Debesis $11,600 2019 Apr. 1 Collected the maturity value of the Go - Mart note Jun 23 Sold merchandise inventory to Creative Corp. receiving a 60-day 9 note for $11,000 Ignare Cost of Goods Sold Aug 22 Creative, Corp. dishonored its note at malunity: the business converted the maturity value of the note to an account recewa Nov 16 Loaned $23,000 cash lo Crowe, Inc., receiving a 90-day, hoe Dec 5 Collected in full on account from Creative Corp 31 Accrued the rest on the Crowe, Inc. note Dec. 31: Accrued the interest on the Crowe, Inc. note Date Accounts Debit Credit 2013 Dec 31 Print Done Choose from any stor enter any number in the input fields and then continue to the next questi

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started